Formation of a funded pension

Funded pension in accordance with Federal Law No. 424 of December 28, 2013.

“On funded pension” is currently being formed:

- for citizens born in 1967 and younger - from 2002 to 2014 in the amount of 6% of wages from employer contributions; from 2015 – the amount in the individual pension account increases only due to investment income;

- participants of the State Pension Co-financing Program and owners of maternity capital who invested it in a funded pension.

From 2002 to 2005 The funded pension was also formed:

- for men born 1953-1966

- women born 1957-1966,

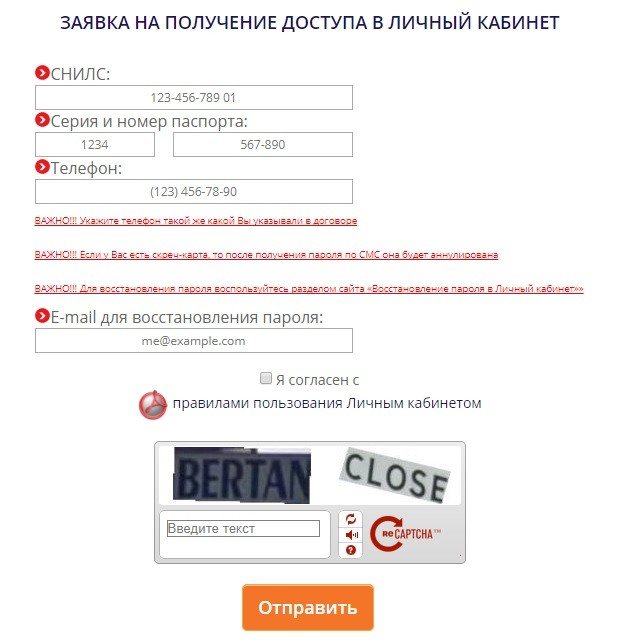

Access to your personal account

From the moment funds are received into the personal account, the client receives the right to enter the Personal Account. The following features are available on the electronic resource:

- control over the account status;

- viewing personal data and changing it;

- changing client email data;

- changing the password to access the resource.

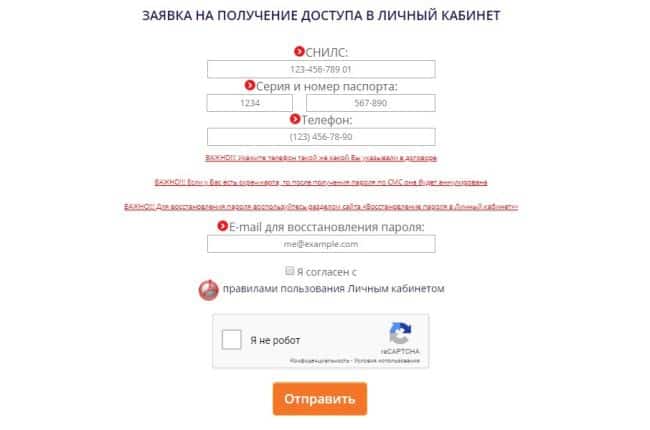

Fig.4. Login to your Personal Account

You can enter your account only after completing the registration procedure. To do this, you must provide the following information in the appropriate section:

- SNILS number;

- Full name in accordance with the passport document;

- Mobile phone number;

- verification code;

- a note indicating that you have read the User's Guide.

Fig.5. Registration in the system

If all the information is correct, a password will be sent to your phone number to access the system.

Important! When logging into the system for the first time, it is recommended to change the password to a user one to avoid its compromise.

What kind of NPF is it and what does old age have to do with it?

Our future pension is divided into two parts: insurance and funded.

You can deliberately choose the Pension Fund of the Russian Federation as your insurer by writing a statement about it. Then you will also remain in the Pension Fund of Russia, but you will not be considered a “silent” person. You can also invest your funded pension through a non-state pension fund (NPF) and receive income with its help. If the income is good and in the next 25 years no one decides to use it for the imperial ambitions of our country, then in old age you will have something to live on.

Non-state pension funds earn money from the profits they make for their investors, so they compete for clients. The more clients, the more money and the greater the potential profit. Sometimes, in pursuit of turnover, funds begin to play unfairly - and let’s talk about this.

How our pension is structured now - a diagram from the training manual of the Trust Foundation

NPF "Doverie" - personal account

› 5 Author of the article Elena Smirnova Reading time: 4 minutes 8,813 Consultation with a pension lawyer by phone In Moscow and the Moscow region St. Petersburg and the region NPF card Profitability: 6.19% Assets: 95393988.10811 thousand rubles. Reliability: Official website: Personal account: Phone: 8 (800) 700 8020 Information current as of 12/20/2018. All current obligations of NPF “Doverie” to clients are fulfilled without changes and in full.

By merging funds, we are increasing the efficiency of pension fund management and the level of customer service. The non-state pension fund "Doverie" began its activities in 1997. The organization has created special programs of non-state support for pensioners.

