Rating of NPFs of Russia

When choosing a non-state pension fund, it is important to pay attention not only to the profitability of the fund, but also to its stability. The stability of the fund is ensured by the volume of funds transferred to the fund as part of mandatory pension provision.

The presented rating lists only the largest non-state pension funds in terms of the volume of pension savings managed. The main factor in the distribution of places in the ranking is the average profitability of non-state pension funds over three years (2010, 2011, 2012), and how successfully pension funds emerged from the financial crisis of 2011.

Information about the fund

JSC NPF "Gazfond" is a financial organization that provides insurance and non-state support services to citizens of the Russian Federation. The fund is one of the largest companies in the industry.

The partners are well-known Russian organizations: Gazprom PJSC, Sogaz JSC, Leader CJSC. According to employee reviews, NPF Gazfond JSC is one of the largest.

The fund became known in 1994. It was not a joint stock company then. The reorganization and name change took place in 2020, as required by the new legislation of the Russian Federation.

NPF Gazfond enters into agreements with individuals or organizations (as part of corporate programs). That is, its clients are individuals.

Asset exchange

NPF Heritage (ex-Norilsk Nickel) is the most modest in size in Anatoly Gavrilenko’s collection, but he got it with a set of very attractive assets. By the fall of 2013, when Gavrilenko, together with the structures of Ilya Shcherbovich, bought the fund from MMC Norilsk Nickel, its assets included, for example, SGB Bank and. The latter, in 2011-2012, built the first and only toll railway crossing in Russia between two districts of Ryazan within the framework of a PPP - with a loan from the State Security Service. This project was a pilot in the ambitious program of Norilsk Nickel, which planned to use pension money to build about 50 overpasses worth up to 2.5 billion rubles. True, the matter never got beyond the Ryazan crossing.

But Heritage’s most valuable asset turned out to be the owner of the Marr Plaza business center, located near the Ulitsa 1905 Goda metro station. It was built in 2011 by a structure controlled by the family of the ex-senator from Altai and the father of the famous singer Alsu Ralif Safin. Already in 2012, business. Safin built Marr Plaza with a loan from Raiffeisenbank in order to pay it off at the beginning of 2014 (at that time Heritage had already come under the control of Gavrilenko), it was decided to refinance with the affiliated bank SGB and the offshore Sinnarol Investment Limited, the business center itself acted as collateral

At the end of 2020, RPD-Ryazan and Snezhka Factory were purchased by Gazfond and transferred to ZIPF New Horizons. Thus, all real estate-related assets in the pension group were consolidated on the Gazfond balance sheet.

According to Gazfond’s reporting, the purchase of Marr Plaza cost the fund 4.7 billion rubles, and Marr Plaza’s balance sheet was even more expensive - 6.6 billion rubles. The amount at which the transaction took place does not coincide with the conclusions of an independent appraiser hired in 2020 to evaluate the closed mutual fund “Perspective Investments” (under the management of Management Company “Partner”), which owned shares in the Snezhka Factory. Then 75% of the company was valued at only 2.2 billion rubles. In general, thanks to the transfer of assets from Heritage to Gazfond, the net assets of the Perspective Investments Closed Unit Fund immediately increased by 27%, from 3 to 3.9 billion rubles.

A similar situation during the exchange of assets occurred with RPD-Ryazan. At the end of 2020, the overpass was valued at 285.5 million rubles by the Center for Independent Assessment, and 100% RPD-Ryazan was valued at 87.2 million rubles. Nevertheless, he paid 135 million rubles for 75%, and the overpass was reflected on the balance sheet at a cost of 390 million rubles. Gazfond ignored Forbes’ question on the basis of what estimates these purchases were made.

