Home / Labor Law / Employment / Hiring

Back

Published: June 26, 2016

Reading time: 7 min

0

1593

Every Russian citizen of retirement age has at least once thought about continuing to work after retirement, if he is able to work.

Thus, the choice of profession and field of activity is the right of every person, including pensioners, enshrined in the Constitution of the Russian Federation (Article No. 3 of the Labor Code of the Russian Federation). An employer who selects personnel for a company or enterprise does not have the legal right to discriminate against a person because of his age, which means that people of retirement age have the same right to work as other citizens of the country.

The first priority when considering this issue is to turn to Russian legislation. In this case, we will need the latest edition of the Labor Code of the Russian Federation (dated December 30, 2015). Article 59 of the Labor Code of the Russian Federation states that persons of retirement age (women over 55 and men over 60), as well as those who, for health reasons, cannot perform certain work for a long time, can get a job only on the basis of a fixed-term contract (up to five years), i.e. for a certain time specified in the contract.

It is important to know that the payment of old-age labor pension continues even to working pensioners; this is enshrined in the federal law “On Labor Pensions in the Russian Federation” (Article No. 18)

The conditions for employment are the same as for citizens who are not of retirement age. A person of retirement age must be able to work due to health reasons, and must also meet the basic requirements for employment in a particular company or enterprise. It is impossible to refuse employment because of age due to Art. 3 of the Labor Code of the Russian Federation, which gives the right to work to every able-bodied citizen.

Age is an exception only in a few cases:

- You can serve in the civil service for up to sixty years, with the right of extension up to sixty-five years.

- A person holding the position of rector, as well as vice-rector, head of an institute in state and municipal universities must be no older than sixty-five years.

Upon reaching this age, employees occupying the positions listed above will be transferred, with their consent, to other positions that they may occupy by law and circumstances. That is, they will not dismiss people based on age.

- The process of hiring a pensioner

- Features of hiring

- Features of hiring under a fixed-term employment contract

How to determine the business qualities of an applicant

Business qualities are the personal, professional and qualification qualities of employees (Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2). Qualification requirements for the applicant are established based on the position for which the age applicant is applying:

- Requirements for candidates for positions in law enforcement agencies, the prosecutor's office, and customs are established by federal laws. For example, in Art. 40.1 of the Law of January 17, 1992 No. 2202-1 “On the Prosecutor’s Office of the Russian Federation” lists the requirements for applicants for prosecutorial positions.

- Professional qualification reference books (professional standards) have been established for professions in the fields of education, medicine, construction, electric power and others that require special skills and abilities. For example, you cannot hire a person as a chess coach who does not have a certificate of appropriate teaching qualifications.

- In addition to professional standards, each organization has the right to develop local regulations (regulations, job descriptions), which indicate special requirements for candidates. For example, an Asian restaurant can quite legally refuse to hire a woman of Slavic appearance for the position of cloakroom attendant if it specifies in a special regulation or job description that all employees of the establishment must have an appearance or nationality that matches its concept.

An employer has the right to refuse employment to a pre-retirement person who has previously been dismissed from this organization for violating labor discipline.

Pension system in 2020

Since January 1, 2020, there have been a number of changes in pension legislation that affected all participants in the compulsory pension insurance system.

ASSIGNMENT OF PENSION

To assign an old-age insurance pension, a number of requirements must be met. In 2020, the right to a pension is given by having:

— at least 11 years of experience; - at least 18.6 individual pension coefficient.

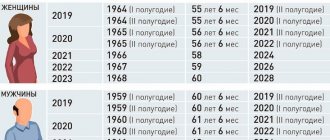

In 2020, a gradual increase in the generally established age began, which gives the right to receive an old-age insurance pension and a state security pension. The transition to new parameters is gradual and will be completed in 2028. Despite the fact that from 2020 the retirement age has increased by another year, and the total increase has already been two years, pensions, as last year, are assigned six months later than the previous retirement age. This year, women born in the second half of 1964 will have the right to an insurance pension - at 55 years 6 months and men born in the second half of 1959 - at 60 years 6 months.

Every year, the number of length of service and pension coefficients will increase until they become equal to 15 and 30, respectively.

