Pension insurance contract is an agreement between the participants in the insurance relationship, under which the insurer undertakes to make insurance payments to the insured person (policyholder) in a fixed amount and with a certain frequency, subject to the full amount of payment by the policyholder of the insurance premium and his survival to the age stipulated by the concluded pension contract insurance.

Compulsory pension insurance agreement is an agreement between the insured person and the fund, concluded in favor of the insured person (beneficiary, legal successor), according to which, upon the occurrence of pension grounds, the fund is obliged to assign and pay to the insured person the accumulative part of the labor pension or payments for the beneficiary (legal successor). Legal successors include persons noted in Article 16, paragraph 6 of Federal Law No. 173-FZ “On Labor Pensions in the Russian Federation” of December 17, 2001.

Main provisions of the agreement

Policyholders under a pension insurance agreement include legal entities and capable citizens of the Russian Federation who have entered into an agreement in their own favor (in favor of a third party). At the time of concluding the contract, the age of the policyholder cannot exceed two to three years before retirement age, namely: up to 54 years for women and up to 59 years for men. A pension insurance contract is concluded with citizens of the Russian Federation, regardless of their state of health.

When insuring a pension, the insured event includes the survival of the insured person to the age stipulated by the pension insurance contract and the start date of insurance payments, as well as the next established periodic payments for insurance coverage in the form of pensions. The pension insurance contract may also include other types of insurance risks.

In an insurance contract, the insured amount is established at the time of signing the contract with a stipulated amount of periodic payments. The policyholder agrees with the insurer on the amount of these payments, which will directly depend on the financial capabilities of the insured person and the size of the insurer's insurance premium. The pension insurance contract separately stipulates the conditions under which the policyholder receives additional profit from the insurer’s investment activities. The insurer annually informs the policyholder about the amount of profit payments.

Without state help: how and where to save for retirement on your own

“I invest my money in global markets,” says Movchan. — These are fixed income instruments, stocks, derivatives. I use the dollar as my currency.” Gerasimenko says that he is a supporter of placing pension capital through managers.

Selecting a non-state pension fund

Read on RBC Pro

How economic shocks are changing people’s habitual patterns of behavior How a mysterious startup intends to create a quantum computer faster than Google How to adapt to new consumption models - Nielsen recommendations Lean management tools: kaizen session

What to do if you decide to save for retirement in a non-state pension fund? Financial advisors recommend paying attention to several key factors. General Director Natalya Smirnova advises choosing the largest non-state pension funds, which with a high degree of probability will not have their license revoked. “As you know, our guarantee system only applies to compulsory savings,” says Smirnova. “Therefore, these should be non-state pension funds that are affiliated with systemically important companies.”

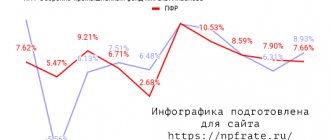

It is worth assessing the reliability rating and choosing the fund that has demonstrated the most stable and high returns throughout its history. “Particular attention should be paid to 2008–2009 and to the years starting from 2014, that is, to periods of instability,” advises Smirnova. Gerasimenko believes that it is necessary to look at the results of the fund’s activities for at least a ten-year period and assess how much the profitability is ahead of the accumulated inflation. “If it doesn’t overtake, this is an alarming signal, which means that managers are unable to increase capital,” the expert sums up.

RBC assessed the profitability of voluntary pension savings for the last three years, since the Bank of Russia does not publish data for an earlier period. The calculations are based on the profitability data that the funds provide to the regulator. But there is a possibility that all or part of the NPF disclosed the so-called dirty profitability, that is, along with the amount that the management company will have to pay for its work. This payment can reach 25% of profitability. According to the former head of NPF LUKOIL-Garant Sergei Erlik, some funds can provide net returns to the Central Bank, and some can provide a commission to management companies.