Which encourage employees, together with the company, to accumulate funds for people who have retired and to interest citizens in joining a non-state pension fund.

Benefits of a funded pension

Pension savings are the totality of funds recorded in the funded pension account of the insured person. Pension savings:

- are formed in rubles;

- can be increased due to the annual income of the Fund, as well as through participation in the State Co-financing Program for pensions and maternity capital;

- inherited (at the accumulation stage) - paid to legal successors;

- they can be managed - transferred to a non-state pension fund or invested through a private management company.

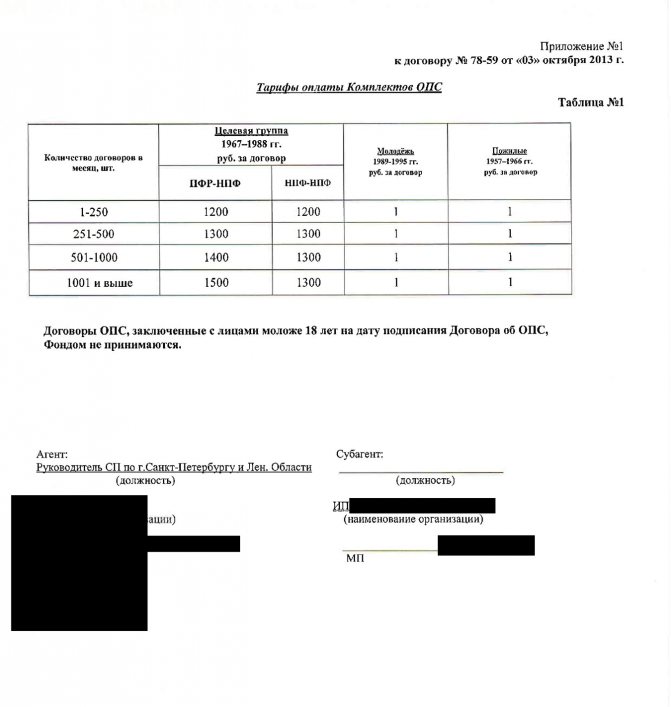

How to conclude an agreement under OPS

It is possible to transfer OPS to NPF “Doverie” only after concluding the agreement Doc_1. To complete all the necessary documents, the client can contact the company’s office in person or leave a request on the official website npfdoverie.ru.

Important! The company warns everyone wishing to transfer a pension to the Fund about the need to first familiarize themselves with the insurance rules and the Charter.

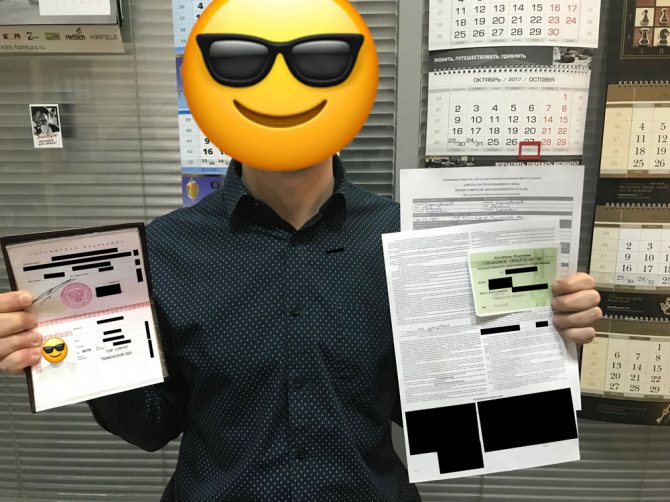

Fig.3. Conclusion of a contract for OPS

Package of documents required for application:

- passport of a citizen of the Russian Federation;

- SNILS;

- TIN if available.

The contract will reflect the following personal information:

- Full name of the person based on the passport;

- insurance certificate number;

- address.

Attention! If there is a subsequent change in personal data about such facts, it is mandatory to notify the fund.

The validity period of the concluded agreement is unlimited. The date of its entry into force is the day of transfer of funds from the previous insurer to the account of the insured person in the NPF “Doverie”.

NPF agents

Non-state pension funds are financial companies, they deal with money: a million here, a million here, bought papers, sold papers, debit-credit. They do not always have a network of offices throughout Russia and their own salespeople.

To attract money from the public, NPFs quite often turn to the services of agents. An agent sells NPF services for a fee - this can be a person or a company. For example, a non-state pension fund can agree with a well-promoted bank so that it sells the services of this non-state pension fund to its clients. For each executed contract, the NPF pays the bank a fee. Everyone is happy.

Agents can be banks, stores, website owners, your postman, your Apple dealer, your employer, and even all sorts of shady characters. By and large, the NPF does not matter through whom you signed the agreement: the main thing is that you agree to transfer your money to this NPF. And the main thing for an agent is to fill out the paperwork and receive his fee. Nobody cares, so it turns out...

