In 2020, a new funded system is expected to be introduced to replace the “frozen” funded pension. A special procedure for assigning and providing funds for non-working pensioners will also be applied. New trends in raising the retirement age will emerge. As for indexation, its level in 2018 will be 4-5%.

Additional payments (allowances) to pensions in the Republic of Khakassia and Abakan

If the amount of pension payments for a pensioner who is not working is less than the minimum subsistence level, then he has the right to a state supplement. It is paid from the first day of the next month from the date of submission of the application to the Pension Fund department. This amount is then indexed and paid automatically. When a pensioner of the Republic of Khakassia gets a job, the right to receive the bonus is immediately canceled.

In addition to pension supplements, citizens can count on various types of benefits and subsidies. For example, paying utility bills at discounts, using public transport for free, and receiving additional cash payments.

Self-study documents

Decree of the Government of the Russian Federation N 975 “On approval of the Rules for determining the cost of living of a pensioner in the constituent entities of the Russian Federation in order to establish a social supplement to pensions” (07/30/2019)

Federal Law N 178-FZ “On State Social Assistance” (04/24/2020)

Federal Law N 134-FZ “On the subsistence minimum in the Russian Federation” (04/01/2019)

Law of the Smolensk Region N 30-з “On the procedure for establishing the cost of living in the Smolensk Region” (05/30/2019)

Did you find this information useful?

4 4

Conditions for obtaining a pension in the Republic of Khakassia and Abakan

A citizen can apply for pension payments in Abakan and the Republic of Khakassia at the place of actual residence at the branch of the Pension Fund. To do this, you need to collect a certain package of documents in advance, namely:

statement; passport; work book or other document indicating your work experience.

If a citizen applies for disability pension payments, then he must provide a medical report indicating the disability group.

Social old-age pension is issued upon presentation of a passport and work book.

In order to find out the exact list of all documents for processing a particular pension payment, you need to visit the Pension Fund department, where employees will describe in detail the procedure.

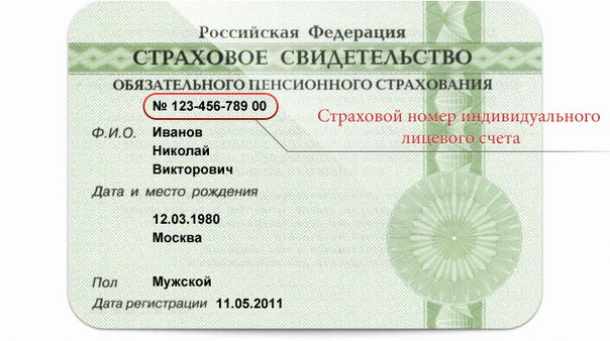

If a citizen has moved to a given region and wants to apply for a pension, he must submit an application to the Pension Fund department at the place of permanent or temporary registration. In order to transfer a pension to another region, you must present a passport and SNILS. After temporary registration, the citizen will receive pension payments, taking into account the cost of living and the system of additional payments that operate in the given region. In order for Pension Fund employees to accrue payments, they must permanently reside at their place of registration.

Minimum pension and minimum wage in the Republic of Khakassia and Abakan

The cost of living in Abakan and the Republic of Khakassia is 8,519 rubles.

This amount is fixed. If pensioners have payments below this indicator, taking into account additional security, then they are entitled to an additional payment. The minimum pension payment is 8,519 rubles. The minimum wage is 7,500 rubles. This amount will gradually increase. In 2018, the minimum wage will be 90% of the subsistence level, and in 2020 - 100%.

Since the beginning of this year, insurance pensions have increased by 5.4%. This happened due to rising consumer prices over the past year. The price of one pension point is 78.28 rubles. The average amount of an insurance pension in Abakan is 12,546 rubles.

According to Art. 12.1 of the Law “On State Social Assistance” in Russia, a non-working pensioner cannot receive a total amount of material support that is less than the pensioner’s subsistence level (PMP). It does not matter whether he has an insurance or social pension (despite the fact that in practice the size of the social pension is, as a rule, significantly less than the insurance one).

