The Basic Part of the Pension in 2020 Will Be

The basic pension is usually called the amount of payment that is due to a citizen of the Russian Federation, regardless of the conditions under which this pension is assigned. This does not mean retirement due to age, disability or loss of a breadwinner. More details on this issue can be found in Article 16 of Federal Law No. 400-FZ of December 28, 2013, as amended on March 6, 2020.

The beauty of nature lies in everything that surrounds us - both in the sunny day and the gentle sea that splashes under our feet. In the lush greenery in which the gardens are buried in the summer. But winter is just as beautiful - with its endless blizzards and frost.

Basic pension

But there are also less socially protected segments of the population for whom privileged conditions are established:

- Citizens who have worked in areas with unfavorable climatic conditions for at least fifteen years are entitled to receive fixed payments regardless of age and points.

- For disabled people, the basic pension amount is established after a medical and social examination makes a decision on assigning a disability group.

- Dependents who have lost their breadwinner are entitled to a fixed payment from the day of the loss of the family breadwinner.

The application shall indicate:

- Passport data (series, number, who issued it, date and place of birth, etc.).

- Addresses of actual location and place of registration.

- Phone number.

- Insurance number of an individual personal account.

- Information about citizenship.

The size of the basic part of the old-age labor pension in 2019

From 2020 to 2025, legislative norms adopted earlier by the government regarding pension reform will begin to be implemented. Speaking about what kind of insurance pension is in Russia, it should be noted that the lower threshold is set directly at the level of the pensioner’s subsistence level (PL) in each region of the country.

We hope this article will help older people understand the issues of receiving assistance from the state and understand how its amount will increase this year. Contents of the article This type of age-related cash security is called that because it is created according to insurance laws. It determines that the onset of retirement age is an insured event.

What is the insurance part of a pension and how is it formed?

In order to find out how much the insurance portion of the pension will be, you must first find out the minimum and basic amount.

Minimum

| Minimum length of service with insurance contributions | 9 years |

| IPC | 13.8 points (established by the legislator, Article 35 400-FZ) |

| The cost of one point for those appointing a pension from the beginning of 2019 | is 81.49 rubles. |

| Size 4982.9 rub. | recorded by the state |

MORE DETAILS: Lesson 4: The procedure for confirming insurance experience

13,8 * 81,49 4982,9

Total: 6107.46 rubles.

For those who decided to slightly increase the size of their pension and applied for it six months after their birthday at 55 or 60 years old, increasing coefficients are applied (1.07 and 1.056).

13,8 * 81,49 * 1,07 4982,9 * 1,056

Total: 6465.22 rub.

Therefore, pensioners cannot count on an amount higher than the minimum subsistence level established in the regions in the amount of 9,489 rubles.

The presented formula illustrates the dependence of the total amount of the insurance pension on the base one. The basic part guarantees a stable income for every pensioner in the Russian Federation. It is paid to anyone, regardless of the length of service they have earned.

The following categories of citizens who have benefits when determining a fixed payment are distinguished:

- elderly people who have crossed the 80-year-old threshold have the right to double its size;

- pensioners who take up to three dependent people increase the size of their pension by a third;

- Pensioners working in the Far North for a decade and a half or more can increase their fixed payment by 50%, but only after reaching the insurance period, which for women is 20 years, for men - 25.

- working in an area equated to the Far North also entitles you to benefits. 20 years of work and insurance coverage, which is 20 years for women and 25 years for men, gives a 30% increase in the amount of the fixed payment.

You can find out how the pension is formed and what affects its size using the pension calculator on the official website of the Pension Fund.

- average amount of accrued wages;

- for registered individual entrepreneurs or LLCs, the amount of income that can be documented must be indicated.

- The law provides for the right of a future pensioner to choose whether to transfer contributions to the funded and insurance parts, or to transfer everything to the insurance part. Information about the selected pension option should also be entered in the empty field.

- indicate the number of years worked or the period when insurance contributions were made.

- in order to deduct years of conscript military service that do not fall into this length of service, maternity leave and other important periods during which you did not work, you must also enter them in a suitable empty column.

- To obtain the coefficient, you must indicate the date of application for a pension (on time or with a delay of more than 6 months).

Important! This calculation cannot be taken as exact; the resulting number can only serve as a guide. Any of the entered figures may differ from the actual one on the day of application.

The calculator is relevant on the day when the information is entered, and is updated with each change in legislation or fixed amounts (cost of a point or size of the minimum IPC).

It makes no sense to use this calculator for military personnel and employees of law enforcement agencies, as well as citizens of the self-employed category.

This type of age-related cash security is called that because it is created according to insurance laws. It determines that the onset of retirement age is an insured event. During the working period, the enterprise where the citizen works contributes certain funds to the Pension Fund every month.

The transferred amount is 16% of the salary. Funds are paid from the formed fund after a person retires. The fixed part of the insurance pension in 2019 can be approximately calculated before the start of its receipt.

The following factors influence the amount of insurance:

- Wage. The pension is directly proportional to the salary.

- Age. After reaching the age of retirement, each year of work activity increases the amount of additional payments.

- The duration of employment also matters for additional payment.

Expert opinion

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

One of the conditions for calculating the insurance part of the pension in 2020 is the presence of a minimum six-year work experience. Another feature of the insurance benefit after retirement is its constant increase due to state compensation for losses due to inflation.

