History and activities of the foundation

NPF "Strategy" is one of the oldest non-state pension funds. The institution was founded in 1993, and from that moment on it was the largest financial institution in the Urals. Since 2002, the fund began to participate in the state pension insurance program. Three years later, it underwent reform and began operating in the form of a joint stock company.

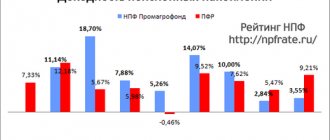

Before the license was revoked, rating agencies assessed the activities of NPF “Strategy” with a high (A+) reliability rating, which is also evidenced by the large number of fund clients throughout Russia, and not just in the Perm region.

At the end of 2014, the Strategy Fund entered the top thirty of the best non-state funds in the Russian Federation with pension savings of more than 4 billion rubles and reserves of 2.5 billion. The number of participants at that time was more than 77,000 people, and almost 30,000 people were already receiving pension payments.

All the fund’s work was aimed at accumulating and increasing the funds of depositors and insured persons, while financial information and reporting were publicly available to each client.

NPF "Strategy" - actions of investors after the bankruptcy of the fund

The funds accumulated in the personal accounts of the participants were invested in business entities, bank deposits, and mutual funds. This brought good profitability, which allowed them to increase additional profits for their clients.

Despite this, on March 16 of this year, the Central Bank revoked the current license from the Strategy Fund. Among the reasons given were manipulation of the Central Bank market during trading and repeated violation of reporting deadlines. Order No. OD-871 canceled the license; accordingly, all the company’s offices were closed, and within a few days the first requests from participants appeared to receive their own money.

Actions of investors

The latest news about NPF “Strategy” in Perm made investors worry; after the introduction of a temporary administration, the fund ceased its activities, and today does not accept or issue funds to its clients.

It is important to know what a depositor of NPF “Strategy” (Perm) should do in order to receive his savings. The Pension Fund of Russia has issued a memo for clients of this fund, which states how to act in order to receive their savings:

- Previously concluded agreements with the fund are considered terminated and invalid. Payments of funds under all agreements will be made subject to and in order for NPF “Strategy” to satisfy the claims of creditors. Payments will begin no earlier than bankruptcy proceedings are initiated.

- You will be able to receive your savings from NPF “Strategy” upon prior application. In the request form, you must indicate the TIN, passport data, and SNILS number of the fund’s client. If a proxy will act on his behalf, you will need to indicate the authority of the proxy, the number and details of the power of attorney. The application also indicates the contract number, name and date of its conclusion, and the total amount of debt in Russian rubles.

- The information obtained in this way is entered into the register, and the claims of creditors (which include former clients of the fund) are satisfied in accordance with the provisions of the Federal Law “On Insolvency”.

- Pension savings are transferred to the client’s bank account, the details of which must be indicated in the application form (TIN, BIC of the bank, personal account). In addition, the recipient may be a third party, and it will be necessary to submit documents certified by a notary, which will confirm the right to receive funds transferred to the creditor.

- In the event that funds are received by the client’s legal successors, the funds are paid based on the information that was left to the participants in the process of filling out the agreement.

- To this requirement it will be necessary to attach all contracts, court decisions, documents that confirm the transfer of contributions to the client’s personal account, passport, INN, SNILS and others that could confirm the validity of the requirements.

If the client had an OPS agreement with NPF “Strategy”, then all funds accumulated in the personal account will be transferred to the Pension Fund in the amount of par value.

This includes contributions transferred by the employer, voluntary insurance contributions, funds or part thereof from maternity capital, as well as state co-financing funds. The transfer is carried out within 3 months or less from the date of cancellation of the fund’s license.

Today, NPF “Strategy” has stopped not only accepting voluntary contributions from citizens, but also paying previously issued non-state pensions, urgent, one-time payments and funded pensions, however, all savings funds will be transferred through the Bank of Russia to the Pension Fund of the Russian Federation and accumulated in the personal accounts of clients. It is the Pension Fund of Russia that has the rights of a bankruptcy trustee and will continue to serve legal successors and clients.

A request for payment of funds can be sent in writing or electronically to the Arbitration Court of Perm, or to the liquidator in Moscow. The application must be submitted before June 30, 2016. Claims filed later will be satisfied after all earlier claims have been paid or after the assets of the bankrupt institution are liquidated.

Date: 06/06/2016

Dear creditors of JSC NPF “Strategy”!