“The price of 4.7 billion rubles for Marr Plaza looks like a market price, based on current market rental rates and rates of return for class A office real estate,” says Sayan Tsyrenov, director of the capital markets department at Colliers International. “The value on the balance sheet may be explained by the higher rates at which leases were signed pre-crisis.” “The building does not grow three times in a year,” doubts one of the financiers interviewed by Forbes in the pension market. — Maybe Heritage needed to “draw” profitability. In general, everything is logical. "Heritage works with pension savings, liquidity is more important to it, and Gazfond is a high-quality business center Marr Plaza, populated by tenants."

Read also: Large pension: how the Gavrilenko family of financiers took leading roles in the non-state pension fund market

The assets of Anatoly Gavrilenko’s funds are indeed more diverse than those of Gazfond - NPFs of the founder of Alor invest in securities that are in one way or another connected with the state. The majority of the portfolios of the four funds are investments in state-owned banks and companies. Thus, approximately 54 billion rubles at the end of 2020 were invested in securities and were in accounts and deposits with Sberbank, VTB, VTB24, Gazprombank and Rosselkhozbank. Other large items are bonds of Russian Railways (22 billion rubles), Bashneft (19 billion rubles), MOESK (11 billion rubles) and RusHydro (9 billion rubles). In addition, approximately 43 billion rubles were invested in debt securities of regional governments, and 60 billion rubles in OFZs. All these investments make up approximately two-thirds of the funds accumulated in Gavrilenko’s funds.

“The presence of the Leader Management Company in the pension group of Anatoly Gavrilenko and the fact that NPF Gazfond remains a shareholder of some funds allows us to conclude that Alor is to some extent guided by state interests when investing,” reflects Pavel Mitrofanov. “This is also evidenced by the fact that Gavrilenko’s funds were the first to enter into public-private partnership (PPP) projects, and Leader Management Company is a powerful driver of PPP and concessions.”

Information from clients of NPF Gazfond

Feedback from participants in this organization's pension programs is positive in 9 out of 10 cases. The main feature, according to customers, is the high percentage and reliability.

Based on reviews of NPF Gazfond, it can be judged that investors trust the policyholder with their pension savings. The reputation of the organization is beyond doubt. Reliability is confirmed by the high rating of the rating agency Expert Ra (ruAAA). The fund's performance forecast is extremely stable.

According to investors, the fund can be trusted with their savings for a long period. Co-financing programs offered by employees are attractive due to their simplicity and investment income. Reviews from agents of NPF Gazfond confirm the opinion of clients: investors are happy to entrust pension contributions to the organization.

Gazfond NPF official website personal account

And preliminary preparation on the contact page will save them from fuss and help them focus on solving their issue.

An impeccable business reputation is reflected in the section disclosing all information about the fund

Probably, many will be interested in the reliability of the fund’s material support. The size of each position amounts to billions of rubles. The section also introduces users to the investment policy and partnership programs of the organization, its structure. Details and more than a dozen official documents are provided, which can be viewed in PDF format and downloaded to your computer for detailed review.

The main direction is working with individuals

The section describes in detail the schemes, principles of pension savings and the mechanism for interaction of citizens with OJSC NPF Gazfond through the official website.

Negative feedback from investors

According to reviews, NPF Gazfond previously also engaged in attracting clients fraudulently. But the employees who attracted clients in this way have not been on the team for a long time.

In order not to spoil its reputation in the eyes of clients, NPF Gazfond stopped all attempts by agents to obtain information from citizens by fraudulent means. This allowed the fund to maintain its reputation as an honest non-state company. Currently, concluding an OPS agreement is possible only after a visit to the Gazfond office or with an online application from the client himself.

Those who previously transferred their savings in a similar illegitimate way wrote negative reviews about NPF Gazfond. The dissatisfaction of clients is easy to understand, since more than 86% of them did not understand how and when they agreed to transfer the funded part of their pension to a non-state company.

Feedback from employees of NPF Gazfond confirms the 100% legitimacy of the company’s activities. All clients who have signed OPS or NPO agreements since 2018 made their choice voluntarily. Therefore, employees of a non-state fund speak positively about the integrity of the employer.