If a pensioner’s monthly income is less than the SMP in the region of his residence, then

social supplement to pension

. Its size is the difference between the financial support of a pensioner and the subsistence level. The amount of PMP for establishing the minimum pension

revised annually from 1 January

based on regional laws.

The rule applies only to non-working pensioners. Those who work can only rely on their own income and their pension itself, which, as of 2020, is also not even indexed. Thus, the pension size of working pensioners may be less than the PMP, since social supplements are not provided to such pensioners.

The minimum pension in Russia in 2020 for non-working pensioners will correspond to the minimum subsistence level for a pensioner, effective from 01/01/2019 and calculated on the basis of the consumer basket for food and non-food products.

The amounts for the constituent entities of the Russian Federation differ significantly; they are shown in the table.

| No. | Name of the subject of the Russian Federation | Size of PMP in the subject, rub. |

| Central Federal District | ||

| 1 | Belgorod region | 8016 |

| 2 | Bryansk region | 8523 |

| 3 | Vladimir region | 8523 |

| 4 | Voronezh region | 8750 |

| 5 | Ivanovo region | 8576 |

| 6 | Kaluga region | 8708 |

| 7 | Kostroma region | 8630 |

| 8 | Kursk region | 8600 |

| 9 | Lipetsk region | 8620 |

| 10 | Oryol Region | 8730 |

| 11 | Ryazan Oblast | 8568 |

| 12 | Smolensk region | 8825 |

| 13 | Tambov Region | 7811 |

| 14 | Tver region | 8846 |

| 15 | Tula region | 8658 |

| 16 | Yaroslavl region | 8163 |

| 17 | Moscow | 12115 |

| 18 | Moscow region | 9908 |

| Northwestern Federal District | ||

| 19 | Republic of Karelia | 8846 |

| 20 | Komi Republic | 10742 |

| 21 | Arhangelsk region | 10258 |

| 22 | Nenets Autonomous Okrug | 17956 |

| 23 | Vologda Region | 8846 |

| 24 | Kaliningrad region | 8846 |

| 25 | Saint Petersburg | 8846 |

| 26 | Leningrad region | 8846 |

| 27 | Murmansk region | 12674 |

| 28 | Novgorod region | 8846 |

| 29 | Pskov region | 8806 |

| North Caucasus Federal District | ||

| 30 | The Republic of Dagestan | 8680 |

| 31 | The Republic of Ingushetia | 8846 |

| 32 | Kabardino-Balkarian Republic | 8846 |

| 33 | Karachay-Cherkess Republic | 8846 |

| 34 | Republic of North Ossetia-Alania | 8455 |

| 35 | Chechen Republic | 8735 |

| 36 | Stavropol region | 8297 |

| Southern Federal District | ||

| 37 | Republic of Adygea | 8138 |

| 38 | Republic of Kalmykia | 8081 |

| 39 | Krasnodar region | 8657 |

| 40 | Astrakhan region | 8352 |

| 41 | Volgograd region | 8569 |

| 42 | Rostov region | 8488 |

| 43 | Republic of Crimea | 8370 |

| 44 | Sevastopol | 8842 |

| Volga Federal District | ||

| 45 | Republic of Bashkortostan | 8645 |

| 46 | Mari El Republic | 8191 |

| 47 | The Republic of Mordovia | 8522 |

| 48 | Republic of Tatarstan | 8232 |

| 49 | Udmurt republic | 8502 |

| 50 | Chuvash Republic | 7953 |

| 51 | Kirov region | 8474 |

| 52 | Nizhny Novgorod Region | 8102 |

| 53 | Orenburg region | 8252 |

| 54 | Penza region | 8404 |

| 55 | Perm region | 8539 |

| 56 | Samara Region | 8413 |

| 57 | Saratov region | 8278 |

| 58 | Ulyanovsk region | 8474 |

| Ural Federal District | ||

| 59 | Kurgan region | 8750 |

| 60 | Sverdlovsk region | 8846 |

| 61 | Tyumen region | 8846 |

| 62 | Chelyabinsk region | 8691 |

| 63 | Khanty-Mansiysk Autonomous Okrug - Ugra | 12176 |

| 64 | Yamalo-Nenets Autonomous Okrug | 13425 |

| Siberian Federal District | ||

| 65 | Altai Republic | 8712 |

| 66 | The Republic of Buryatia | 8846 |

| 67 | Tyva Republic | 8846 |

| 68 | The Republic of Khakassia | 8782 |

| 69 | Altai region | 8669 |

| 70 | Krasnoyarsk region | 8846 |

| 71 | Irkutsk region | 8841 |

| 72 | Kemerovo region | 8387 |

| 73 | Novosibirsk region | 8814 |

| 74 | Omsk region | 8480 |

| 75 | Tomsk region | 8795 |

| 76 | Transbaikal region | 8846 |

| Far Eastern Federal District | ||

| 77 | The Republic of Sakha (Yakutia) | 13951 |

| 78 | Primorsky Krai | 9988 |

| 79 | Khabarovsk region | 10895 |

| 80 | Amur region | 8846 |

| 81 | Kamchatka Krai | 16543 |