State Corporation "Deposit Insurance Agency", which, on the basis of the decision of the Arbitration Court of the Perm Territory dated April 20, 2020 in case No. A50-5876/2016, is the liquidator of the Joint Stock Company "Non-state Pension Fund "Strategy" (hereinafter referred to as the Fund), for the purpose of protection the rights and legitimate interests of the Fund's creditors additionally informs about the procedure for filing and establishing creditors' claims during the forced liquidation of the Fund.

According to the information available to the liquidator, during the period of activity of the temporary administration to manage the Fund, facts were established of distortion in the Fund’s database of information on contributions made by investors and participants, and information on payments made by the Fund to pensioners. This circumstance was also the basis for initiating a criminal case by the Main Investigation Department of the Main Directorate of the Ministry of Internal Affairs of Russia for the Perm Territory against the former general director of the Fund under Part 4 of Article 159 of the Criminal Code of the Russian Federation.

The register of declared claims of creditors of the Fund is subject to closure on June 30, 2020.

Considering that the liquidator does not have sufficient information to reliably determine the volume of the Fund’s obligations to creditors, the establishment of obligations under non-state pension provision and compulsory pension insurance agreements for the purpose of their subsequent inclusion in the register of declared claims of the Fund’s creditors is ensured by the Agency in the following order:

1). The Fund's obligations based on non-state pension agreements are subject to establishment on the basis of the requirements stated by creditors, including documents confirming the deposit of funds.

Claiming claims against the Fund is carried out by sending claims to the liquidator with the attachment of documents confirming the validity of the stated claims (we pay special attention to the need to attach all available payment documents confirming the payment of pension contributions during the period from September 1, 2020 to March 20, 2020).

The claim must be personally signed by the creditor (or his representative). A sample request form is posted on the Agency’s official website on the Internet.

Requirements and original documents, or copies thereof, confirming the validity of the requirements (no mandatory notarization is required)

can be sent to the representative of the liquidator at the address: 127055, Moscow, st. Lesnaya, 59, building 2.

Requirements stated during the activities of the temporary administration will be considered and taken into account by the liquidator; they are not required to be sent to the liquidator again.

2).

History of changes in the Unified State Register of Legal Entities for 2015–2018

2018

- 08.05.2018

- GRN

2185958519030 - SPVZ code

12201

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- P14001 application for changes in information not related to changes. constituent documents (clause 2.1) dated 04/27/2018

- Court decision (copy from copy) dated January 30, 2018

- Power of attorney for Kozhemyakina A.M. (notarized copy) dated 02/01/2018

- Cover letter dated 04/24/2018

- Inventory of investments in the envelope dated 04/25/2018

- Envelope dated 04/25/2018

- 08.05.2018

- GRN

2185958519008 - SPVZ code

14103

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

The legal entity has been declared insolvent (bankrupt) and bankruptcy proceedings have been opened against it

Documentation:

- Court decision on bankruptcy and opening of bankruptcy proceedings dated January 30, 2018

- 13.02.2018

- GRN

2185958131137 - SPVZ code

12201

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- P14001 application for changes in information not related to changes. constituent documents (clause 2.1) dated 02/09/2018

- Inventory of attachment dated 02/06/2018

- Power of attorney for Kozhemyakina A.M. (notarized copy) dated 02/01/2018

- Envelope dated 02/06/2018

- Cover letter dated 02/05/2018

- Decision of the Arbitration Court of the Perm Territory (copy of a copy, certified by a notary) dated January 30, 2018

2017

- 14.08.2017

- GRN

2175958730715 - SPVZ code

14114

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Adoption by a legal entity of a decision on liquidation and appointment of a liquidator

Documentation:

- R15001 notification of the decision to liquidate a legal entity dated 08/08/2017

- Covering letter from the Bank of Russia dated July 28, 2017

- Power of attorney for A.M. Kozhemyakina (notarized copy) dated 04/21/2016

- Inventory of attachment dated 07/31/2017

- Decision of the Arbitration Court of the Perm Territory (copy) dated April 20, 2016

2016

- 23.06.2016

- GRN

2165958655322 - SPVZ code

12201

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- P14001 application for changes in information not related to changes. constituent documents (clause 2.1) dated June 20, 2016

- Inventory of attachment dated 06/10/2016

- The decision on registration was made by the authorities of the Central Bank of the Russian Federation dated 06/08/2016

- 21.04.2016

- GRN

2165958463075 - SPVZ code

13105

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Submission by the licensing authority of information on license revocation