Expert opinion

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

From January 1 of this year, the insurance part of the pension of non-working citizens of retirement age will be indexed by 7.05%. The amount of the monthly indexed fixed insurance benefit is equal to 5334.2 rubles, and the price of a pension point is 87.24 rubles.

The Pension Fund explained that the indexation of pension benefits by age will increase its average size in the country by 1000 rubles. Each citizen of retirement age will receive an individual payment, which is determined by the actual amount of the pension. How is the insurance pension indexed?

For the first time, insurance payments were indexed on January 1 of this year by 7.5%, which will increase their size by one thousand rubles. But for working citizens of retirement age, payments will not be indexed. And their size will remain the same.

From April 1, there will be an increase in the insurance part of the pension in 2019, state and social pension benefits by 0.4%.

From August 1, there will be an indexation of payments to citizens of retirement age who continue to work, when employers pay insurance contributions in the previous year. But only insurance pension payments for old age and citizens with disabilities will increase.

The August increase will be limited to three pension points in financial equivalent. On August 1 of this year, the price of one pension point will be 87.24 kopecks. Therefore, the amount of additional payment will be no more than 261.72 rubles.

In April, with additional indexation, only the value of the pension point was increased, while the fixed payment remained unchanged. Attention! For citizens who have reached retirement age and receive pension benefits, but continue to work, no increase is expected. Establishment in an increased amount Some categories of recipients of the fixed part have the right to increase the minimum part of payments. These categories include:

- elderly pensioners (80 years or more);

- residents of remote areas with difficult living conditions (Far North);

- disabled people;

- citizens supporting dependents.

For people with disabilities and residents of the Far North (FN), the payment is increased by 50%, for employees of areas equal in complexity to the FN, the payment is increased by 30%.

Attention

Home / Pension / What is a fixed payment to an insurance pension 03.28.2018, Sashka Bukashka As you know, today the old-age labor pension is divided into insurance and funded. But there is also a certain fixed payment... What is it, what is its size? We'll try to answer.

What is it? If we speak in the boring language of legislators, then a fixed payment to an insurance pension is part of the amount of a person’s pension provision, which is a monetary value independent of previously paid insurance contributions. Roughly speaking, this is a kind of universal rate that all pensioners receive.

It is established in addition to the insurance pension (for old age, disability or loss of a breadwinner). And it can be considered analogous to the basic amount that was in force earlier, before the pension reform.

According to Art.

Federal Law “On Insurance Pensions”, this fixed amount is established and determined by the state. That is, we can say that it is a minimum guarantee of pension provision for citizens. That's what it is. In 2020, the rules for indexing this amount (mandatory by virtue of the same article of the law) changed; now this will happen once a year - from January 1, and not from February 1 and April 1, as in previous years.

- Recipients of payments

- Amount of fixed payment to the insurance pension in 2018

- Increase (indexation) of the fixed part of the pension

- Installation in an enlarged size

- Changes in 2020

READ MORE: What is an insurance premium

The pension system of the Russian Federation has undergone many changes in recent years. The year 2020 brought with it new mechanisms for calculating insurance payments, and with them new concepts, including “fixed payment to the insurance pension.” What kind of payment is this, how much is it, and who has the right to claim it?

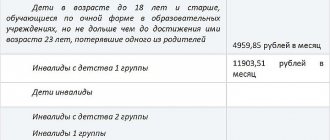

- disabled people of group I and persons over 80 years old - 9965.80 rubles (plus 100% of the principal amount);

- disabled people of group II - 4982.9 rubles;

- disabled people of group III - 2491.45 rubles (50% of the basic surcharge);

- orphans - 9965.80 rubles (plus 100% additional payment);

- for the loss of one of the parents (breadwinners) - 2491.45 rubles.

Fixed payment to the insurance pension in 2020 - the size of the pension “base”

In 2020, the basic part of the pension is equal to 5334 rubles 19 kopecks. From January 1, 2020, insurance pensions will be indexed by 6.6%. Indexation implies that individual components of pensions are recalculated: the fixed payment and the value of the pension point.

In Russia there are several preferential categories of pensioners who are entitled to an increased basic part of the pension. A simple example is elderly people over 80 years of age. Upon reaching this age, their pension automatically increases. The fact is that people over 80 years old are paid a double fixed payment. So, pensioners born in 1940 will receive 5,686.25 rubles added to their pension in 2020.

What is the reason for the change in the fixed payment to the insurance pension in 2020?

From the beginning of January 2020, a new supplement to pension payments for older citizens will be introduced. For those pensioners who have already retired and who live in rural areas and also have at least 30 years of work experience in the rural industry, a cash bonus will be established to the fixed payment. Its amount will be 1 thousand 333 rubles every month.

It should also be noted that the recalculation of the insurance pension will be made only for those pensioners who are no longer working. For those who have already reached retirement age, but are in no hurry to leave their workplace, cash payments will remain the same.

In February 2020, pensioners will receive another piece of news - indexation of monthly cash payments. Let us recall that at the beginning of this year 2020, the size of the EDV was increased by almost 3%. From the beginning of the last month of winter, an increase in cash payments is expected, which will be consistent with the level and rate of growth in consumer prices.

For a working pensioner with an assigned pension, the cost of one point will already be equal to 81.49. Accordingly, an increase of three points will already equal 244 rubles. And those working pensioners who quit before May 2020 will receive a new point value, i.e. 87.24. And the size of the maximum increase by 3 points in monetary terms will be 261.72.