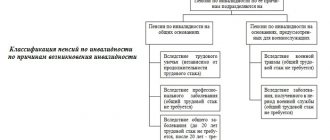

When assigning a disability pension, age does not matter, since it is issued from the moment disability is established.

When assigning an old-age insurance pension, the pension coefficients accrued for each year of insurance coverage are summed up and multiplied by the cost of one pension coefficient established on the day the pension was assigned. In 2020, the cost of one individual pension coefficient is 93 rubles.

It is worth noting that for many Russians, the assignment of pensions remains within the same age limits. This primarily applies to people who have early retirement benefits. For example, rescuers, public transport drivers and other workers engaged in difficult, dangerous and harmful working conditions. Employers pay additional contributions to pension insurance for them. Most of these workers continue to retire at 50 or 55, depending on their gender.

Early retirement is also preserved for teachers, doctors and representatives of some creative professions, for whom payments are assigned not upon reaching retirement age, but after acquiring the necessary length of service. The pension is assigned taking into account the transition period for raising the retirement age, which begins to operate from the moment of acquiring length of service in the profession. For example, a school teacher who completed the required teaching experience in April 2020 will be able to retire in accordance with the transition period after a year and a half, in October 2021.

You can clarify this information and send an application for a pension either in the “Citizen’s Personal Account” on the official website of the Pension Fund or on the government services portal, or by personally contacting the territorial bodies of the Pension Fund or the MFC.

In the Jewish Autonomy, 634 citizens will retire in 2020.

INCREASING INSURANCE PENSIONS

Every year, the Pension Fund of Russia carries out indexation of insurance pensions of non-working pensioners. 2020 was no exception. Since January 1, insurance pensions of non-working pensioners have increased by 6.6%. After indexation, the average pension in the Jewish Autonomous Region increased to 15,219 rubles.

Such components of the insurance pension as the fixed payment and the cost of the pension coefficient have also increased. Now their size is 5,686.25 rubles and 93 rubles, respectively.

The increase in the pension amount for each pensioner was individual. The higher the pension rights acquired by a citizen during his working life (length of service, earnings, insurance contributions, number of pension coefficients), the larger the size of the insurance pension and, consequently, the amount of increase to it after indexation.

Today, over 46 thousand pensioners live in the Jewish Autonomous Region.

MATERNAL CAPITAL

In 2020, owners of maternity (family) capital will face serious changes. First of all, maternity capital was indexed by 3% and in 2020 its size amounted to 466,617 rubles. The amount of the maternity capital balance of those certificate holders who previously partially used its funds in one of the areas was increased by the same percentage.

Since the beginning of the state program to support families in the Jewish Autonomous Region, more than 12 thousand families have received certificates for maternity capital.

The directions for using maternity capital remain the same:

- improving the family's living conditions;

- children's education;

- formation of a mother's funded pension;

- acquisition of goods and services intended for social adaptation and integration of disabled children into society;

- receiving a monthly payment.

Serious changes have affected those holders of maternity (family) capital certificates who receive monthly payments or plan to choose this direction.

Let us remind you that the monthly payment is due to those families in which the second child was born (adopted) after January 1, 2020. From January 1, 2020, according to the law, families whose average per capita income does not exceed twice the subsistence level of the working-age population in the region for the second quarter of 2020 are entitled to receive payments. In the autonomy it is 30,507 rubles 66 kopecks. In addition, monthly payments from maternity capital funds will be made until the child reaches three years of age.

The changes also affected the application rules. From January 1, 2020, an application for payment is submitted until the child reaches the age of 1 year, two years, and then until he reaches three years.

To schedule a monthly payment, you can contact the client services of the Pension Fund of Russia or the MFC, and it is also possible to submit an application electronically through your Personal Account on the Pension Fund of Russia website or through the government services website. If you apply for payment in the first six months, then it will be established from the date of birth of the child, if you apply later, then the payment will be assigned from the date of filing the application.

In 2020, the monthly payment from maternity capital in the Jewish Autonomy is 14,869.63 rubles. The new payment amount is equal to the subsistence minimum for children, which was established in the region for the second quarter of 2020.