- 08.04.2016

- GRN

2165958423960 - SPVZ code

12201

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Changing information about a legal entity contained in the Unified State Register of Legal Entities

Documentation:

- P14001 application for changes in information not related to changes. constituent documents (clause 2.1) dated 04/06/2016

- Inventory of investments in envelope dated March 30, 2016

- Cover letter dated 03/29/2016

- Envelope dated 04/06/2016

- 18.02.2016

- GRN

2165958183103 - SPVZ code

13300

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Submission of information on registration of a legal entity as an insurer in the territorial body of the Pension Fund of the Russian Federation

2015

- 14.04.2015

- GRN

2155958280180 - SPVZ code

13102

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Submission by the licensing authority of information on the re-issuance of documents confirming the availability of a license (information on the extension of the license validity period)

- 27.03.2015

- GRN

2155958226983 - SPVZ code

13400

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Submission of information on registration of a legal entity as an insurer in the executive body of the Social Insurance Fund of the Russian Federation

- 17.03.2015

- GRN

2155958201045 - SPVZ code

13200

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Submission of information on registration of a legal entity with the tax authority

- 17.03.2015

- GRN

1155958020844 - SPVZ code

11301

- Code NO

5958

Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

Creation of a legal entity through reorganization in the form of transformation

Documentation:

- Р12001 application for the creation of a legal entity during reorganization dated 03/10/2015

- Cover letter dated 02/26/2015

- Charter of the legal entity dated 02/19/2015

- Document confirming payment of state duty dated 10/21/2014

- Receipt dated 10/24/2014

- Decision dated 02/19/2015

WHAT YOU NEED TO KNOW ABOUT THE NEW PENSION LAW

The Fund's obligations to pay assigned non-state pensions, based on non-state pension agreements, are determined by the liquidator and included in the register of creditors' claims based on information established during the activities of the temporary administration of the Fund. Claims by the Fund's creditors are not required.

3). The claims of creditors based on contracts on compulsory pension insurance, as well as the claims of creditors based on contracts of non-state pension provision (agreements on the payment of a non-state pension with the right to make pension contributions after the appointment of a non-state pension) are subject to establishment by the liquidator on the basis of information from the Pension Fund of the Russian Federation and the Central Bank of the Russian Federation. In this regard, the filing of claims by the Fund's creditors is not required.

Return to list

Currently, the “Strategy” case is being handled by representatives of the Bank of Russia, headed by the Deputy Chairman of the Board of the Bank, Vladimir CHISTYUKHIN. He clarified the situation.

Vladimir Chistyukhin says:

— Today, the Bank of Russia strictly controls several segments of the financial market. These are the MTPL market, the microfinance organization (MFO) market and the non-state pension fund (NPF) market. One of the results of our work was the revocation, or more precisely, the cancellation of the license of NPF “Strategy”.

— This fund has many investors. What should they do?

— Today we met with your governor, and it seems to me that we are acting coherently and can jointly implement all measures to protect the rights of citizens.

The “strategy” worked in two directions. The first is voluntary pension insurance, the so-called pension reserves, which citizens formed voluntarily and in the amount they considered necessary; here the Strategy has accumulated 800 million rubles. But there are not enough assets to support this amount. On April 20, a meeting of the Arbitration Court will take place, at which the issue of forced liquidation of the NPF will be considered, a liquidator will be appointed and the issue of asset restoration will be decided. For now, all appeals can be sent to the liquidation commission, consisting of Bank of Russia employees. Now the urgent question is how to improve the process of citizens' appeals. The issuance of forms will be fully ensured, and a multi-channel hotline will also be opened: the governor gave the command to the Minister of Communications. In queues at the Strategy office to receive forms for inclusion in the Register of Creditors, so far everything is calm. But “Strategy” worked not only in the Perm region, it also has an office in Yekaterinburg. The forms will arrive there within two days. This is the first stage of our work. The second, as I already said, will begin after April 20.

The second direction of the “Strategy” is the mandatory funded part, which was formed by employers. Here the amount of savings is 4.2 billion rubles.