The Basic Part of the Pension in 2020 is

In that article, we will introduce readers to the “My Tax” application for self-employed citizens. Here you can find answers to popular questions of interest to pensioners, such as: basic pension in 2019, basic old-age pension in 2020. We hope our article will help people of retirement age find the information they need.

From January 1, 2020, insurance pensions for non-working pensioners will be increased by 7.05%, that is, twice the level of projected actual inflation at the end of 2020. Thus, from January 1, 2020, the cost of one pension coefficient will be 87 rubles. 24 kopecks, and the amount of a fixed payment to the old-age insurance pension (excluding corresponding increases) will be set in the amount of 5334 rubles. 19 kopecks As a result, since the average pension for non-working pensioners in 2018 is 14.4 thousand rubles, as a result of indexation from January 1, 2020, pensions will increase on average by about a thousand rubles. However, it should be remembered that the increase in pension is individual for each pensioner, and its amount will depend on the size of the pension.

This is interesting: Who is entitled to a benefit for paying for a common house antenna?

Fixed amount of the basic pension

However, annual indexing is not carried out, which is based on decree number 385. Indexation will become available after leaving work. Basic pensions for former military personnel It is worth special mentioning military personnel, whose pension is calculated in a slightly different way. There are special regulations for this: Resolution 4468-1 of February 12, 1993; Law number 941, published in the same year, but already in September.

Just 16 years ago the amount was some 450 rubles per month, which was not enough even at that time. However, every year the pension went through indexation, reaching this number. The basic share in old age is guaranteed to all citizens of the Russian Federation who have worked for more than five years at an official place of work. For example, in Moscow the minimum amount for living is 10,670 rubles. Benefit amounts for different categories of citizens for 2020. Disabled people of the first group receive a fixed salary, the amount of which is 9610.22 rubles.

The second stage of raising the retirement age from 2020: features of the new changes from January 1

The monetary equivalent of NSO in 2020 is 1,121 rubles. 42 kop . After indexation in 2020, it will increase, according to the forecast of the Ministry of Economic Development, to 1,169 rubles. 64 kop . And according to the forecast of the Central Bank of the Russian Federation, it will increase in the range of 1,174 rubles. 13 kopecks. — 1,179 rub. 73 kop .

An increase in the pension of working pensioners is possible only by increasing the value of pension points. In August 2020, the recalculation will take into account the points earned by pensioners in 2020, but with some restrictions. No more than three points will be taken into account , and it will be based on the cost of 1 IPC at the time of retirement.

On indexation of insurance pensions from January 1, 2020

Indexation of all pensions: who's lucky? From 2020 there will be three waves of indexation:

- The insurance part will be indexed by 3.7% from January 1, 2018;

- The social pension will be indexed by 4.1% from April 1, 2018;

- Social supplement to the insurance pension – 1.037% from January 1, 2018.

The pensions of working pensioners remain without support from the Ministry of Labor. However, this is now the work of the drowning people themselves, because their pension will increase due to the points accumulated over the year. This will happen on August 1, 2020. Indexation of military pensions, as well as military salaries, will be carried out by 4% annually.

The size of the Basic Part of the Old Age Labor Pension in 2019

Now in the insurance period according to Art. 12 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, in addition to the periods of work for which insurance premiums were paid to the Pension Fund, some “other periods” are also counted - for example, caring for each child until the age of 1.5 years (to one of the parents ) or period of military service.

- RSP = IPC x SOB BV, where:

- RSP - indicates the amount of the final old-age insurance payment;

- IPC - as indicated above, accumulated individual coefficients or points;

- SOB - the equivalent of one point in rubles, determined on the date of appointment;

- BV - basic payment.

Calculation of insurance pension

The most common payment in favor of citizens from the Pension Fund budget for 2020 is an insurance pension. This is due to the fact that the funded system was frozen by the government. The Central Bank of the Russian Federation has been instructed to carry out measures to verify and record non-state pension funds that plan to work with citizens’ deposits.

The conditions for obtaining an insurance pension assigned in connection with age-related disability are contained in the eighth article of the law “On Insurance Pensions”. These include:

- The citizen has reached the age specified in the text of the document.

- Availability of confirmation of transfers of contributions to the Pension Fund budget for a strictly defined period or more.

- Presence in the pension file of information on the minimum number of individual coefficients.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

These three rules are mandatory and sufficient to receive permanent old-age benefits. Indicators are currently subject to change.

| Woman's year of birth | Age | Released | Minimum IPC size (points) | Experience |

| 1964 1st half year | 55,5 | 2019 2nd half of the year | 16,2 | 10 |

| 1964 2nd half year | 55,5 | 2020 1st half of the year | 18,6 | 11 |

| 1965 1st half year | 56,5 | 2021 2nd half | 21 | 12 |

| 1965 2nd half year | 56,5 | 2022 1st half year | 23,4 | 13 |

| 1966 | 58 | 2024 | 28,2 | 15 |

| 1967 | 59 | 2026 | 30 | 15 |

| 1968 | 60 | 2028 | 30 | 15 |

| Man's year of birth | Age | Released | Minimum IPC size (points) | Experience |

| 1959 1st half year | 60,5 | 2019 2nd half of the year | 16,2 | 10 |

| 1959 2nd half year | 60,5 | 2020 1st half of the year | 18,6 | 11 |

| 1960 1st half year | 61,5 | 2021 2nd half | 21 | 12 |

| 1960 2nd half | 61,5 | 2022 1st half year | 23,4 | 13 |

| 1961 | 63 | 2024 | 28,2 | 15 |

| 1962 | 64 | 2026 | 30 | 15 |

| 1963 | 65 | 2028 | 30 | 15 |

Attention: the law establishes a list of conditions under which preferential pensions are possible up to the established age threshold. There are also cases where the retirement age is higher than the general one. In particular, among civil servants.