Among the ten largest NPFs in terms of the volume of pension reserves, the best average returns over three years were shown by NPF LUKOIL-Garant (9.74%), Neftegarant (9.16%) and Telecom-Soyuz (9.07%). If we assume that a person will contribute 10 thousand rubles monthly to a non-state pension fund for 25 years, then after retirement for 20 years he will receive 109.1 thousand rubles from LUKOIL-Garant. per month, in Neftegarant - 96.1 thousand rubles, and in Telecom-Soyuz - 94.2 thousand rubles. This is possible only on the condition that the funds annually accrue to the accounts of the insured a return equal to the average for the last three years. The worst results in terms of profitability of these ten were shown by NPF Gazfond (2.61%) and Khanty-Mansiysk NPF (3.38%). Pensions from these funds can amount to 22.4 thousand and 26.7 thousand per month, respectively.

According to the calculations of the funds themselves, their clients will receive other pensions: in the Khanty-Mansiysk NPF they promise 41.6 thousand rubles monthly, in the Sberbank NPF - 77.4 thousand rubles, in the NPF Telecom-Soyuz - 46.8 thousand roubles. The remaining NPFs did not respond to RBC's request.

Non-state pensions of today's pensioners are much more modest. From calculations based on Central Bank data, it follows that the largest average monthly payment is 8.1 thousand rubles. and pays it to NPF Gazfond. The smallest average monthly pension in NPF Telecom-Soyuz is 810 rubles.

Registration of the contract

Today, a non-state pension provision (NPO) agreement can be concluded in almost any non-state pension fund. Having called the ten largest funds in terms of the volume of pension reserves, the RBC correspondent did not receive a refusal anywhere.

To conclude an agreement, citizens must submit an identification document to the office of the selected fund. In addition, some market participants offer to draw up an agreement online. Sberbank NPF was one of the first to launch such a service. By filling out a form on the website, a citizen can also read the terms of the contract, indicate the amount of the down payment and pay the down payment. For subsequent contributions you can connect. The contract will then be sent to the client’s email.

A citizen can theoretically make voluntary pension contributions through his employer. “At the request of an employee, submitted to the employer on a voluntary basis, deductions can be made from wages for any purpose and in any amount,” says Denis Lysenko, president of the Association of Professional Accountants Commonwealth.

But it should be remembered that the employer has the right, but not the obligation, to accept an application from an employee to deduct certain amounts from his salary and transfer them to the accounts of third parties. The activities of NPFs are regulated by the basic law on non-state pension funds, and it does not assign the employer the obligation to transfer contributions, notes lawyer Alexander Karabanov.

“Usually employers make decisions on transferring money to NPFs centrally, in relation to all employees,” says Sergei Okolesnov, general director of Pension Partner. “It will be more difficult for an individual to negotiate this separately.”

Alternative to NPF

Experts call opening an individual investment account (IIA) a more effective way to save money for a future retirement. Within this tool, you can choose any strategy, explains Natalya Smirnova. For example, this could be an investment in government bonds with a guaranteed income of 10% per annum. “In NPFs, no one guarantees you profitability,” she says. “Moreover, in a non-state pension fund you cannot influence the investment strategy in any way, but in an IIS you manage it yourself.”

Isaac Becker advises opening such an account in a good bank, the doubts about the reliability of which are minimal. “For a retirement plan, a better investment account would be one that offers tax advantages,” says Becker. — For this, from about 35 years old, I would start saving and investing money, for example, 10% of my monthly income. Now I would save in dollars.”

Insurance premium

In a pension insurance contract, the amount of the insurance premium is determined by the insurer based on statistical tables. The policyholder has the right to set the amount of the insurance premium himself, based on his financial situation. The insured person can change the amount of the insurance premium at any time, either down or up. To do this, it is necessary (at the request of the policyholder and with the consent of the insurer) to change the sum insured.

Under a pension insurance agreement, the insurance premium is paid by the policyholder in two ways:

- at one time;

- periodic payments (in installments).