Additional activities of JSC NPF "STRATEGY"

Support activities in the field of insurance and non-state pension provision

Activities in the field of compulsory social security

This group includes: - activities related to the provision of benefits for illness, maternity and temporary disability - activities related to the provision of pensions for civil servants; activities related to the provision of pensions for old age, disability, loss of a breadwinner, for long service, except for those paid to civil servants - activities related to the provision of unemployment benefits - activities related to the provision of benefits to large families and child benefits This group does not includes: - insurance of pensions and annuities, management of non-state pension funds, see 66.02 - additional health insurance, see 66.03.1 - provision of social assistance and social services, see 85.3

Activities in the field of compulsory social security

This group includes: - financing and regulation of activities related to the provision of coverage in case of work injury and occupational disease, the need to receive medical care; — provision of an old-age labor pension, a labor disability pension, a labor pension for the loss of a breadwinner, a social pension, a state pension; provision of benefits in connection with the birth of a child, benefits for temporary disability; - activities related to social support for unemployed citizens, with the provision of benefits to large families. This group does not include: - voluntary pension insurance and non-state pension provision, see 65.30; - provision of social assistance and social services, see 88.10, 88.99

Support activities in the field of insurance and pensions

This class includes: - the activities of agents (brokers) in the sale of annuities and insurance policies, as well as the provision of other insurance, pension benefits and related services to employees, such as claims for changes in the amount of benefits and transfer of liability to third parties

Activities related to non-state pension provision

This group includes: - activities in the field of financial intermediation of insurance offices, companies, societies, etc., related to the receipt and redistribution of insurance premiums providing additional pension coverage. This group also includes: - activities for the management of non-state pension funds. This group does not include : - management of social programs financed primarily from public sources and not involving own contribution, see 75.12 - compulsory pension provision, see 75.30

Tatyana Margolina: Payments to Strategy investors may last for six months

Here the situation is simpler: citizens can receive their savings from the Pension Fund, which will receive money from the Bank of Russia.

— Are there signs of a criminal case?

— Yes, in our opinion, there are signs of a criminal offense in the activities of “Strategy”. After a complete analysis of the fund’s activities, which we will conduct in the very near future, we intend to contact law enforcement agencies.

— What is the article by which the actions of the fund’s management are assessed?

— It’s impossible to name the exact article right now, but it’s something close to fraud.

— How many citizens suffered from the actions of the Strategy leadership?

— In the first part (pension reserves) 66 thousand people. For the second (funded part) – 77 thousand. But they cannot be summed up, since the same people donated money both here and there.

— How many people have applied to the fund to date?

— So far, about three thousand.

— What is the amount of payments?

— According to the first part, 800 million is divided by the number of citizens. But, I repeat, the Strategy does not have sufficient assets. There is also no real assessment of the quality of these assets yet. The asset statements were falsified. In addition, out of the estimated 800 million, we clearly see only 100 so far. On another part, I can say the following: - 2.5 billion rubles out of 4.2 will be reimbursed by the Central Bank.

— So, do you want to say that all investors receive their money?

— In the insurance part they will receive only the nominal value, that is, without the promised interest (investment income). Interest will depend on the availability of assets. The fact is that the “Strategy” was not included in the Pension Guarantee System, which the Central Bank introduced two years ago as a special type of control over non-state pension funds.

— When will the money start being issued?

— Two months after April 20, when the liquidator will be appointed, that is, in June.

— Have the fund’s leaders gone on the run?

— No, they are all in Perm. We hope that the owners will show honesty and decency.

Clients of the non-state pension fund (NPF) "Strategy" recently experienced a real shock - the fund's license was canceled, clients were asked to withdraw their savings. This can only be done after the bankruptcy procedure has been completed.

A temporary administration has been put into operation to manage this NPF “Strategy” fund in the city of Perm. According to current legislation, all contracts with clients are terminated.

Clients of NPF "Strategy" intend to seek justice from the prosecutor's office

The time for “Strategy” is over. As we already reported the day before, the Bank of Russia canceled the license of a large non-state pension fund from Perm. A temporary administration has been appointed. Why was Strategy closed, and what should its clients, of whom there are almost 80 thousand, do?

Sovetskaya, 72. Head office of the non-state pension fund "Strategy". Dozens of NPF clients gathered at the entrance in the morning. They are all at a loss and don't know what to do. The Central Bank revoked the organization's license. Everyone wants to hear the answer to the question: how to get their money back. But they come across a closed door.

NPF "STRATEGY" CLIENTS:

- They don’t answer?

- No.

Galina Sukhanova is already preparing a statement to the prosecutor’s office, and dozens more people are going to join the woman.

Galina Sukhanova, client of NPF "Strategy":

There are also pensioners who cannot walk at all, it’s okay, we still walk. Everyone brings money here, but the result is that they were robbed again.