| 82 | Magadan Region | 15460 |

| 83 | Sakhalin region | 12333 |

| 84 | Jewish Autonomous Region | 9166 |

| 85 | Chukotka Autonomous Okrug | 19000 |

| 86 | Baikonur | 8846 |

Note: the national average PMS in 2020 is set at 8,846 rubles. according to paragraph 5 of Art. 8 of the Federal Budget Law of December 5, 2017 No. 362-FZ.

In January 2020, the minimum wage was increased to 11,280 rubles. In this regard, there were many expectations about raising pensions. However, they were all unfounded - from January 1, minimum pensions in Russia increased for another reason.

The minimum pension is related only to the pensioner's subsistence level (PLS), but not to the minimum subsistence minimum for the working-age population. An increase in the minimum wage does not in any way affect the size of pension payments, since this value sets the minimum level of income only for the working population.

Let us remind you that pensions can be increased only in 3 cases:

- Due to indexation by the coefficient established by the Government:

- insurance (labor) pensions - from January 1, 2020 increased by 7.05%;

- state, including social pensions - from April 1, 2019 they were increased by 2.0%.

- Due to recalculation according to pension legislation:

- for working pensioners - they increase annually from August 1 on a non-declaration basis (in accordance with the insurance premiums paid);

- at any time at the request of the pension recipient, if there are grounds.

- Due to the increase in regional PMP, which is carried out annually from January 1 (in this case, other things being equal, the amount of social supplement for non-working pensioners, whose pension is less than the subsistence level established in the region, increases).

Thus, from January 1, 2020, pensions were increased only due to indexation by 7.05%, and not due to an increase in the minimum wage. As a result, pensioners received an average increase of 1,000 rubles. This amount of additional payment is determined relative to the average size of the insurance pension in the Russian Federation (RUB 14,414 at the end of 2020). Accordingly, those who receive the minimum pension have not experienced a significant increase in payments since 01/01/2019.

To calculate the regional amounts of PMP, on which the size of the minimum pensions for non-working pensioners actually depends, until 2020 there was no single established methodology (each region calculated it differently). Therefore, the size of the pension subsistence minimum may be overestimated in some places, and underestimated in others.

Experts from the Ministry of Labor calculated that in 2020, in 14 regions, the value of PMP did not reach the actual average annual value, and in 71 subjects of the federation it exceeded. Therefore, the Ministry of Labor and Social Protection came up with a proposal to standardize the calculation of PMP and bring it to a unified methodology.

The corresponding methodology for calculating the cost of living for pensioners was approved in 2020. According to the new rules, PMP will be calculated starting from 2020.

In connection with the initiative, unfounded rumors arose that the PMP would be equalized throughout Russia and brought to a single value. This is not true! However, increasing minimum pensions in some regions may be in question. After all, if the methodology for determining PMS is unified, in some regions the new subsistence level may be less than the old one.

However, there is still no need to worry that the size of your pension may decrease. In accordance with Russian legislation, when revising the amount of social supplements, the total amount of pension benefits for the current year cannot be less than as of December 31 of the previous year (including social supplements). Thanks to this, pensions should not decrease in any region in 2020.

Minimum pension in 2019

The Ministry of Labor has found that the calculation of the cost of living in many regions is done incorrectly. The difference with the actual PM indicator was found in more than half of the constituent entities of the Russian Federation and in some it was more than 15%.