DRAFT FEDERAL LAW “ON AMENDING THE FEDERAL LAW “ON ADDITIONAL MEASURES OF STATE SUPPORT FOR FAMILIES WITH CHILDREN”

In accordance with the Address of the President of the Russian Federation to the Federal Assembly of the Russian Federation, from 2020 the conditions for the provision of maternity (family) capital and its size are subject to changes.

Upon the birth of the first child in a family, from January 1, 2020, the family will receive the right to maternity capital in the amount established for 2020 - 466,617 rubles. If a second child is born in this family in the future, the family will receive an additional 150,000 rubles.

Thus, the amount of maternal (family) capital in 2020 is:

- 466,617 rubles - for families whose right to additional measures of state support for families arose before January 1, 2020;

- 466,617 rubles - for families whose first child was born (adopted) starting from January 1, 2020;

- 616,617 rubles - for families in which a second child was born (adopted) in 2020;

- 616,617 rubles - for families in which, starting from January 1, 2020, a second child or subsequent children was born (adopted) and the right to additional measures of state support did not arise before January 1, 2020.

In addition, the maternity capital program will be extended until December 31, 2026.

Changes in the mechanism for paying maternity capital require amendments to the law “On additional measures of state support for families with children,” which are currently being prepared by the Ministry of Labor and Social Protection of the Russian Federation and the Pension Fund of the Russian Federation for submission to the Government of the Russian Federation.

ELECTRONIC LABOR BOOK

Since 2020, electronic work books will be introduced in Russia. The transition to digital work books is provided for by amendments to the current legislation.

A digital work book will provide employees with constant and convenient access to information about their work activities, and will open up new opportunities for personnel records for employers. The transition to electronic work books is voluntary and allows you to keep a paper book for as long as necessary.

During 2020, employers will have to work to change local regulations governing the activities of the organization, and make changes to agreements and collective agreements.

The employer will have until July 1, 2020 to notify employees in writing about changes in legislation related to the generation of information about their work activities in electronic form.

During 2020, citizens will be able to submit an application to their employer in any form to retain a paper work book or to maintain a work book in electronic form. In the first case, the employer, along with the electronic book, will continue to enter information about work activities in the paper version. In the second case, if a citizen has submitted an application to maintain an electronic work record book, the work record book is not kept on paper, but is issued to the employee with a record of filing an application to maintain information about labor activity.

For citizens who will get a job for the first time in 2021, all information about periods of work will initially be maintained only in electronic form without issuing a paper work book.

Since 2020, information on labor activity is provided to the Pension Fund of the Russian Federation by employers on a monthly basis no later than the 15th day of the month following the reporting month. Starting from January 1, 2021, in cases of hiring or dismissal, this information is provided no later than the working day following the day of publication of the relevant document that is the basis for hiring or dismissal.

You can view your e-book information in your personal account on the website of the Russian Pension Fund, on the State Services portal, or through the appropriate smartphone applications.

If necessary, electronic work record information will be provided in the form of a paper extract. It can be provided by the employer (at the last place of work), the Pension Fund or a multifunctional center. The service is provided extraterritorially, without reference to the person’s place of residence or work.

The electronic work book saves the entire list of information that is recorded in the paper work book.

INCREASING A NUMBER OF SOCIAL PAYMENTS FROM FEBRUARY 1

The monthly cash payment (MCB), which in the Jewish Autonomous Region is received by more than 14 thousand people entitled to federal benefits, has increased by 3%. Such people include disabled people, combat veterans, people exposed to radiation, Heroes of the Soviet Union and Russia, as well as Heroes of Socialist Labor and some other persons.

When making a payment, you must take into account that if a citizen has the right to receive EDV on several grounds under one law, EDV is established on one basis, which provides for a higher payment amount. And if a citizen simultaneously has the right to EDV under several federal laws, he is provided with EDV on one of the grounds of the citizen’s choice.

For each category of citizens, a certain amount of EDV is established.

The set of social services (NSS) included in the monthly cash payment was also indexed.

The cost of a set of social services will be 1155.06 rubles. per month, including:

- provision of medicines – 889.66 rubles;

- provision of a voucher for sanatorium-resort treatment for the prevention of major diseases - 137.63 rubles;

- free travel on suburban railway transport, as well as on intercity transport to the place of treatment and back – 127.77 rubles.