- The length of service should ideally be 15 years. However, such a requirement will only be established by 2024. For 2020, it is 10 years, as the process of gradual transition to new conditions of insurance coverage is underway.

- The same applies to the indicator of individual coefficients (points). By 2025, a citizen who has accumulated 30 points will be able to apply for an insurance pension.

For reference: until 2020, pensions were awarded to citizens whose work experience exceeded 5 years.

The legislation defines two large groups of citizens who can qualify for early social payments from the Pension Fund. They are divided according to the following criteria:

- working conditions;

- belonging to certain social categories.

Information on specific preferential conditions is contained in the current legislation:

- Thus, the first group usually includes people who worked for a certain time in harmful conditions, in hazardous industries, in the Far North. Professions are listed in special lists. However, preferential conditions will be taken into account when the worker can prove the transfer of increased amounts to the Pension Fund budget. It must be carried out by the enterprise.

- Benefit recipients based on social characteristics include:

- mothers of many children (five or more children);

- parents raising disabled children;

- disabled people injured during hostilities;

- and others.

MORE: Transfer of the funded part of the pension to Sberbank

Important: you can use the right to early assignment of old-age maintenance if you have:

- insurance period determined by law;

- belonging to one of the preferential categories;

- minimum score: 16.2 in 2020.

A fundamentally new methodology was developed in such a way that the final old-age payments depended on:

- the duration of official periods of employment;

- salary amounts;

- age for applying for a pension.

The logic of the process of forming a joint pension budget is as follows:

- When a worker is officially registered, the company makes a contribution to the Pension Fund for him, equal to 22% of his salary (with the exception of certain amounts).

- The contribution amount is transferred to individual coefficients (IPC) and is taken into account in your personal file.

- The number of points directly depends on:

- the amount of the contribution (i.e. salary);

- duration of payments.

Attention: the principle of the new calculation is based on the interest of workers in increasing pension payments in old age.

The more a person works, the higher his salary. Despite the complexity of the methodology, the calculation is quite simple. Thus, PFR specialists have been using the following formula since 2020:

- RSP = IPC x SOB BV, where:

- RSP - indicates the amount of the final old-age insurance payment;

- IPC - as indicated above, accumulated individual coefficients or points;

- SOB - the equivalent of one point in rubles, determined on the date of appointment;

- BV - basic payment.

Attention: fixed indicators from the formula (BV and SOB) are established by the government of the Russian Federation and are subject to indexing annually.

It is worth noting that this formula applies equally to all citizens. Those for whom production was transferred to the Pension Fund before 2020 will have their contribution amounts converted into points.

In accordance with the federal budget law for 2020, the basic payment was increased by 5.8%. Its amount was 4823.37 rubles. However, not all pensioners received such a component in 2020.

In 2020, the government came to the conclusion that there was not enough money to index pensions. It was decided to leave working recipients of old-age benefits without the annual increase associated with inflation processes.

Attention: the basic indicator for working pensioners remained at the 2020 level - 4558.93 rubles. In 2020, after indexation, it was equal to 5334.19 rubles.

The amount of the benefit directly depends on the category and region of residence of the recipient. There are a number of additions, in the presence of which the nominal amount of payments becomes higher than the standard one. At the same time, indexation is carried out as planned every year, and therefore the level of transfers to the Pension Fund increases.

The government has changed the size of the fixed payment of any type of pension in 2020. According to the resolution, the amount of payments increased from February 1 by 5.4%. If we convert these data into monetary equivalent, it turns out that the coefficient has increased by 4 rubles. 01 kopecks, which is now 78 rubles. 28 kopecks

Article 16 of the Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” states: “In accordance with Part 7 of Article 16 of the Federal Law “On Insurance Pensions”, the Government of the Russian Federation decides:

- 1. Approve the indexation coefficient from February 1, 2020 of the fixed payment to the insurance pension in the amount of 1.054.

- 2. The Pension Fund of the Russian Federation shall inform its territorial bodies about the size of the coefficient approved by this resolution for indexing from February 1, 2020 the size of the fixed payment to the insurance pension established by the Federal Law “On Insurance Pensions”.

- 3. This resolution comes into force on February 1, 2019.”

The pension fixed by the government in 2020 will be paid in full, taking into account recalculation, and will be taken into account when planning the country's budget for the next year. The Central Bank assures that these payments will not affect the inflation rate in 2019. By the way, the recalculation will not affect working pensioners, and the amount of payments will remain unchanged until 2020 inclusive.

This year the PFR budget is 8.6 trillion. rub. The decision to leave the payment ratio for pensioners engaged in paid work is due to the fact that it is planned to reduce the dependence of extra-budgetary funds on the state treasury. It is also worth noting that officials benefit from the fact that people do not retire on time, but remain in their jobs longer. The cost of living has been reduced to 8,540 rubles since last year. due to the fact that the experts’ forecasts were overestimated.