When paying the insurance premium in installments, indexation of insurance premiums is established. This helps the policyholder and the insurer adjust the amount of mutual obligations to the actual cost of insurance obligations.

It is important to know!

If the insured person fails to pay insurance premiums (this condition is stipulated in the insurance contract), the insurer will not terminate the insurance coverage, but its amount will be recalculated downward.

Agreement with NPF Sberbank

Sberbank has its own non-state pension fund, the largest in Russia. The OPS agreement with this organization is drawn up on the basis of the relevant rules.

The agreement has the following main sections:

- General provisions , which contain information about the parties to the agreement.

- Item . This is the activity of storing and investing pension subsidies.

- Rights and obligations of the fund .

The organization has the right to represent the interests of a citizen before the company paying pension contributions, and also to direct part of the income received to support its activities (what are insurance contributions for compulsory pension insurance?). The NPF is obliged to keep track of available funds, inform the other party about all changes in insurance rules, provide information about the state of the pension account, etc. - Rights and responsibilities of a citizen .

A person can demand that a non-state pension fund fulfill the terms of the agreement, apply for information about his pension account, and receive money in cases provided for by law. A person is obliged to submit documents to the fund and provide information that affects the assignment of a pension. For example, about age, place of residence, citizenship and others. - Accounting and investing funds . The investment of money takes place on the basis of the provisions of federal legislation. The main legal act in this area is Law No. 111-FZ of July 24, 2002. It contains the basic requirements for organizations that work with this money and for operations carried out with these subsidies.

- Payment procedure and conditions . The section contains the legal basis for transferring funds to a citizen as part of a pension subsidy, as well as the algorithm of actions required for this.

- Responsibility of the parties . Persons who signed the agreement are liable in accordance with the provisions of the law.

- Change and termination of the contract. The Foundation may change any clause of the document only if it receives the consent of the other party to do so. The section also lists the grounds for termination of the agreement:

- a citizen’s statement of desire to transfer funds to another NPF;

- liquidation of the fund;

- death of a person;

- revocation of an organization's license.

- Validity . Typically, agreements last for an indefinite period of time.

- Final provisions.

You can sign the agreement at any branch of a bank or non-state pension fund.

Insurance payments

The amount of insurance payments that the insured person will receive in accordance with the concluded pension insurance agreement depends on:

- on the amount of the insurance premium paid;

- accumulation period (the amount of the pension received for the insured person will be higher, the longer the period of accumulation of insurance payments);

- the age of the policyholder (the older the policyholder, the shorter the period of accumulation of pension benefits becomes, and the amount of the insurance premium for the insured person increases significantly);

- gender of the policyholder.

There are insurance programs under which insurance premiums for women are one and a half times higher than for men. However, we should not forget about pension insurance programs, in which the amount of insurance premiums is calculated according to the combined mortality table and the amount of the insurance premium does not depend on the gender of the insured person.

In the event of the death of the insured person upon reaching retirement age, in accordance with the legislative norms of the Russian Federation, legal successors (beneficiaries) are entitled to:

- receipt of the total number of pension payments established by the pension insurance contract, provided that no pension payment was made to the insured person;

- receiving the difference between the total number of pension payments established by the pension insurance contract and the number of pensions received by the insured person, provided that the insurer has already made a certain number of pension payments to the insured person.

Important!

The policyholder has the right to independently choose a pension insurance program. Pension payments, at the request of the policyholder, can be paid by the insurer monthly, quarterly or once a year. Payment of insurance pension benefits is transferred to the insured person by mail or transferred to a personal bank account.

The Ministry of Labor will force pension funds to renew contracts with clients

Non-state pension funds will have to renegotiate contracts with their clients. This follows from the draft law “On funded pensions” prepared by the Ministry of Labor, which was published today on the unified portal of draft regulations.

Article 16 of the bill contains a rule according to which contracts on compulsory pension insurance concluded between non-state pension funds and insured persons “are brought into compliance with the requirements of this Federal Law by April 1, 2015.”