Disclosure of information of JSC NPF Doverie

The activities of non-state pension funds are strictly regulated by law; the main regulator is the Central Bank of the Russian Federation. To monitor the activities of reporting companies, reports are regularly compiled showing the results of their activities. The key parameters of which are profitability, growth of the savings portfolio and the number of insured persons.

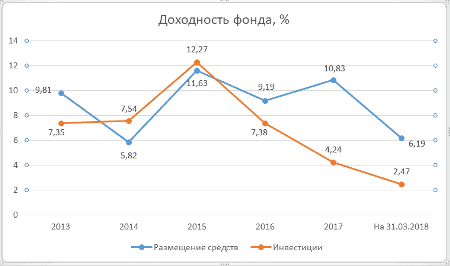

Profitability

JSC NPF Doverie makes a profit on the amounts transferred by the insured persons by placing them in specialized institutions or investing.

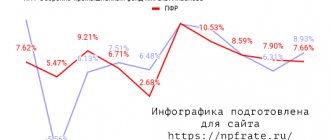

Table 2. Fund profitability 2013-2018 Source: official website

| Year | Placement of funds | Investment activities |

| 2013 | 9,81 | 7,35 |

| 2014 | 5,82 | 7,54 |

| 2015 | 11,63 | 12,27 |

| 2016 | 9,19 | 7,38 |

| 2017 | 10,83 | 4,24 |

| As of 03/31/2018 | 6,19 | 2,47 |

Chart 1. Profitability of JSC NPF Doverie in dynamics 2013-2018. Source: official website

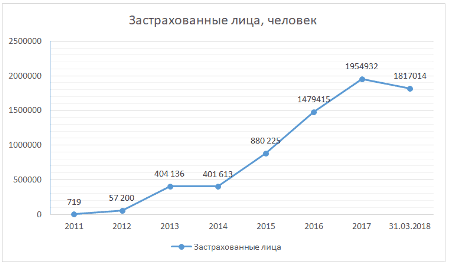

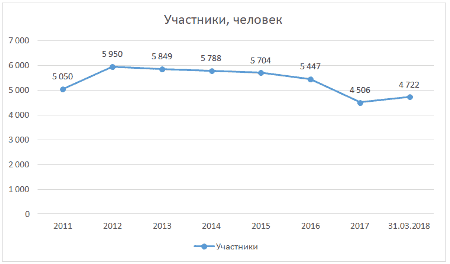

Total number of fund clients

The non-state pension fund "Doverie" shows positive dynamics in increasing the number of clients.

Table 3. Number of participants and insured persons 2011-2018 Source: official website

| Period | Insured | Participants |

| 2011 | 719 | 5 050 |

| 2012 | 57 200 | 5 950 |

| 2013 | 404 136 | 5 849 |

| 2014 | 401 613 | 5 788 |

| 2015 | 880 225 | 5 704 |

| 2016 | 1 479 415 | 5 447 |

| 2017 | 1 954 932 | 4 506 |

| 31.03.2018 | 1 817 014 | 4 722 |

Chart 2. Dynamics of changes in the number of insured persons for the period 2011-2018. Source: official website

Chart 3. Dynamics of changes in the number of NPF participants 2011-2018. Source: official website

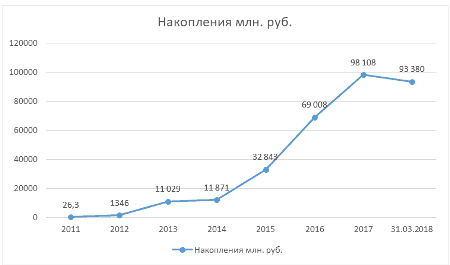

Volume of attracted pension savings

In addition to pension savings, non-state pension funds also form pension reserves, which allow them to pay payments due to insured persons.

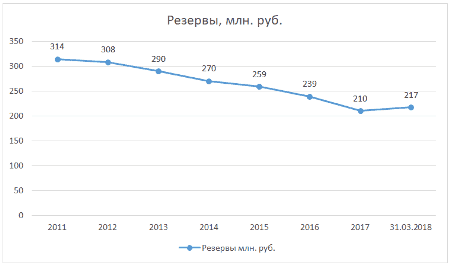

Table 4. Volumes of savings and reserves of the fund 2011-2018. Source: official website

| Year | Accumulations million rubles | Reserves million rubles |

| 2011 | 26,3 | 314 |

| 2012 | 1 346 | 308 |

| 2013 | 11 029 | 290 |

| 2014 | 11 871 | 270 |

| 2015 | 32 843 | 259 |

| 2016 | 69 008 | 239 |

| 2017 | 98 108 | 210 |

| 31.03.2018 | 93 380 | 217 |

Chart 4. Pension savings of the fund over the period 2011-2018. Source: official website

Chart 5. Reserves over time from 2011 to the 1st quarter of 2020. Source: official website

Early transfer to another NPF

This is exactly what happened to me. In 2020, I entered into an agreement with NPF “Doverie”. At that time, the savings account had 33,000 RUR. For two years, my NPF invested money, and I received income. When I was deceived into transferring to a new NPF, everything I earned was burned, and the original 33,000 RUR remained in the account.