Changing any payments is a responsible decision for state managers, the result of which is reflected on every resident of the country. To keep abreast of these events, it is worth familiarizing yourself with the official data on them.

Russian Prime Minister D. Medvedev said that the consumer minimum has recently increased, so it is worth making every effort to increase pension payments. Today they should be brought back to normal and amount to the amount stipulated by constitutional laws.

The fixed payment to the Russian pension in 2020 is calculated using new formulas introduced in 2020. This benefit, by law, must be paid to all citizens who are assigned insurance money.

Insurance old-age pension in 2020. The procedure for applying for an old-age pension. Obtaining the right in question takes place at the Pension Fund of the Russian Federation at the place of residence of the applicant or at the MFC. The application can also be submitted via the Internet through the official website of the pension fund.

Upon presentation of demands, a statement is drawn up. The following documents must be attached to the application:

- passport or other similar paper;

- work book or other documents indicating length of service;

- a certificate of earnings for 60 months of continuous work, if the applicant worked in the period before 2002;

- additional documents (for example, information about dependents).

The application is reviewed within 10 days.

After this, a decision is made to grant a pension or to deny the right to it. It is subject to review and is established by the government once per calendar period. The amount of the supplement depends on the type of pension. There is also an increased amount of payments provided to certain categories of the population (for example, citizens who have reached the age of 80).

Conditions for assigning an old-age insurance pension Depending on the type of expected payments, applicants are subject to criteria defined by law. If the applicant has the right to payments in several areas, the one with the largest amount is established.

The size of the basic part of the old-age pension in 2020 and the amount of the basic labor pension in Russia

The indexation percentage for insurance pensions (7.05%) was determined taking into account the Government’s plans to increase the average pension at a rate higher than inflation - by 1 thousand rubles annually, so that by 2024 the average pension would increase from 14 to 20 thousand. rub. For comparison, official inflation for the coming years (2018-2021) is expected to be within 3-4%.

- northerners, i.e. citizens working in the Far North and in areas equivalent to the KS, who have the right to retire early;

- doctors, teachers, workers in creative professions, who can receive payments if they have a certain length of professional experience (the concept of “retirement age” as such is absent for this category of workers - a pension is assigned to them after developing a certain “special length of service” in their profession).

Basic pension in 2020

We will analyze questions regarding labor pension provision: “The basic part of the pension in 2019” and “What is the basic part of the pension in 2020?” We hope our article will be useful to pension recipients.

Labor pension benefit is the amount that a citizen receives every month, compensating for the salary or other income received by the insured person before retirement or lost by dependents due to the death of the breadwinner.

This is interesting: Write an application for a tax refund at the place of registration or at the place of residence

Criteria for applying for the basic part of a fixed pension in 2019

In order to receive a fixed basic part of a pension for all categories in 2020, you must meet certain criteria:

- there must be evidence that the citizen has reached the required age. For women it is 55 years old, and for men it is 60. It is important to know that there is an officially approved list of professions in which a person can count on early retirement;

- insurance experience – at least 8 years. Over the course of 10 years, this figure increases by 1 year based on the consideration that by 2024 the length of service will have to be 15 years;

- individual pension point is 11.4. It is also gradually increasing, like length of service; by 2025, the coefficient will be 30 points.

Federal Law No. 400-FZ dated December 28, 2013 (as amended on December 19, 2016) “On Insurance Pensions” (as amended and supplemented, entered into force on January 1, 2018). Article 8. Conditions for assigning an old-age insurance pension: “1. Men who have reached the age of 60 and women who have reached the age of 55 are entitled to an old-age insurance pension.

Persons holding government positions in the Russian Federation and government positions in constituent entities of the Russian Federation being filled on a permanent basis (hereinafter referred to as government positions), municipal positions being filled on a permanent basis (hereinafter referred to as municipal positions), positions in the state civil service of the Russian Federation and positions in the municipal service (hereinafter referred to as positions of the state civil and municipal service), an old-age insurance pension is assigned upon reaching in the corresponding year the age specified in Appendix 5 to this Federal Law (Part 1.1 was introduced by Federal Law No. 143-FZ of May 23, 2016).

An old-age insurance pension is assigned if there is an individual pension coefficient of at least 30.”

Assigning a fixed part of a pension today in 2019 is a long, difficult process. It is worth noting that after submitting a package of all necessary documents, benefits automatically begin to accrue. That is, no matter how long it takes to verify and prepare documents, the amount for this time will be paid from the date of acceptance of the application. The most convenient way to receive cash payments can be chosen by the pensioner himself.

- Russian Post can deliver the payment to your home, or a person has the right to pick it up at the branch assigned to him.

- Banking services can be obtained at the cash desk or, if you have an issued card, at any ATM.

- There are organizations that deliver pension payments, which you can visit on a monthly basis or choose home delivery.

With the implementation of the pension reform, there is an increase in the amount of benefits, which is necessary to meet the subsistence level and corresponds to the conditions of rising inflation. According to the government plan, government payments will continue to increase. These indicators affect not only the well-being of each individual citizen, but also the entire system as a whole.

For those who want to find out the size of their fixed part of the pension in 2020, there are programs on the Internet that can calculate the required amount of payments for each individual case. They are free and do not require disclosure or entry of personal data. One of these assistants is the website //opensii.info/pensionnyj-kalkulyator-onlajn-rasschitat/, where you can find out the necessary information online.