In addition, since February, the funeral benefit that the Pension Fund pays to the relatives of a deceased non-working pensioner has increased. The indexed payment amount excluding the regional coefficient was 6,124.86 rubles.

How to determine the health status of an applicant

The employer has the right to determine whether a pre-retirement employee is suitable for the work performed due to health reasons or personal qualities. To do this, they conduct a medical examination of applicants, their psychological testing, as well as polygraph (lie detector) testing.

You cannot refuse this if you are applying for a position for which the employer has determined that a test is required. The employer has the right not to hire those who do not provide the necessary documents, refuse the offered position or undergo an examination (Article 64 of the Labor Code of the Russian Federation).

A medical examination is necessary when work requires stamina and well-being. This often applies to professions related to the management of transport, equipment, and machine tools. The examination is carried out at the expense of the organization.

Working conditions, guarantees and compensation for working pensioners

For the working category of pensioners, certain conditions and guarantees are established:

- the length of the working week for working pensioners who have a disability group is reduced from 40 to 35 hours, but with the condition that the salary is paid as for a full forty-hour week;

- also, an incomplete week can be set by the employer himself and, at the request of the pensioner, in this case payments are made in accordance with the time worked;

- For persons with reduced working hours, all employee rights are retained.

To create comfortable conditions for their workers, employers have the right to:

- make work easier if it leads to overwork of the pensioner;

- provide work according to the worker’s strength;

- monitor health status;

- improve workplace safety.

A number of clauses guaranteeing certain improved working conditions and some additional guarantees must be spelled out in the employment agreement.

See on topic:

- Retired work (vacancies)

- Remote work exchanges

Probation

The head of the company retains the right to set probationary periods; the pensioner also has the right to demand the establishment of such a period. This information is indicated in the text of the employment agreement. How long the test will last and whether this period will be set at all is discussed between both parties.

- An open-ended contract allows for a period of two to six months, this will also be influenced by the vacancy for which the pensioner applied;

- If the agreement is urgent, then the maximum trial period cannot be longer than two weeks.

Attention ! If the working agreement is established for two months, then the verification period is not established.

Vacation

Leave is provided to pensioners in the same way as to other employees and according to the same rules:

- for those who have just settled down, the right to rest arises six months after employment;

- further in accordance with the drawn up schedule;

- if you work two jobs, you will have to take vacation at the same time;

- It is possible to take two weeks off at your own expense.

Finding a job in accordance with the law, that is, under an employment agreement, will provide the employee with the right to claim from the employer all the benefits and guarantees due to him, therefore it is not recommended to start working without concluding such an agreement.

Medical service

Working pensioners in the field of medical care are provided with the following benefits:

- the right to free examination in medical clinics in the priority group;

- free flu vaccination;

- the opportunity to purchase medicines at a 50% discount for persons with a labor veteran’s certificate;

- Free dental treatment and prosthetics are also provided for labor veterans.

To exercise your right to benefits, you will need to provide a certificate confirming your pensioner status.

Dismissal

At the request of a subject of retirement age, a statement of desire to resign can be submitted, and in this case he can resign without working the required two weeks. Removal from a position of a similar category of workers must be carried out on any day at their request.

Important ! It is impossible to fire a working pensioner from his job just because he has reached the age limit.

What to do if you receive an unreasonable refusal

If you believe that you fully meet the requirements for a candidate, and the refusal to hire is unfounded, send a written request to the employer to provide a reasoned refusal in writing. Such a request can be sent by registered mail, to the company’s email address, or submitted against signature to a HR employee.

No later than 7 working days you should be provided with an answer (Article 64 of the Labor Code of the Russian Federation). The response, with reference to legal regulations, must indicate the reason why the applicant was not hired by this company.

Possible objective reasons for refusal of employment.

- inappropriate education;

- medical contraindications identified by the examination results;

- insufficient work experience;

- lack of necessary qualifications;

- refusal due to the actions of the candidate himself;

- changes in staffing levels and job reductions;

- other reasons related to business qualities.

All other reasons for refusal that are not related to business qualities or health conditions can be appealed in court.