How to withdraw pension savings from the Pension Fund and how to withdraw them from the Non-State Pension Fund?

» Many future retirees are concerned about the pressing question - is it possible to withdraw the funds that were deducted from their income.

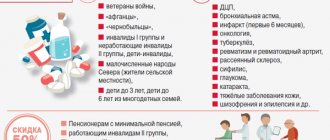

Such retirement savings may be held in a private or public pension fund.

The amount accumulated is quite large. In connection with various reforms and shocks, as well as alarming expectations of such changes, citizens want to have reliable information about the possibility of receiving these funds before retirement. First, you need to understand what the funded part of the pension is, where exactly savings occur and in what amounts are deducted. The accumulation of a certain part of the pension is applicable for citizens who were born before 1967 inclusive. The condition for accumulation is that they make a voluntary decision on such deductions, with notification of the Pension Fund of the Russian Federation. Six percent are subject to deductions.

In this case, the citizen himself chooses which organization the funds will be transferred to.

It depends on how you plan to increase such savings. Who can become the insurer of your savings and how to change the insurer - all the information in the picture: The funded part of future pension contributions can be formed from two sources: Amounts that the employer is obliged to transfer. Expressed as a percentage of the amount of income. The total percentage of such deductions is 22%; At his own request, the future pensioner himself can make deductions.

He transfers the percentage of deductions himself, and he can

Reviews on the salaries of Gazfond agents

The absence of “hidden” activities does not prevent NPF Gazfond from maintaining its leading position in terms of capital volumes and the number of attracted investors. The company's growth is ensured by the national average salary for the fund's insurance agents.

According to reviews, NPF Gazfond, the employer, provides employees with an income of 45-70 thousand rubles. Payment depends on the number of transactions. Since NPF Gazfond is a commercial organization, insurance agents must fulfill sales plans. When the plan is fulfilled, agents receive at least 50 thousand rubles. There is no upper limit for earnings in a non-state pension fund: fund employees always have something to strive for.

The advantage of salary is official income, bonuses in the form of a regular bonus for the number of completed applications. In cooperation with Gazprombank, fund agents have the right to offer programs at bank offices or non-state pension fund branches.

Personal Area

The personal account section on the official page is located in the upper right corner.

They are verified by daily practice and years of crises through which the team managed to go. The left side-bar for the visitor is simply a control panel for managing your own capital, starting from viewing the possibilities (additional pension calculator, rules) and ending with concluding an agreement and paying contributions.

The success of personnel and social policies using the example of corporate programs

Just as Japan adopted the idea of socialist competition from us, we are coming to realize the need to protect the corporate integrity of business. One of the sections is entirely devoted to the activities of enterprise-wide non-state pension insurance companies:

- tools,

- agreements,

- scheme.

In particular, the Gazprom program allowed every third production veteran to receive an additional non-state pension.

Conditions for employees

Working in a comfortable office within the city, with a separate office space - this is what the employer, represented by NPF Gazfond, guarantees to employees. Many people dream of working in such conditions.

Gazfond employees must adhere to business attire. White shirts, suits in dark colors, and the girls have blue ties with the brand image on their necks. According to reviews, the employer (NPF Gazfond) does not provide uniforms for employees, but ties, name badges and badges are provided free of charge.

Branches and workplaces for employees are fully equipped with office equipment. Managers and agents don’t skimp on office supplies: everything is provided by NPF Gazfond JSC. Such conditions attract many applicants who see their calling in working as an agent or sales manager.

Attractive working conditions are reflected in the fund’s activities: it occupies a leading position among similar ones in terms of capital volume and number of investors. The well-known independent website "Gosmarket" in employee reviews of the NPF "Gazfond" recognized it as non-state fund No. 1 in Russia based on the results of 2020.