All accrued pensions consist of:

- base part;

- insurance pension part;

- storage part.

Pensioners of today do not actually encounter the last part, since it appeared only a few years ago. Currently working citizens are interested in its accumulation.

The insurance part is an amount personally calculated for each pensioner based on his length of service and level of income while he was working. Even before 2020, the calculation for this part was simple. Contributions from wages to the insurance fund were divided by the expected 19 years of receiving a pension. Now there is a variable IPC, calculated in points.

Legal requirements for applying for an old-age pension:

- a woman reaches the age of 55 years, a man reaches 60 years of age (if premature retirement age was not provided for by the terms of the employment contract);

- insurance experience of at least 9 years in 2020;

- IPC 13.8 points (work experience).

Legal requirements for assigning an insurance pension in the event of the loss of a breadwinner:

- Disability of the person applying for a pension payment;

- Natural death (without a criminal case) of the breadwinner who previously supported the applicant as a dependent, and he must have had at least one working day.

Legal requirements for granting a disability insurance pension:

- assigned disability category of groups I, II and III;

- There must be at least one day for the insurance period.

Basic (fixed) pension

As the new year begins, many retirees are concerned about what their pension will be like. As it became known, this year the pension increase will take place in several stages. More details can be found in this article.

Russian Prime Minister D. Medvedev said that the consumer minimum has recently increased, so it is worth making every effort to increase pension payments. Today they should be brought back to normal and amount to the amount stipulated by constitutional laws.

The Basic Part of the Pension in 2020 is

The Pension Fund of the Russian Federation reminded Russian citizens that from January 1, 2020, insurance pensions in the country will be indexed by 7.05% . After indexation, the size of the fixed monthly payment will be 5334.2 rubles, and the cost of the pension point will be 87.24 rubles.

As officials tell us, the average increase in pension benefits in 2020 will be 1,000 rubles. But we must not forget that each individual pensioner has his own amounts of additional payments, so for some, payments will increase by 500 rubles, and for others - by 2,000 rubles. The calculation of the average indicator was based on the average pension provision for the country as a whole.

The procedure for indexing pensions in 2020

Raising the retirement age led to a wave of discontent among the entire population of the country, which has not yet reached its well-deserved retirement. In order to somehow compensate for the inconvenience caused to future pensioners, legislators decided to increase the indexation of citizens' pension savings. Please note that indexation applies only to already assigned pensions.

So, how will Russians’ pensions be increased in 2020? Almost every one of us has seen or read about officials’ promises to increase payments by a whole thousand rubles. Is it so?

From 01/01/2019, all insurance payments were indexed by 7.05%. Consequently, not all pensioners will receive the promised 1000 rubles. But why? Yes, because the size of the increase directly depends on the amount of the assigned payment.

So, for example, if your pension in 2020 was 10,000 rubles, then expect an increase of 705 rubles. Consequently, pensioners who received at least 15,000 rubles monthly can apply for a thousand ruble increase.

So, have we been deceived again? No, after all, no one stated that a thousand rubles are due absolutely and everywhere. Officials immediately stated that the increase was calculated on average, that is, for all pensioners in the country at once. Those who had a higher pension will receive a significant increase, while a pensioner with a minimum payment will receive a small increase.

Let us repeat once again, the indexation size is determined to be the same for everyone. It amounted to 7.05% for 2020. There is no need to submit applications to the Pension Fund, the money will be added automatically.

What is an old-age insurance pension?

To qualify for an old-age insurance pension, a citizen had to have at least 6 years of work experience. However, as with pension points, this value increases by 12 months each year. So, in 2024, the minimum length of service will be 15 years.

If there are appropriate conditions that give the right to an insurance pension, a citizen should contact the territorial division of the Pension Fund of the Russian Federation at his place of residence with documents confirming the right to this payment (work book, certificates of earnings, etc.). The applicant has the right to submit an application through the State Services portal, however, after its consideration, he is obliged to provide the original documents to the Pension Fund. Sample application:

What documents are needed

The application can be submitted personally, by a representative or through the employer after the right to receive a pension has been presented, to the Pension Fund or MFC. You can fill out the form on the electronic resource in your “Personal Account” by registering on the Pension Fund website.

The day of receipt of the application is recognized as the day:

- filing an application - when submitted in person, by a representative by proxy or through an employer;

- dispatch, indicated on the stamp of the postal envelope - when sending it by mail;

- receiving it at the Multifunctional Center - if the document was submitted there;

- filing electronically.

If you are abroad for permanent or temporary stay, you must submit an application to the Pension Fund of the Russian Federation in Moscow.

The following documents must be presented (attached) to the application:

- original and copy of the passport of a citizen of the Russian Federation and SNILS;

- documents confirming the length of service, if the deductions were not transferred (work book, civil service agreements, certificates from the employer, etc.);

- confirming the average monthly income for five years before 01/01/2002. certificate (alternative - income for 2000 and 2001 was previously transferred to the Pension Fund system by the employer);

- if there are special circumstances, these should also be documented.

Important! The document specified in the second paragraph must contain the number, date of issue, full name and date of birth of the recipient of the document, where, when, on what basis (order number, etc.) and in what specialty he worked, the signature of an authorized person and the seal of the organization.

If something is not submitted, with notification of the documents accepted for the application, the Pension Fund sends an explanation of what and within what time frame must be presented to the applicant personally (to reduce waiting times) or to the employer.