We recommend reading: Bailiffs Violated My Rights And My Minor Children

The head of the Pension Fund Drozdov believes that additional funding will not be required. Moreover, officials promise a similar increase in subsequent years. However, it will be possible to judge what the minimum pension will be in 2020 only in December 2018, when the budget law for the new financial period is adopted.

Social support for residents of Smolensk

Social old-age pension to citizens who have reached the age of 65 for a man and 60 for a woman is not paid during the period of work and (or) other activities during which the corresponding citizens are subject to compulsory pension insurance in accordance with the legislation of the Russian Federation.

The fixed amount of alimony depends on the cost of living per child, which is 10,541 rubles for children and 10,599 rubles per capita. Or 25% of all income of the child support payer for one child

We recommend reading: New Federal Law on St.228 in 2020

Pension in Abakan and the Republic of Khakassia

The insurance pension in Khakassia in 2020 was indexed by 7.05%. All citizens who have reached the age established by law can count on receiving such payments. The type of security paid directly depends on the category of citizens.

For example, to receive an insurance pension, the following conditions must be met:

- The man is over 65, the woman is over 60.

- Work experience of at least 10 years.

Attention!

From 01/01/2019 there is a transition period for retirement requirements. Age, length of service, IPC will be gradually increased to the generally established ones. The insurance pension in the Republic of Khakassia in 2020 directly depended on the subsistence minimum established in this region - 8,782 rubles. And in general for the Russian Federation - 8,846 rubles. If the payment calculated for a pensioner is not enough to achieve this indicator, he is entitled to an additional payment.

Minimum pension in the Smolensk region in 2020

In the Smolensk region in 2020, non-working pensioners are entitled to an additional payment to their pension of up to 9,460

rubles.

The size of the regional subsistence minimum for a pensioner (9,460 rubles) is greater than the subsistence minimum for a pensioner in the Russian Federation as a whole ( The subsistence minimum for a pensioner in the Russian Federation as a whole has not yet been adopted

).

Non-working pensioners whose total amount of material support is less than the regional subsistence level of a pensioner are entitled to a regional social supplement (from the local budget):

Amount of supplement, rub.

= 9460 – Amount of material support for a pensioner The cost of living for a pensioner in the Russian Federation as a whole is established to determine the amount of the federal social supplement to the pension.

The regional cost of living for a pensioner is established in each subject of the Russian Federation in order to determine the social supplement to the pension.

Only non-working pensioners have the right to a social supplement to their pension if the amount of their financial support is lower than the pensioner’s subsistence level established in the region at their place of residence.

Please note that local legislation may provide for certain conditions for receiving a regional social supplement to a pension.

The social supplement to the pension is established from the 1st day of the month following the month of applying for it with the appropriate application and necessary documents.

What amounts are taken into account when calculating the amount of financial support for a pensioner:

- all types of pensions;

- immediate pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other measures of social support (assistance) established by regional legislation in monetary terms (with the exception of measures of social support provided at a time);

- cash equivalents of the social support measures provided to pay for the use of telephones, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services.

What amounts are NOT taken into account when calculating

the amount of financial support for a pensioner: social support measures provided in accordance with the law in kind.

For information

In the Smolensk region, a subsistence minimum per capita has been adopted for certain socio-demographic groups (pensioners, children, working population). It is used for:

- assessing the standard of living of the population in the Smolensk region in the development and implementation of regional social programs;

- providing state social assistance to low-income citizens;

- formation of the budget of the Smolensk region.

The cost of living is calculated once a quarter on the basis of the consumer basket (products, industrial goods, services) adopted in the Smolensk region. It is not used directly for calculating and calculating pensions.

Minimum pension in the Smolensk region

Increase in pension for Labor Veterans in 2020: amount of payments

The prices observed in Moscow, together with a fairly high standard of living, have contributed to the fact that the city authorities have provided various types of benefits to the capital’s veterans. In order to learn more about all the amounts and conditions, the veteran should contact the local social security office.

In other constituent entities of the Russian Federation, veterans are issued cards that give them the right to enjoy discounts on a certain category of goods, as well as free medicine and sanatoriums. In those regions where many benefits are not provided, veterans receive a cash supplement based on the regional budget. For example, in Samara such an increase is approximately five thousand rubles without taking into account other additional payments and concessions.