NPF Gazfond official website personal account

Attention

At the first stage, the system will ask you to enter your email address and verification code - protection from robots. The second will be the completion of the recovery associated with the instructions in the letter that will be sent to the specified mailbox. If you happen to be an unregistered user, the corresponding button will be offered below the fields.

- Click on the "Registration" link.

- A window with registration conditions will open. Please read the points carefully before moving on to the next step.

- Confirm your agreement with the rules by checking the empty box.

Please also read the agreement on using a simple electronic signature.

- Click Next.

- The second stage is email registration.

Agent Feedback

Working as a pension fund agent requires good communication skills. Applicants are interviewed before being hired. Future NPF employees must understand that the main goal of their activities is to attract new investors. With the growth of capital volumes, the income of non-state pension funds increases. And therefore, the wages of agents.

According to reviews, work at NPF Gazfond is not difficult. But agents must make the most of their communication and persuasion skills. Not all citizens are aware of how pension programs can change their lives in the future. The agents’ task is to convey to clients the benefits of switching to NPF Gazfond.

Based on the results of activities, wages are paid in accordance with the Labor Code of the Russian Federation. Employees receive their salaries on Gazprombank cards. The premium depends on the number of registered applications.

Additional job requirements

The execution of the contract is considered completed when the client not only signs the application to transfer to the NPF, but also confirms his decision 5-10 days later. Confirmation occurs after contacting the operator of the Pension Fund or NPF Gazfond.

If during a telephone conversation the client refuses to switch to a non-state company, his savings remain with the previous supplier. Automatic transfer to NPF Gazfond without prior confirmation is impossible.

The work of agents of the non-state pension fund "Gazfond" includes not only attracting new clients, but also retaining citizens who decide to choose another NPF or return to the Russian Pension Fund. An application for re-conclusion of an agreement with a client who was previously a member of NPF Gazfond, but transferred his savings to another private organization, is considered a new OPS agreement.

Gazfond and Promagrofond

In 1994, a fund called Promagrofond was formed, which helps citizens of the country increase their future pension savings. To analyze the activities of this organization, it is worth taking into account criteria such as the level of trust, profitability rating, reviews and other key points that will be highlighted in this material.

General characteristics The non-state pension fund Promagrofond (hereinafter referred to as NPF) has more than 20 years of experience. Since April, active work on the consolidation of funds has been going on in the Safmar pension group - NPF "European", "Education and Science" and "Regionfond" should merge into NPF Safmar by the end of this year. In 2020, NPF “Doverie” will join them.

“The merger of funds will have the effect of strengthening control over risks, operational processes and costs”

,” noted the Safmar pension group.

The pause in the merger of funds, which KIT Finance Pension Administrator endured, could be caused by several reasons, experts indicate.

“Until recently, non-state pension funds could not buy back more than 40% of the volume of infrastructure bonds issued, in which the group was actively placing. After amendments were made to the Central Bank resolution in March of this year, for a number of issuers that meet the regulator’s requirements, there are no longer such restrictions. The above methods of concluding an agreement are possible only for individuals, and as for a corporate pension agreement, for this you should seek advice from the fund’s specialists in corporate programs.

This can be done by phone, by fax or by email to the NPF.

How to terminate an agreement with the non-state pension fund "Promagrofond" To terminate an agreement with a non-state pension fund, the following actions should be taken:

- submitting an application to the fund with the necessary documents;

- decide on actions regarding the redemption amount, or transfer it to another non-state pension fund or pay it.

Important!

The procedure for receiving and the method for calculating redemption amounts are established by the “Pension Rules of Non-State Pension Funds”, which are in force on the date of conclusion of such an agreement on a non-state pension.

The deadline for returning the redemption amount is approximately 3 months from the date of filing the application.

Documents that will be required upon termination of the agreement:

- bank details indicating the personal account number;

- consent of another NPF to receive the redemption amount;

- a certificate from the Federal Tax Service regarding receipt or non-receipt of a social tax deduction (applies to individuals);

- the original application for receiving the redemption amount;

- consent to the processing of personal information and a questionnaire;

- a certified copy of the passport of the first two pages;

- information about SNILS.