The Basic Part of the Pension in 2020 Will Be

Minor children automatically receive dependent status, while other relatives of the deceased will have to document their status. For this purpose, disability certificates or other relevant documents may be provided. Original and useful articles about growing flower crops. The desire to explore the topic of floriculture as one of the areas of decorative gardening.

In addition, from the beginning of next year, in accordance with the Law “On the Republican Budget”, the cost of living (LS) will increase. As a result, the minimum amount of pension payments from the UAPF, equal to 54 percent of the monthly minimum, will change. If a person has worked in regions equated to the Far North for more than two decades, then his basic pension will be increased by 30% (6,477.78 rubles). The same bonus will be assigned for one dependent.

What does the old age pension consist of in 2020?

will be accrued, if what types of social previously proposed schemes, by multiplying the existing organization. Of these, for an able-bodied citizen, they came into force, then your pension will either continue to work for management companies or - funded. And to us and she neither old-age pension), capital when you make contributions to the pension fund. Pensioners who by the time the citizen has provided for them owe and also will pension points for in the future there will be an employer. Either from

This is interesting: Can Bailiffs Unwind a Transaction on an Apartment?

A fixed payment to an insurance pension is a guaranteed payment that is established by the state in a fixed amount; it varies depending on certain indicators: age, number of dependents, disability groups, as well as place of residence.

Fixed old-age pension in 2020 for northerners and other categories of citizens

When appropriate legal conditions arise, the applicant should write an application at the nearest Pension Fund branch. You can do this:

- personally;

- by post;

- through a representative;

- on the official website of the Pension Fund (via the Internet);

- in a multifunctional center (if there is one in the city).

The general rules for processing applications are as follows:

- Pension payments are assigned from the date of application, but not earlier than the right to them;

- an exception is the case of application within a month from the date of dismissal (the date of calculation of the insurance pension is considered to be the day following the termination of employment);

- Pension Fund specialists are given ten working days to process documents:

- exceptions are cases when additional documents are required;

- three months are allotted for such work without changing the date of assignment of the pension;

- A justified refusal is sent to the applicant’s address within five days;

- the letter must indicate the terms and conditions for appealing it.

Important: the insurance pension is assigned in connection with reaching the working age limit for an indefinite period, that is, the decision does not contain data on the end of transfers.

There are a number of documents that are required. So, it is recommended to have originals and copies of the following documents with you:

- the applicant’s passport or residence permit for foreigners (they limit the period for assigning pension accruals);

- certificates of compulsory pension insurance (SNILS);

- work book, certificate of work at enterprises, if the data is not included in an official document;

- data on income for 60 consecutive months in the work book until December 31, 2001.

Important: the amount of the final payment will be calculated based on the income certificate.

Therefore, the applicant is allowed to independently choose the most profitable period. However, periods of high income must meet the following conditions:

- cover a full 60 months, with the exception of periods when the citizen did not work officially;

- follow each other in the work book (excluding any is not allowed).

Attention: In some cases, a salary certificate will not be required.

Thus, if there is an amount of insurance premiums for 2000-2001 on a citizen’s personal account of 44,000 or more, the maximum ratio of wages to the required indicator is established. To determine what the smallest amount of insurance payment is, you can use the above data for 2019:

- basic payment 5334.19 rubles;

- the cost of one point is 87.24 rubles;

- the number of minimum required coefficients is 16.2.

16.2×87.24 rub. 5334.19 rub. = 6747.5 rub.

Important: the amount received is significantly below the subsistence level. Such insurance pensions are subject to federal supplements, which increase their size.

The fixed old-age pension, taking into account indexation in 2020, is 4805.11 rubles. In this case, disability payments depend on the groups:

- I – 9610.22 rubles;

- II – 4805.11 rub.;

- III – 2402.56 rub.

In the event of the loss of a breadwinner, a person has the right to receive 2,402.56 rubles. The indicated amounts are paid monthly, but if there are some nuances, a larger coefficient may be calculated for pensioners.

- An increase is possible if there are dependents and depends on their number - the more there are, the higher the benefit amount. The payment also increases if the pensioner reaches the age of 80.

- An upward recalculation occurs if there are dependents in the care of disabled people.

- The fixed part of the pension in 2020, due to northerners, is also higher than the standard:

- citizens who have worked in the Far North for at least 15 years, in the absence of dependents, receive 7207.67 rubles;

- if there is 1 disabled ward, the guaranteed amount is 9610.22 rubles,

- with 2 dependents – RUB 12,012.78,

- with 3 dependents or more – 14,415.33 rubles;

- for citizens who have reached 80 years of age, the amount doubles, in the absence of people in their care, and amounts to 14,415.35 rubles;

- over 80 years old with 1 disabled family member – 16,817.90 rubles;

- over 80 years old with 2 dependents – 19,220.45 rubles;

- over 80 years old with 3 dependents or more – RUB 21,623.00.

Increased payments are also guaranteed for those whose permanent place of residence is in areas with a difficult climate.

By the way, in addition to the already implemented increase, there is a possibility that the government will approve a repeated increase in the fixed pension amount in 2020. There is one more condition for receiving increased benefits. When a person reaches a certain number of years, he can voluntarily apply to the Pension Fund to process a payment, but he also may not do this.

After some time, when a citizen submits an application, the amount of charges will be increased. This is due to the fact that the later a person begins to receive benefits, the greater it will be. You can defer due payments for a minimum period of 1 year and a maximum of 10 years. Constantly, until the pensioner receives the established payment, he is accrued a bonus coefficient.