But the losses did not end there. The fact is that money is not transferred from one NPF to another exactly on January 1, but in the period from January 1 to April 1. That is, if during this period the funded pension has already left the old NPF, but has not yet entered the new one, then during this time you will not receive any income either.

I was quite satisfied with the profitability of my old NPF - 10%. This is twice the inflation rate. Now I’m 35 years old, I have at least 25 more years until retirement. All this time, the lost money would continue to work. With a yield of 10%, 8,000 R would turn into 80,000 R by 2042! I will miss this amount due to the fact that back in 2017, someone decided to transfer me to another NPF.

Personal account of NPF Trust

» »

The private pension fund "Doverie" offers the population services in the field of compulsory and voluntary pension insurance.

Legal entities can enter into an NGO agreement with a company.

Clients of the organization can gain access to a personal account, thanks to which remote interaction between the NPF and the investor is carried out.

Contents The main task of the personal account is to provide the fund client with the opportunity to control the status of the savings account and track the profitability of the deposit online. The personal account also contains a tool for sorting records of financial transactions, with which the user can obtain the information he is interested in for any time period.

To protect the client’s finances and personal data from intruders

We recommend reading: Challenge to the representative of the defendant in civil proceedings

Payment procedure

| Type of receipt | Conditions |

| Indefinite |

|

| Urgent |

|

| One-time |

|

| To the heirs of a pensioner |

|

The payment of funded pension funds is established after applying for it to the fund in which it was formed. An application with documents for the appointment of a funded pension or an urgent payment is considered by the fund from the moment of their acceptance within 10 working days, an application for a lump sum payment - within one month from the date of submission of the last required document, if it was submitted within the prescribed period.

Based on the results of reviewing the documents, the recipient is notified of the purpose of payment or refusal, indicating the reasons. A one-time payment of pension savings funds is made within no more than two months from the date of its establishment. The funded pension and urgent payment are made simultaneously with the insurance pension for the current month.

In accordance with Law 360-FZ of November 30, 2011 “On the procedure for financing payments from pension savings”, if the funded pension of the insured person at the time of application is formed in the Pension Fund, then the Pension Fund will pay it, if the funded pension is formed in a non-state pension fund, then payments will be made by the corresponding NPF.

Insured persons can apply for payment of pension savings:

- who have reached retirement age (men - 60 years, women - 55 years) and have the appropriate insurance length and the value of the individual pension coefficient, entitling them to an old-age insurance pension,

- preferential categories are special professional and social categories of citizens in accordance with Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”, who have the necessary insurance experience and the value of the individual pension coefficient entitling them to an old-age insurance pension.

There are 3 types of payments from pension savings: a lump sum payment, an urgent pension payment, and a funded pension.

A one-time payment is made to the following persons:

- the amount of the funded pension of which is 5% or less in relation to the amount of the insurance pension assigned by the Pension Fund of the Russian Federation, the size of the funded pension, on the date of assignment of the funded pension upon reaching the ages of 60 and 55 years - if there is a required insurance period and an established individual pension coefficient;

- citizens who have not acquired the right to receive a funded pension due to their lack of required insurance coverage and the established value of the individual pension coefficient.

In this case, the entire amount of pension savings reflected in the AP’s account in the selected NPF is paid at a time.

Urgent pension payments are made to persons:

- when the right to an old-age pension arises;

- those who have formed pension savings through contributions under the State Co-financing of Pensions Program and/or from maternity (family) capital.

The duration of the payment is determined by the AP itself (but not less than 10 years). Succession is possible.

The funded pension is paid to persons entitled to an old-age pension.

Payments of funded pensions are established by law and are carried out monthly and for life. Succession is impossible.

How people cheat when touring apartments

When I worked as an agent, our company used only legal methods to find clients. The most common are door-to-door visits and staff meetings in large organizations. In addition, so-called cross-selling was common, when credit managers in banks or stores acted as agents.

In 2013, when I worked in a brokerage company-agent, NPF paid from 1200 to 1500 rubles for each client.

Sometimes agents deceive during door-to-door visits, when you can talk to a person one-on-one, without witnesses. For example, agents pose as employees of a pension fund. From the point of view of the law, everything is clean here, because NPF is also a pension fund, only non-state. The potential client thinks that they came to him from the Pension Fund of the Russian Federation, and trusts the guest.

When offering an agreement, agents can intimidate, saying that you must sign it, otherwise you may lose part of your future pension. This, by the way, is also a half-truth: the agent can show the fund’s profitability - if it is higher than your current NPF, then part of the future pension is actually lost.