Payments to pensioners

As mentioned, for the most part, retirees are not much different from other workers. In particular, their wages are calculated in accordance with the general procedure. In turn, this means that there are also no distinctive features of tax accounting for the corresponding amounts and the procedure for their taxation as insurance contributions to extra-budgetary funds. So let’s focus only on the one-time benefit in connection with retirement.

Note! The employee must deal with the registration of a pension independently (clause 1 of article 18 of Law No. 173-FZ; clause 5 of the Rules for applying for a pension, approved by Resolution of the Ministry of Labor of Russia No. 17, Pension Fund of the Russian Federation No. 19pb dated February 27, 2002). The employer is only obliged, upon his written application, within three working days to issue documents (copies thereof) related to work and necessary for obtaining a pension, and within 10 days to submit to the Pension Fund of Russia form SPV-1 containing information about the insurance period and accrued pensions .

In practice, upon retirement, older workers, as a reward for long-term and conscientious work, are often paid a lump sum benefit, the amount of which depends on the length of service with a given employer (two salaries for at least 10 years of work experience, five salaries for at least 20 years of experience). years, etc.). The specific procedure for calculating and paying benefits is prescribed in the employment or collective agreement. At the same time, the parties to these are not limited in any way, so that, among other things, it may be stipulated that the benefit is assigned not only to those who quit due to retirement, but also to those who continue to work. Moreover, in the first case, the amount of the benefit will definitely not be taken into account when taxing profits, without thereby subsequently causing claims from the tax authorities. As representatives of the Ministry of Finance point out, incentives paid to resigning employees in connection with their retirement are not aimed at further stimulating the employee to improve professional skills and abilities, achieve more significant work results, etc. Thus, such amounts are not aimed at generating income, and therefore do not comply with the requirements of Art. 252 Tax Code (Letters of the Ministry of Finance of Russia dated February 21, 2011 N 03-03-06/1/111, dated August 27, 2010 N 03-03-06/4/79). Moreover, paragraph 25 of Art. 270 of the Tax Code determines that when calculating income tax, costs in the form of bonuses to pensions and benefits for retiring labor veterans are not taken into account. As for the payment of benefits when, after retirement, the employee remains to work in the organization, officials did not comment on it. Meanwhile, it is obvious that since we are not talking about dismissal, the financiers’ arguments lose their force. However, for obvious reasons, it is very risky to adhere to such a position. As for personal income tax and insurance contributions, a one-time benefit in connection with retirement is taxed in accordance with the general procedure (clause 1 of Article 7 of the Law of July 24, 2009 N 212-FZ, Letter of May 7, 2007 N 03 -04-05-01/130).

What to do if you were illegally denied a job

An unjustified refusal can be appealed in court within 3 months from the date of its receipt (Article 392 of the Labor Code of the Russian Federation). Provide evidence to the court that your competencies correspond to the vacant position. These can be professional certificates, certificates of advanced training, medical certificates and others. Attach a written response from the employer with the reasons for the refusal.

After the case is reviewed, you may be awarded compensation. For example, in the amount of the average salary for a similar job in your area.

The second way to punish an employer for refusing to hire a pre-retirement person is to file an application with the prosecutor’s office and the police. The competent authorities will initiate a criminal case under Article 144.1 of the Criminal Code of the Russian Federation. Violators are subject to a fine of up to 200 thousand rubles or in the amount of their salary for a period of up to 18 months, or compulsory work for up to 360 hours.

2155317.ru

In case of layoffs, all employees of an enterprise have absolutely identical rights, and the administration of the enterprise should not make a decision on dismissal only on the basis of a person reaching a certain age.

Dismissal due to staff reduction of a pensioner is no different from the process of laying off ordinary employees.

Preliminary notice of dismissal must be given to the employee against signature two months in advance. The head of the enterprise can offer the pensioner an alternative option and select an appropriate position for him that is not subject to reduction. By agreement with management, an employee can be laid off earlier than the two-month period has expired.

At the same time, he is entitled to monetary compensation (according to Part.

3 tbsp. 180 of the Labor Code of the Russian Federation) for the entire remaining period that he still had to work at the enterprise.