Lyudmila Antipova, client of NPF "Strategy":

The day before yesterday, my husband and I only deposited 5 thousand, the day before yesterday, on the 16th. And on the 16th the license was revoked. They didn't say anything in the office.

Evgeny Gulyaev, TSN correspondent:

The non-state pension fund "Strategy" is the largest organization in the Perm region dealing with pension deposits and savings of individuals. According to the Central Bank, as of October 1, 2020, Strategy’s pension savings amounted to more than 4 billion rubles, and 78 thousand insured persons were clients of the fund.

A press release from the Bank of Russia states: the reason for the revocation of the license was repeated violations of requirements for providing information about the fund’s activities and manipulation of the securities market. The most important question: what will happen to pension savings? In Russia there is a system for guaranteeing them. But, as Kommersant-Prikamye writes, “Strategy” was not included in it. Now the Central Bank must reimburse the insured persons for these funds. However, the income received from investing funds will most likely not be compensated. In addition, experts noted that this is the first time they have encountered such harsh language from the Central Bank. And they do not rule out the initiation of a criminal case in the near future.

Sergey Okolesnov, CEO of the consulting company:

Last year, licenses were revoked from 19 non-state pension funds, none of them were accused of manipulation during trading on the stock exchange. It is possible that the materials of the Bank of Russia inspection will be transferred to law enforcement agencies.

Clients can find out what is happening with their savings from messages from the Bank of Russia. And also in your personal account on the government services website. Their savings will be transferred to the Russian Pension Fund within three months. In the future, they can be transferred to another non-state pension fund or left in the Pension Fund.

Evgeny Gulyaev, Mikhail Osetrov, Television news service

History and activities of the foundation

NPF "Strategy" is one of the oldest non-state pension funds. The institution was founded in 1993, and from that moment on it was the largest financial institution in the Urals. Since 2002, the fund began to participate in the state pension insurance program. Three years later, it underwent reform and began operating in the form of a joint stock company.

Before the license was revoked, rating agencies assessed the activities of NPF “Strategy” with a high (A+) reliability rating, which is also evidenced by the large number of fund clients throughout Russia, and not just in the Perm region.

At the end of 2014, the Strategy Fund entered the top thirty of the best non-state funds in the Russian Federation with pension savings of more than 4 billion rubles and reserves of 2.5 billion. The number of participants at that time was more than 77,000 people, and almost 30,000 people were already receiving pension payments.

All the fund’s work was aimed at accumulating and increasing the funds of depositors and insured persons, while financial information and reporting were publicly available to each client. The funds accumulated in the personal accounts of the participants were invested in business entities, bank deposits, and mutual funds. This brought good profitability, which allowed them to increase additional profits for their clients.

Despite this, on March 16 of this year, the Central Bank revoked the current license from the Strategy Fund. Among the reasons given were manipulation of the Central Bank market during trading and repeated violation of reporting deadlines. Order No. OD-871 canceled the license; accordingly, all the company’s offices were closed, and within a few days the first requests from participants appeared to receive their own money.

Actions of investors

The latest news about NPF “Strategy” in Perm made investors worry; after the introduction of a temporary administration, the fund ceased its activities, and today does not accept or issue funds to its clients.

It is important to know what a depositor of NPF “Strategy” (Perm) should do in order to receive his savings. The Pension Fund of Russia has issued a memo for clients of this fund, which states how to act in order to receive their savings:

- Previously concluded agreements with the fund are considered terminated and invalid. Payments of funds under all agreements will be made subject to and in order for NPF “Strategy” to satisfy the claims of creditors.

brief information

The organization NPF "STRATEGY" was registered on September 08, 1995 by the registrar: Interdistrict Inspectorate of the Federal Tax Service No. 17 for the Perm Territory

.

After registration, the company was assigned: OGRN: 1025900510261, INN: 5902111999 and KPP: 590201001. The main type of activity is “ Non-state pension provision

”, the organization also has 1 additional type of activity. Legal address of NPF "STRATEGY" - 614045, Perm region, Perm, st. Sovetskaya, 72.

Address on the map

From “Strategy” to tragedy

Payments will begin no earlier than bankruptcy proceedings are initiated.

If the client had an OPS agreement with NPF “Strategy”, then all funds accumulated in the personal account will be transferred to the Pension Fund in the amount of par value. This includes contributions transferred by the employer, voluntary insurance contributions, funds or part thereof from maternity capital, as well as state co-financing funds. The transfer is carried out within 3 months or less from the date of cancellation of the fund’s license.