- a copy of the TIN assignment document;

Payment of contributions Pension contributions are paid only by non-cash method to the account of NPF "GAZFOND" in rubles.

Feedback from employees about the fund's programs

To be a successful NPF insurance agent, employees must not only know the features of the company's products. If an employee doesn't believe in the action or revenue of a product, he is unlikely to be able to offer it to customers in a way that will interest them. Employee reviews of OJSC NPF "Gazfond Pension Savings" indicate hundreds of reasons why employees themselves use the fund's products. This confirms the successful activities of the company.

The most popular, according to reviews of NPF Gazfond, are pension co-financing programs. Employees confidently offer them, as they themselves have sensed the prospects of the direction.

The convenience of the programs lies in the individual approach to the financial capabilities of investors. The client himself chooses which replenishment method is most convenient for him and sets its frequency.

There are no negative reviews of NPF Gazfond products written by the employees themselves. Fund agents have repeatedly proven by personal example that pension programs really work. Their relatives and friends who have already retired can afford to travel and make expensive purchases without saving. Reliability and high profitability are what distinguishes the products of NPF Gazfond from the offerings of dozens of other companies.

Anatoly Gavrilenko may buy Gazfond Pension Savings

- To save this material as favorites, or Material added to “Favorites”, you can read it later from any device. The section is available in your personal account Material added to “Favorites” Remove material from “Favorites”? Delete Material removed from Favorites

- To save this material as favorites, or Material added to “Favorites”, you can read it later from any device.

The section is available in your personal account Material added to “Favorites” Remove material from “Favorites”? Delete Material removed from Favorites

The Central Bank is doing everything to ensure that pension savings do not burn with a blue flame S. Nikolaev / Vedomosti Gazprom's corporate pension fund - Gazfond and the owner of the Alor group Anatoly Gavrilenko are agreeing to merge their funds involved in pension savings.

Two counterparties of Gazfond told Vedomosti about this. According to them, we are talking about the “daughter” of Gazfond – Gazfond Pension Savings.

In the spring of 2014, the large Gazfond separated it into a separate legal entity and transferred there the market business - funded pensions (now - 108.6 billion rubles). Gazfond PN is planned to be merged with Gavrilenko’s pension assets - these are three non-state pension funds (Heritage, Promagrofond, KIT Finance), which have 210.3 billion rubles between them.

funded and 15 billion corporate pensions. As a result, a pension group may be formed that will become the No. 1 player in the savings market (about 320 billion rubles).

The current leader, the Otkritie group, has 305 billion rubles.

savings. The deal will most likely be cash-free, Vedomosti’s interlocutors say: it is being discussed that the parties will receive shares proportional to the funds’ contribution to the assets of the combined structure. Thus, Gazfond may receive 33–35% of the combined group. The deal is structured through an operational transaction, Vedomosti’s source says, and the parties applied for approval from the Federal Antimonopoly Service (FAS) and the Central Bank.

The service received a request from KIT Finance Pension Administrator to purchase shares of NPF Gazfond PN; a decision has not yet been made, confirmed the head of the FAS financial markets control department, Irina Smirnova. The Central Bank traditionally “does not comment on existing companies.” Denial of pensions A similar transaction was carried out in August by the non-profit NPF Surgutneftegaz, which, according to a ring scheme, owned a subsidiary fund of the same name with funded pensions.

The “daughter” was sold to a certain LLC “Oil Consulting”.

But the sale was formal - in fact, the owner of the pension fund does not change, said the counterparty of NPF Surgutneftegaz, simply because of the requirements of the law, the “historical” founders of the funds are forced to renounce their pension assets. The buyer “is not unknown to us,” admitted Ruslan Gabdulkhakov, executive director of the non-profit Surgutneftegaz Foundation. For Gazfond, this is a forced transaction - from 2020.