We recommend reading: New Housing and Utilities Tariffs from July 1, 2020 in Novokuznetsk

Conditions of registration

The conditions for obtaining a pension in the Smolensk region do not differ from other regions and require mandatory adherence to the following sequence:

- first, you should collect the necessary package of documents, which it is better to request from the Pension Fund in advance - before submitting an application to a government agency to calculate and receive pension payments;

- submit an application with a collected package of certificates and statements. To do this, you should contact the Pension Fund at the place of registration, but if this is not possible, it is enough to send documents by Russian Post or submit an application through the MFC at your place of residence;

- wait for the documents to be processed, which occurs within 10 days from submission of the application. If Pension Fund employees refuse to consider the submitted application, you must receive a written refusal and complain to senior management.

Based on the results of consideration of the potential pensioner’s case, a written decision is issued - with a refusal and indicating the reasons for this, or with a positive answer and an extract from the individual account with the calculated amount of pension payments.

The documents required to be submitted to the Pension Fund include:

- applicant's passport;

- passport of the trustee and a notarized power of attorney, if the application is submitted by a representative;

- work book or documents confirming work experience - extracts from places of official employment;

- if for some reason the applicant could not carry out work, it is necessary to submit medical certificates or documents for assignment of disability;

- SNILS;

- an application filled out according to the form or written by hand, but in the prescribed manner - will be precisely indicated in the Pension Fund department.

Additional documents may be required, but if you are applying for a minimum pension, it is enough to submit the minimum package. All certificates and extracts are prepared in originals and copies.

Pension benefits for residents of Smolensk and the Smolensk region in 2020

- confirming the right: SNILS;

- passport, which indicates the date of birth;

- work book containing all information about the length of service.

- certificate of assignment of a disability group;

- information about the presence of dependents;

Hint: documents are submitted to the branch at the place of registration.

Interesting to read: List of documents for Rosreestr transfer of ownership

Amounts to be paid are formed according to the current formula. It involves the formation of a final value from several components. Namely:

Social pensions in 2019

In 2020, social pensions and state pensions. security will be traditionally increased from April 1 . According to Art. 25 of Law No. 166-FZ of December 15, 2001 “On state pension provision in the Russian Federation”, the coefficient by which social pensions are indexed is established at the beginning of each year by Decree of the Government of the Russian Federation . This coefficient is defined as the growth index of the pensioner’s subsistence level (PMP) over the past year, in this case for 2018 .

- The law on the PFR budget for 2020 preliminarily includes funds for the indexation of social pensions and state pensions. pension provision by 2.4% .

- The exact value of the indexation coefficient became known only on March 15, 2020 after the publication of the Government Resolution - exactly 2%. The indexation coefficient for social pensions of 2% was determined based on calculations to increase the cost of living of a pensioner.

Minimum pension in Crimea from January 1, 2020

The regional government will have to increase the minimum pension in Crimea from January 1, 2020 to the established minimum federal amount, with a gradual subsequent increase from the amounts allocated by the federal government and its own budget.

In the Republic of Crimea, which became a subject of the Russian Federation in March 2014, after the completion of the transition period, which ended in 2020, pensions for all pensioners are calculated in accordance with Federal Law No. 208-FZ dated July 21, 2014. The size of the minimum pension in Crimea from January 1, 2020 is determined by the local republican government, taking into account the subsistence level (ML) in the region, on which the increase and amount of pension payments will depend.

How it is formed

The minimum pension in Russia does not depend on the subsistence level, but if it is assigned less than the established cost of the consumer basket, pensioners are entitled to additional payments up to the available amount.

At the moment, payments are formed on the basis of 3 components - the basic part, the insurance part and the savings part.

For working citizens, pension payments are calculated based on the use of all amounts that gradually accumulated during official employment and contributions to the Pension Fund.

Persons who cannot qualify for insurance benefits receive only the basic portion. For 2020 in the Smolensk region, this amount does not exceed 8,160 rubles.

The cost of living in the region is 8,726 rubles for a pensioner. Since it exceeds social pension payments, citizens can apply for additional payment.