Our competitors even opened and issued IDs for agents with this inscription - and sales soared. Conscientious non-state pension funds never do this - in our country the phrase “I am from a pension fund” was prohibited.

One of my clients told me how agents came to her home and told her that our fund had closed and she urgently had to sign an agreement with a new NPF. In fact, our company simply merged with another NPF and changed its name. Competitors found out about this and began to scare customers.

Agents also came to my house. I let them in out of professional interest. They used this technique: they asked for SNILS “for verification,” then they immediately called somewhere and told me that I was no longer in the client database and that the contract urgently needed to be reissued. In fact, they checked SNILS with the combined database of several non-state pension funds, but I was not there, because my fund simply did not submit data there.

An employee of a bank, insurance company or microfinance organization can simultaneously work for a non-state pension fund. In this case, you may be allowed to sign an agreement under the guise of other documents. For example, when you apply for a store loan and sign a large number of papers. They may say that this is an insurance contract, it is free.

One client told me how an unfamiliar man came to their village and said that he was recruiting people for work. Under this pretext, he collected passport and SNILS data from those wishing to find a job, then had them sign some papers and left. No one got a job, but the next year everyone received a notice about the transfer to the NPF.

- OPS agreement in three copies. There will be 3 copies of the agreement in total, each of which you will sign in at least two places.

- Applications for early transfer. Usually, just in case, clients are given two statements to sign at once: on the transfer from the Pension Fund to the Non-State Pension Fund and on the transfer from the Non-State Pension Fund to the Non-State Pension Fund.

- Consent to the processing of personal data.

Personal account of NPF Trust

OA NPF "Doverie" is a non-state pension fund formed in 1997. Carries out activities in pension insurance and provision on the basis of license No. 318, issued on May 21, 2004.

It is a member of the Association "Alliance of Pension Funds (APF)" and enters into agreements with individuals wishing to transfer their pension savings from the Pension Fund to a non-governmental organization, and with corporate clients. Personal Account is a convenient service for checking pension savings in real time, which is available free of charge to the company’s clients on the official website www.npfdoverie.ru. The registration procedure on the fund’s web resource is as follows: click on the “Personal Account” link at the top of the page; click on the “Registration” link in the side menu; fill out the form that opens by entering in the appropriate fields the SNILS policy number (insurance number of an individual personal account), the number and series of the passport specified in the agreement with the Trust Fund, cell phone number, e-mail to recover a forgotten/lost password;

How to find out the amount of pension savings (via the Internet, according to SNILS, in the Pension Fund)

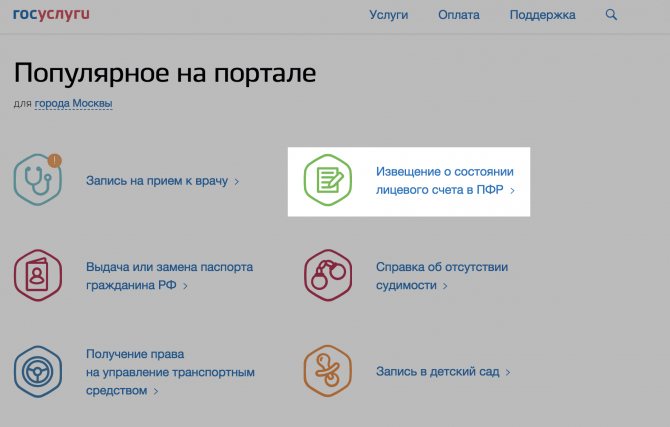

Until 2013, the Pension Fund of the Russian Federation annually sent information about the state of the individual pension insurance, including the amount of pension savings, to insured persons by mail in letters. Currently, depending on where the funded pension is formed in the Pension Fund or Non-State Pension Fund, this information can be obtained in different ways:

- Via the Internet on the website of the Pension Fund or Non-State Pension Fund using your personal account.

- In the territorial pension fund with the provision of a passport and SNILS.

- When contacting the branch of the NPF that the citizen has chosen to form savings.

- Through the bank in which the citizen has an account, if this bank provides such a service.

Video

Safmar Financial Investments is the first public diversified investment holding in Russia with a focus on the financial sector of the economy. The holding is part of the Safmar group, one of the largest industrial and financial groups in Russia, including assets of the financial sector (insurance, leasing, non-state pension funds), commercial real estate and development, oil and gas companies, as well as other non-financial assets.

The Fund carries out activities in compulsory pension insurance and non-state pension provision. Is a participant in the system of guaranteeing the rights of insured persons. Member of the Association of Non-State Pension Funds (ANPF), the Association of European Businesses (AEB).

It has a reliability and quality rating of “A+.pf” with a stable outlook.

NPF "Doverie" is a joint-stock company that offers programs for transferring the funded part of a pension to the Fund under a compulsory pension agreement and programs for the formation of an additional non-state pension under an NPO agreement. The latter are also available to corporate clients. All investors can control their pension accounts through the personal account of NPF Trust - the service is free and is provided from the moment the agreement concluded with the Fund comes into force.