Today, NPF “Strategy” has stopped not only accepting voluntary contributions from citizens, but also paying previously issued non-state pensions, urgent, one-time payments and funded pensions, however, all savings funds will be transferred through the Bank of Russia to the Pension Fund of the Russian Federation and accumulated in the personal accounts of clients. It is the Pension Fund of Russia that has the rights of a bankruptcy trustee and will continue to serve legal successors and clients.

A request for payment of funds can be sent in writing or electronically to the Arbitration Court of Perm, or to the liquidator in Moscow. The application must be submitted before June 30, 2016. Claims filed later will be satisfied after all earlier claims have been paid or after the assets of the bankrupt institution are liquidated.

NPF Strategy had its license revoked: latest news about liquidation

A press release from the Bank of Russia reports that the NPF violated the requirements of the law “On Non-State Pension Funds”, as well as the requirements for the dissemination, provision or disclosure of information provided for by federal laws. The Bank of Russia also reported that it had established the fact of manipulation of the markets for shares of the closed mutual fund Rodnye Prostori and bonds of Rotor LLC, Zhilstroy, STP at trading on the MICEX Stock Exchange in the period from January 2013 to April 2020. These actions were committed with the aim of artificially inflating the value of assets on the balance sheet of the NPF, and “indicate an intention to mislead investors and the regulator regarding the price and liquidity of shares and bonds in order to achieve mandatory standards by the management companies of the NPF “Strategy” by placing pension reserves and investing pension savings of NPF “Strategy” in shares and bonds.”

The Central Bank message states that Rotor LLC, Zhilstroy, AVK, Permtransmekhanizatsiya, TSK-1, Rentek, PJSC Promaktiv, as well as P. V. Romanova participated in transactions with securities and N.A. Ivanov. As part of the audit, it was established that all of the listed organizations, as well as NPF Strategy JSC, are related to each other and belong to one group of legal entities - a group controlled by several individuals. Individuals who participated in trading in shares and bonds and occupy various positions in the organizations of the Strategy Group have either family or professional connections with each other.

Measures were taken against persons who took part in market manipulation, including in accordance with the requirements of the Code of Administrative Offenses of the Russian Federation.

• NPF “Strategy” was created in 1993 on the basis of NPF “BIS-Garant”. The fund was consistently included in the Top 30 Russian NPFs. In 2015, the NPF was corporatized. As of October 1, 2020, pension reserves of NPF Strategy amounted to 2.6 billion rubles, pension savings - 4.1 billion rubles, own property - 6.9 billion rubles. Its clients were 78.2 thousand insured persons, participants - 68.7 thousand people. 75% of the shares of NPF Strategy JSC, according to SPARK-Interfax, belong to Strategy Management Company OJSC, which, in turn, is controlled by STP LLC and the relatives of Peter Pyankov. NPF "Strategy" is not included in the pension guarantee system.

Within three months, all mandatory pension savings will be transferred to the Pension Fund of the Russian Federation, and in the future its participants will be able to decide whether to transfer savings to another non-state pension fund or remain in the Pension Fund. Since NPF “Strategy” was not a participant in the pension guarantee system, mandatory pension savings will be compensated from the funds of the Bank of Russia, explains General Director Natalya Smirnova. “Everything that was additionally transferred to the NPF - within the framework of the state co-financing program or through maternity capital funds, will also be transferred to the Pension Fund. Only investment income can be lost if the NPF, after withdrawing the money, does not have property to compensate for it.”

The general director of the consulting company, Sergei Okolesnov, said that problems may arise for those pensioners to whom NPF Strategy pays a voluntary pension. After revocation of the license, the Deposit Insurance Agency determines whether the pension reserves and the Fund’s own funds are sufficient to organize payments to depositors and participants of the NPF. “It is quite likely that there will not be enough money for everyone. There was a case when the NPF “European” group (BIN group) accepted obligations to pay pensions to the NPF “Podolsky”, which had been deprived of its license, that is, it took on all the risks associated with the fact that there would not be enough money,” he explains. Mr. Okolesnov noted that this is the first time he has encountered such wording from the Central Bank: “Last year, licenses were revoked from 19 non-state pension funds, not one of them was accused of manipulation during trading on the stock exchange. It is possible that the materials of the Bank of Russia inspection will be transferred to law enforcement agencies.”