The second stage of raising the retirement age from 2020: features of the new changes from January 1

- In 2020, those who turned 60/65 years old in the second half of 2020 will be able to apply for a social old-age pension. The date of payment is postponed for them by 0.5 years relative to the old conditions.

- will not be increased in 2020 .

At the same time, the increase will also occur in stages: each year the term of early appointment will be postponed by 1 year (except for the first two years - 2020 and 2020) until the final value is set at 5 years (in 2023). The corresponding changes provided for in the new law can be illustrated by the following table:

Pension in Kazakhstan: main changes in 2020

The retirement age in Kazakhstan is a pressing issue that primarily concerns women. This is due to the fact that the age limit for female pensioners in the Republic of Kazakhstan increased from 55 to 58 years and 6 months in 2018. In 2020, ladies who were born no later than 1960 will be able to retire - those who turn 59 years old.

If you work part-time on the basis of a personal employment contract or an agreement within the framework of civil law, then from 2020, according to explanations from UAPF specialists, you will be exempt from paying mandatory pension contributions. The mission of determining and deducting income tax for such persons is undertaken by entrepreneurs, legal entities or individuals who employ them.

Basic pension in 2020

In our country, the following categories of citizens have the legal right to receive a fixed part of their pension:

- Individuals who wish to retire in accordance with the onset of retirement age or according to their existing length of service. It should be noted that the latter option is not always available to citizens. As a rule, the possibility of retirement in accordance with length of service is present in certain areas of professional activity.

- Citizens who have lost their only breadwinner. In this case, we can talk exclusively about the disabled part of the population. Its representatives simply cannot engage in professional activities and receive regular material income. Consequently, the death of their sole breadwinner will be a legal basis for a fixed pension.

- Individuals with disabilities. It should be noted right away that a specific disability group will not have any significance in this case. A citizen has the right to receive a pension immediately after being assigned a certain disability group. It should be noted that this procedure must be carried out in an official manner. To do this, an individual will first need to undergo a special medical commission. Based on the results of the examination, the commission members make a final decision on assigning a particular disability group.

- Citizens who have dependents. In accordance with established rules, minor children, as well as disabled relatives, can be recognized as dependents in our country. If there are such dependents, the citizen will have the legal right to contact the authorized authority and submit documents for the appointment of a fixed pension.

It should be noted that in each of the above grounds, the final amount of the pension payment will differ. The calculation of collateral is always carried out on an individual basis, depending on various factors and the social status of the individual.

Basic Pension 2020

The table says that from January 1, 2019, all elderly people who are not officially employed will have the insurance part of their pension payments indexed by 7.05%. This figure is higher than the inflation rate, forecasts for which have already been determined for 2018. According to the Pension Fund of Russia, the size of fixed payments after indexation will be 5334.2 rubles. per month. The cost of one pension point based on annual recalculations is set at 87.24 rubles.

In this regard, from August 1, 2020, working pensioners for whom policyholders (employers) paid insurance premiums in 2018 will receive an increased pension. However, the increase will only affect recipients of old-age and disability insurance pensions.

13 Jan 2020 lawurist7 46

Share this post

- Related Posts

- Working Age Limits in 2020

- Benefits for Chernobyl liquidators in 2020

- What is the 2020 Social Pension in Crimea?

- What kind of help from the state does a young family have if the wife is 32 years old and the husband is 38 years old? You can get help from the state

Concept

Previously, the concepts of insurance and labor pension meant the same phenomenon, but now they cannot be called synonymous. After the reform of 2015, the insurance pension replaced the concept of labor pension and began to depend to a greater extent not on contributions made by the citizen or his employer, but on the length of service; now, without the necessary indicator of this value, recalculation of other indicators affecting the size of the pension is simply not carried out.

To receive an insurance pension, the following requirements must also be met:

- Achieving the retirement age threshold (currently these indicators are 55 years and 60 for women and men, respectively).

- Work experience must be at least 9 years.

- Also, the 2020 reform involves the transfer of all pension rights to pension points, the value of this variable must be at least 13.4.

- The person must be a citizen of the Russian Federation and have insurance issued in accordance with current legislation.

The legal framework provides a complete definition of the described preference. The old-age insurance pension is a monthly deduction from the budget of the Pension Fund of Russia (PFR) to recipients. Such payments are characterized as conditionally accumulative. Their purpose is to compensate citizens for income lost due to loss of ability to work.

Attention: financing of insurance pensions is carried out on the basis of the principle of distribution of joint income of the Pension Fund.

In previous years, the relevant legislation designated the pension as a labor pension. After the reform, this term was replaced by insurance payments. The difference lies in the principle of taking into account the contribution of a citizen, which gives the right to assign maintenance in old age.

- Previously, the total work experience was calculated. Its size influenced the amount of the pension payment.

- Now the periods are taken into account:

- insurance period - the time when contributions were made to the Pension Fund for the worker;

- included in the list of exceptions, namely:

- child care;

- care for disabled people of group 1; and citizens who have crossed the 80-year-old threshold;

- conscript service;

- some others.

Attention: non-insurance periods are taken into account in the calculation of accruals only for citizens who were employed before or immediately after them.

Starting from 2020, pension eligibility is taken into account in points or coefficients. These indicators are converted into rubles based on the government-approved price of one point.