The amount of pension savings of the insured person

The size of the insured person’s funded pension is influenced by the amount of funds contributed to its formation and accounted for in his individual personal account (ILA) with the Pension Fund or in his pension account with the NPF.

Amount of pension savings annually

August 1 adjusted

based on the amounts of funds received for its financing that were not taken into account in the calculation when assigned or in the previous adjustment.

NP = PN / T,

- NP - the amount of funded pension;

- PN - the amount of the recipient's pension savings on the day of payment;

- T is the expected period of pension payment (number of months). It is established annually by law and in 2020 it is 246 months.

If you apply for a funded pension later than the recipient is entitled to it, the expected payment period is reduced for each full year of delay in its assignment by 12 months, but cannot be less than 168 months.

To place pension savings, a citizen must choose a management company (MC) or a non-state pension fund (NPF).

Once every five years, the NPF can be changed to another, or the formation of funds can be transferred to the management company. This can be done earlier (ahead of schedule) - once a year, but there may be a loss of investment income.

There are a number of main criteria by which it is best to choose a non-state pension fund:

- Reliability rating. It is worth paying attention to the fund that has the highest and most stable degree of reliability. To determine it, you can use data from rating agencies, for example “Expert RA” or “National Rating Agency”. You should not trust a non-state pension fund whose rating has been revoked.

- Age. The older the fund, the greater its experience in investments, savings, reserves, and pension payments. It is desirable that the fund began operating in the pre-crisis period of 1998. If his activities were effective in difficult financial conditions, he may be able to successfully manage savings funds in similar situations in the future.

- Fund return. This criterion provides information about how successful the fund's financial operations are. It can be seen on the website of NPFs, rating agencies, and determined according to data from the Federal Service for Financial Markets (FSFM).

- Founders. It is best if the founders of the fund are large industrial enterprises. Such funds are considered more reliable than those established by individuals or little-known small companies.

For reference

Every self-respecting foundation should have its own website, which contains all the necessary information about itself, presented in an understandable form. A plus will be the presence of a personal account so that the insured person can track the movement of funds in his personal account.

In addition to the information provided by the fund, it is worth reading reviews about it posted by its clients on websites on the Internet, social media. networks. If the fund is little known and information about it is limited, it may be new to the market and should not be trusted.

The selected NPF must have a license to provide pension insurance and must be included in the system for guaranteeing the safety of savings. A list of non-state pension funds that meet legal requirements can be viewed on the Bank of Russia website. To transfer pension savings to a non-state pension fund you need:

- Contact the NPF and conclude an agreement with it on compulsory pension insurance.

- Submit an application to the territorial Pension Fund for transfer to a non-state pension fund.

After considering the application, the pension fund sends a notification to the insured person. If the non-state pension fund complies with legal requirements, the Pension Fund of the Russian Federation will notify of a positive decision; if the fund’s license is revoked, the notification will indicate the reasons for the refusal.

NPF Safmar - official website

Legal advice Get qualified help right now!

Our lawyers will advise you on any issues. » The non-state pension fund Safmar was founded in 2004. The headquarters of the organization is located in Moscow, and the fund itself belongs to one of the largest groups in the field of industry and finance in our country - the Safmar group.

Details of the activities of NPFs in the field of pension insurance and provision will be discussed below.

The organization has a well-developed website, which is located at The successful provision of services in the areas of compulsory pension insurance and non-state pension provision, as well as the merger of several funds, led to the formation of an impressive client base - more than 2.3 million people. The fund manages over 200 billion rubles of pension assets.

The fund's participation in the system of guaranteeing the rights of insured persons makes it attractive among potential clients.

The procedure for paying the funded part of a pension from a non-state pension fund

One-time payments can be withdrawn from a non-state pension fund if the conditions stipulated by the legislation of the Russian Federation are met. The citizen's age must meet the requirement: born in 1967 and older. The law provides for cash payments of the funded component in the event of:

- receiving a minimum old-age pension;

- participation in the savings co-financing program;

- monthly funded payment of no more than 5 percent of the old-age pension, taking into account the fixed part.

Citizens who have:

- certificate for maternity capital, used to increase private entrepreneurs;

- survivor's pension;

- disability related to disability;

- insufficient length of service for an old-age insurance pension;

- the right to social state pension provision.

Procedure

To withdraw the accumulated part of the funds from the NPF, you need to submit a package of documents. The list of securities is stipulated by the fund to which the citizen has entrusted the management of pension savings. To receive a one-time payment you must:

- Apply in person or through the official website of the NPF.

- Submit an application.

- Attach a package of documents.

- Register papers.

- Receive a receipt.

- Specify the deadline for making a decision.

- Wait for an answer.