Today, more than 20 million people form the funded part of their labor pension in non-state pension funds (NPFs). The funded part goes to 6% of the insurance contributions paid by the employer for the employee to the Pension Fund of Russia (the general tariff in the Pension Fund of the Russian Federation is 22%, 16% goes to the insurance part of the pension, which is of a joint nature and is used to pay current pensioners).

The draft law “On funded pensions” was developed as part of the strategy for the development of the pension system until 2030. Its goal is “to separate the funded part of the labor pension from the composition of the old-age labor pension as an element that does not have a solidary nature in its essence, and to transform this part of the pension into an independent type of pension,” the explanatory note says.

The head of the National Association of Pension Funds (NAPF), Konstantin Ugryumov, called the bill’s provision on the renegotiation of contracts “a mockery” and “an attempt to kill the funded component.”

“The man has already made his choice once and entered into an agreement. And now, at the whim of officials, he again has to go and renegotiate the contract only because the terminology of the law has changed,” Ugryumov is indignant. - This is just a mockery of people and common sense.

As noted by the first vice-president of NAPF, Yuriy Lublin, if the contract cannot be renegotiated, then it is unclear what will happen to the client’s funded part; the consequences are not spelled out in the law, but they need to be spelled out. But it is unlikely that existing agreements will be declared invalid, he believes.

— To renew the contract, a person will have to come to the NPF office, since his personal signature is required. It will be a universal movement,” says Lublin. — It makes more sense to extend old contracts, and draw up those concluded in 2020 according to new rules. In our comments from the Ministry of Labor, we will say that this proposal is at the level of nonsense and requires very large material costs for both the NPF and the Pension Fund (all new contracts are subject to registration in the Pension Fund register).

It seems that such a proposal was prepared by people who have little understanding of what they are writing about, adds Lublin.

This will be hard work, says Andrey Neverov, president of the NPF Sberfond RESO. And carrying it out is problematic.

— Imagine, the fund has 1.5 million clients, who will double-check them? A large NPF submits 100–200 thousand contracts to the Pension Fund every year, and the fund checks them, says Neverov. “And now we need to re-do the work that has been carried out for 10 years in one fell swoop.” This is impossible and most importantly, the goal is unclear. The winners will be those who do not comply with the law and forge signatures.

The press service of the Ministry of Labor believes that the NPF has no grounds for unrest.

— The standard agreement on compulsory pension insurance between a non-state pension fund and the insured person stipulates that amendments to the agreement and appendices to it in connection with changes in legislation are carried out by the fund unilaterally by sending a written notification to the insured person within a month from the date of entry into force of the changes in legislation , the Ministry said. — The Russian Ministry of Labor, through a federal law, proposes to soften this norm - to extend the notice period to three months.

In addition, as can be seen from the norm, non-state pension funds notify citizens unilaterally, that is, by sending a letter. NPFs or agents will not even have to meet with citizens to affix signatures; this is not provided for, the press service said.

— Since this is a bill and it has been submitted for public discussion, the Ministry of Labor is ready to consider other options. But if we remove the proposed norm, the period will be 1 month,” the Ministry of Labor said.

Bureaucratic difficulties: what documents need to be changed when changing registration?

St. Petersburg Komendantsky Prospekt was registered, changed registration; Kudrovo, Leningrad region, 100 meters from the city limits, will the pension change downward?!

State Services On the State Services website, to change your registration, you must first register in your personal account, if this has not been done previously.

In this case, you must visit the Social Protection Center and notify about changes in personal data by writing an application and presenting a passport with a new registration. The procedure is mandatory if the benefit is sent to the address.

The FMS employee checks the information specified in the sent documents and sets a date for the meeting, at which the applicant must appear with the originals. After a personal application upon admission, the FMS department carries out all registration actions within 3-8 days, upon completion of which two marks are placed in the passport. A stamp in the passport is placed only upon receipt of a permanent place of registration.