And now pensioners are being turned away. If a person is still fully able to work, but his pension is below the subsistence level, so he wants to add to his pension, why the complete violation of labor laws by officials?

or is this natural? Only higher ranks can work until the age of 70, and the lower strata of the population are not counted in such lines? infringement of human rights Collapse Victoria Dymova Support employee Pravoved.ru Try looking here:

Let's sum it up

- You can refuse to hire a pre-retirement person only because of his business qualities or for medical reasons. All other reasons are illegal.

- The law protects citizens from age discrimination.

- A written reasoned refusal is provided only upon a written request from the applicant.

- An unjustified refusal of employment can be appealed in court and, possibly, monetary compensation can be obtained.

- A criminal case may be opened against an official who refuses to hire a pre-retirement employee because of his age.

Can a pensioner work part-time?

quoted1 > > The material component will certainly be in the black.

Depending on the specifics of the situation, the following contract options can be concluded:

- civil law.

- economic contract;

- no expiration date;

- with the possibility of combining with another workplace:

- urgent, indicating the period of cooperation;

The employer decides which employment contract will be drawn up with the pensioner.

The official employment of a retired candidate is certified by drawing up a contract.

Is it possible to search for a vacancy through the labor exchange with registration for pensioners?

Will unemployment benefits be paid in this case?

A citizen of retirement age can go to the labor exchange in order to improve their skills or retrain in a new specialty, as well as to search for a vacancy.

Labor resources

Theoretical aspects of the analysis of enterprise labor resources. Analysis of labor indicators. Analysis of the enterprise's supply of labor resources. Analysis of the use of working time fund. Directions for increasing the efficiency of personnel use.

We ask you to use the works published on the site exclusively for personal purposes. Publishing materials on other sites is prohibited. This work (and all others) is available for download completely free of charge. You can mentally thank its author and the site team.

Normative base

The most important documents regulating labor relations are, of course, the Constitution of the Russian Federation, it enshrines the fundamental rights of any person in the sphere of work, and the Labor Code of the Russian Federation is a normative act that describes in more detail and clearly regulates specific aspects and issues of working life.

It is also necessary to recall the Resolution of the Supreme Court of the Russian Federation, which assigns to the employer the right to select candidates “for the purpose of effective economic activity and rational property management independently, under its own responsibility.”

Who is a disabled citizen

The concept of disability was introduced by the Plenum of the Supreme Court of the USSR on July 1, 1966. In accordance with it, disabled people are considered to be residents who have reached retirement age and receive a pension (for women these years are 55 years, for men - 60 years), persons with disabilities of groups I, II, III, depending on whether they have been assigned pensions payments by year or disability, and in addition, persons under the age of majority.

Interesting: Why Can’t Children Who Were Born in 2020 Receive Monthly Payments from Matkapital?

The criteria for the execution of payments are specified in accordance with the Decree of the Head of the Russian Federation of December 26, 2006 No. 1455 “On compensation payments to persons caring for disabled citizens.”

General characteristics of the study (2)

Those. pensioners from extended households go to work precisely in order not to be a burden to their families, even in cases where the family’s situation, at first glance, is not so bad in the general context. Single pensioners or pensioners from households consisting only of people of retirement age can usually be pushed to work only by dire need.

“Disadvantaged” pensioners, compared to other pensioners, are in the worst position. This applies to both their current standard of living and the prospects for its dynamics, which is largely determined by their place of residence. The rural environment sets restrictions on labor activity due to the underdevelopment of local labor markets, although it provides ample opportunities for activity in subsidiary farming.

Which population is considered working age?

Many have heard such an economic term as “working-age population,” which largely determines the development prospects of the state in question. However, it is not clear to everyone who this population belongs to.

The name itself suggests that this refers to that part of the population that is able to work, that is, earn their own living, while simultaneously bringing some benefit to the state. Let’s immediately discard children and pensioners, since in most civilized countries of the world they do not work, or at least are not required to work, and are socially protected to one degree or another. It turns out that the working population is adults, but not yet pensioners. Each country, it turns out, has its own understanding of the working population, since different countries have different legislation on child labor and different retirement ages. In addition, from all people who are neither children nor pensioners by age, one should also deduct disabled people (as people who are unable to work due to health problems), and representatives of those professions who are entitled to pension benefits before reaching retirement age and are already using this kind of support. Again, different countries may have different approaches to such things, so in the case of each individual country, you need to carefully read local laws.