If a citizen is forming a funded pension, he will be able to apply for its assignment at any time after he becomes eligible for an old-age insurance pension (including early).

A funded pension is established regardless of whether the citizen receives another pension or a lifetime monthly allowance.

The assignment and payment of savings, as well as the organization of delivery, is carried out by the fund to which the citizen has entrusted their formation; in this regard, he should apply for a savings benefit:

- to the NPF branch where pension savings were formed;

- or to the territorial Pension Fund, if the funds were transferred to the Criminal Code.

By agreement with the employee, the employer also has the right to apply for a funded pension.

The assignment of a funded pension is possible if the insured person has pension savings. You can apply for the establishment and delivery of savings payments:

- during a personal visit to the Pension Fund or Non-State Pension Fund;

- via the Internet on the Pension Fund website or the state portal. services, or on the NPF website.

All required documents must be attached to the application for a funded pension:

- passport of a citizen of the Russian Federation or residence permit (for foreigners and stateless persons);

- certificate of compulsory pension insurance (SNILS);

- a certificate from the Pension Fund of the Russian Federation on the acquisition of the right to an old-age insurance pension (for submission to the NPF);

- documents that can confirm the insurance period and the periods included in it;

- additional information may be required.

The application will be accepted for consideration if everything necessary is submitted within 5 working days from the date of its submission.

If the application for a funded payment is made through a representative, it is necessary to provide a power of attorney and an identification document, unless the power of attorney is notarized.

You cannot receive pension savings before your retirement date. A citizen’s right to assign funded payments arises simultaneously with the right to an old-age insurance pension, in this case:

- The payment of pension savings can be established for a citizen before he reaches retirement age, but only if he has earned an early assignment of an old-age insurance pension.

- Depending on the amount of savings that was formed at the time the payments were made, as well as from what funds they were financed, there are different types of savings payments.

With a lump sum payment, all pension savings are paid out in one lump sum. It is assigned if the recipient has not been granted a funded pension.

The following may qualify for a one-time payment:

- insured persons who have pension savings, the amount of which is equal to 5% or less of the sum of the old-age insurance pension, taking into account the fixed payment and funded pension as of the day of appointment of funded payments;

- Recipients who are paid an insurance pension for disability or in connection with the loss of a breadwinner, or a state pension benefit who are not entitled to an old-age insurance pension due to the lack of the required insurance period or the number of individual pension points.

Part of the savings, consisting of the specified funds, is paid monthly for a period determined by the recipient themselves, but not less than 10 years. The funded pension is paid monthly and for life.

How to receive the funded part of your pension as a lump sum in 2020

Thus, accumulative capital is funds that a person collects on his own, and then can dispose of them at his own discretion. But before you dispose of them, you need to have at least a minimum of information about what it is and what the mechanism of accumulation is.

- Receive the entire accumulated amount in one go. The following have the right to receive one-time money:

- Citizens whose accumulated capital is no more than 5% of the labor pension.

- Citizens receiving disability or survivor pensions, but they do not have the right to an old-age pension due to lack of work experience, and have reached retirement age.

- Money is transferred monthly to a bank account; you can receive it in the required amount or leave it in the bank.

- Payment in equal installments along with a pension for the rest of your life.

Forgery of signatures

This is what happened in my case. As I later found out, I was transferred to a new fund by an employee of the bank where I received the card. She scanned my passport and SNILS, which was in the cover of the passport, quietly filled out the documents and reported to the fund: “Here, they say, I brought you a new client, give me the money.”

Some NPFs require agents to provide a photo of the client’s passport. True, scammers manage to bypass these barriers, buy databases of scanned documents, and add their own phone numbers to the contract in order to answer calls from NPFs on behalf of clients.

One of my colleagues from NPFs told me that scammers open entire factories to produce forged contracts: they hire special people who forge signatures, other employees answer NPF phone calls, confirming the transfer, and still others hand over documents.

Some NPFs require agents to take a photo of the client along with his documents - so that they can later prove that the person signed the papers himself

According to the law, forging signatures, providing copies of a passport and answering the phone for a client is not enough to transfer a pension. After that, my identity and signatures are certified in one of three options: a personal visit to the Pension Fund or MFC, with the help of a notary, or with an electronic signature. I don’t yet know who confirmed my identity. My new NPF ignored this question, and now I am waiting for an answer from the Pension Fund.

Inheritance of a deceased pensioner's pension

In the event of a citizen's death, his pension savings can be transferred to his heirs. This happens under certain conditions:

- If the death of the recipient of payments occurred before their appointment, pension savings are paid to his successors, except for maternity capital funds aimed at forming a funded pension.

- If the insured person passes away after the establishment of a funded pension, payment of funds by inheritance is not provided for by law.

- In the event of the death of the recipient after the appointment of an urgent payment, the heirs are paid the balance of unpaid funds, except for maternity capital. The balance of maternity capital is paid to the child's father or children.

The legal successors of pension savings are the persons whom the citizen indicated in the application for the distribution of his savings funds in the event of his death or in the contract for compulsory pension insurance. Such an application can be submitted to the savings fund during your lifetime at any time.

If there is no information about the heirs, then succession is established in accordance with the current legislation of the Russian Federation.

What is NPF

In accordance with the estates' legislation adopted in 2010, the pension now includes three main components:

- insurance;

- cumulative;

- basic.

The insurance share of the pension is 14% of the transferred funds, the basic one is 6%, and the funded one is 2%.

All future pensioners have the right to choose for themselves where their funds will be stored and accumulated: in a state or non-state pension fund. If the decision is made in favor of a non-governmental organization, it has the right to manage this money and increase its amount, which has a positive effect on the amount of the monthly benefit when a citizen reaches retirement age. So what is NPF? NPF is a non-profit company whose main function is the social security of investors and their pension insurance.

Each such structure has a completely transparent cash flow system and any of its clients can familiarize themselves with the amount of their contributions either online through their personal account, or by personally visiting the office of the non-state pension fund with which the agreement has been concluded.

What to do

To do this, request by registered mail from your new fund an agreement and consent to the processing of personal data that you allegedly signed. They can be used in court as evidence. When I received my documents, I saw that the signatures for me were made by someone else. Now I have filed a lawsuit.

You can go to court even if you signed the agreement yourself, but you were not told about the loss of profitability. As practice shows, the courts also satisfy such claims.

Remember that the law is on your side. If you yourself did not sign the contract or you were misled, then you will be able to prove everything in court.

Unfortunately, many people, when they learn about a transfer to a new non-state pension fund, simply wave their hand at it: they say, the money is small, why bother now, maybe the new fund will be better. There are three things you need to understand here:

- Now the money is small, but in 10-20 years it will accrue significant interest.

- Choosing an insurer for compulsory pension insurance is your legal right. If you did not choose this NPF, there is no reason to stay in it.

- Most likely, you will only be required to collect documents and appear at the court hearing. My lawyers say that they are not needed there and that I can do everything myself.

Stages of inheritance

First of all, you need to approach the notary with a document containing information about the place of last registration of the deceased. The lawyer will issue a list of papers that need to be collected in order to enter into inheritance rights. After that, contact him again.

The procedure for receiving an inheritance includes 3 stages:

- Write an application requesting a certificate.

- Pay the state fee.

- After 6 months, obtain from a notary a ready-made certificate of the right to inheritance according to the law. If it does not contain a complete list of property, you need to draw up an additional act. If the notary refuses to draw up a document, the heir has the right to go to court.

Remember

- If you change NPF more than once every five years, you will lose investment income.

- Seemingly small lost amounts of investment income for retirement can turn into tens or even hundreds of thousands of rubles.

- Carefully read all the documents you sign when receiving a loan or employment (and generally always).

- Fraudsters only need your passport and SNILS to transfer you to a new NPF.

- If you have become a victim of unscrupulous agents, complain to your new NPF, the Pension Fund of the Russian Federation and the Central Bank.

- To return the funded part of your pension and income, go to court with a claim to invalidate the compulsory pension agreement.

Advantages and disadvantages

Advantages of transferring your savings to NPF Trust:

- constant feedback from clients who can ask questions of interest at any time;

- hotline, where specialists are ready to provide detailed advice;

- the fund's yield is more than 4% higher than the level of consumer price growth;

- availability of corporate pension programs;

- the possibility of round-the-clock monitoring of the status of a special part of an individual personal account on the official website of the NPF;

- the right to make voluntary contributions within the framework of NGOs in order to increase the size of a future pension.

Among the minuses, we note that the reliability rating is not the highest, which, moreover, was recently withdrawn.

So, NPF Doverie offers to use one of the 3 available programs - formation of a future pension in a pension fund, NGO, or participation in corporate pension programs.

To transfer a funded pension to this fund, you must submit an application and enter into an agreement, having only your passport and SNILS with you.

What is more profitable: funded or insurance pension?

https://www.youtube.com/watch?v=a6KJkhlEMvE

Is it profitable to form a funded pension? To answer this question, you need to understand its pros and cons:

- Contributions directed to the insurance pension are transferred to pension points and stored in the account in the form of information, and the funds received by the Pension Fund are used by the state to pay pension benefits to current pensioners.

- Contributions aimed at forming pension savings are stored in the individual account of the insured in the form of money and the state cannot dispose of them.

- The funded pension is not indexed, unlike the insurance pension. It is invested in the financial market; this process can be both profitable and unprofitable.

- Unlike an insurance pension, the funds of a funded pension are inherited if the recipient could not live to see its appointment or if it was assigned, but he did not have time to receive it.

If the license of the selected NPF is revoked, the accumulated funds will be retained and transferred to the Pension Fund, but in the amount of the transferred contributions without taking into account investment income.