In July 2020, the Russian Sberbank conducted a survey among Russian citizens to identify the amount they wish to receive as an old-age pension. Oddly enough, Russians have different preferences.

A social survey conducted by Sberbank among Russian citizens living in cities with a population of over half a million showed what amounts the townspeople want to receive when they are retired. Thanks to the July study, it was possible to identify factors influencing the pension amount. Among the main factors: gender, education and region of residence.

Education influences Russians' desire to have a larger pension in the future

It was possible to find out that current students name the largest amount that would suit them as an old-age pension. Young people receiving education want to receive 62 thousand monthly from the state. Citizens who have already received higher education name a thousand less.

Among the working population, the popular amount is 64 thousand. Among those who want to have such pension accruals are representatives of the following professions:

- marketers;

- PR industry representatives;

- transport industry employees.

General provisions

First of all, it should be clarified that this article will focus exclusively on insured labor pensions. Special pensions are the topics of other articles that are on our website.

Since Russia has had an insurance pension system since 2002, citizens actually determine their own pension destiny. And if everything is done correctly, and not at random, then citizens will not have any questions about when pensioners’ pensions will be raised when they retire.

In other words, instead of the concept of length of service, adopted in the USSR and used in Russia until 2002, the concept of insurance periods was introduced. And the amount that is paid to the pensioner can no longer be considered as state social assistance or subsidies. Rather, it is a return of funds (taking into account inflation and indexation) that the state withdrew from a person’s salary when he was working.

The state, of course, pays a certain fixed part, but its volume is small compared to the remaining “body” of the payment. And the remaining part of the amount received monthly is formed based on the points accumulated by the citizen. The personal coefficient (points) is formed from payments made by the citizen himself (if he was engaged, for example, in business or worked as a lawyer), or the employer transferred them for him.

But not only the funds actually transferred affect the size of the insurance pension. This also includes other factors that contribute to an increase (or decrease in payments). Let's look at the most important ones in more detail.

Russians' requests for retirement depend on their region of residence

The research department was able to find out that the financial needs of Russians in retirement vary depending on the region of residence. Moreover, the difference in amount is noticeable.

Residents of the capital region want to receive the largest pension. The majority of respondents want to receive 92 thousand. Interestingly, this amount is 60% higher than the current amount of pension accruals in the designated region. Residents of Vladivostok expressed the need to receive 78 thousand in old age. The population of St. Petersburg adheres to the amount of 70 thousand.

The smallest pension payments were reported by Russians living in Yaroslavl and Ulyanovsk. For a comfortable old age, it is enough for them to receive 48 thousand monthly. The desired pension of 49-50 thousand was named by the majority of residents of Saratov, Togliatti, Izhevsk, Ryazan and Barnaul.

The size of the pension in the future also depends on gender. So, women would be satisfied with a payment of 56 thousand, for men the bar is higher - 61 thousand.

See also: Dollar exchange rate for the week from August 31 to September 4: daily exchange rate forecast

After the study was fully completed, experts calculated the average amount that Russians would be happy to receive in the future in retirement - 59 thousand.

This year, after indexation of 6.6%, an average figure was obtained, which is 16.5 thousand.

Pension amounts - what factors influence

What, first of all, affects the size of the future pension, a VN.ru correspondent found out with the help of specialists from the regional branch of the Russian Pension Fund.

25.06.2018

The average pension will increase to 15 thousand rubles in 2020

The insurance pension is formed from funds transferred by the employer for his employee throughout his working life. Now the insurance pension is calculated using a system of points, which are earned by a citizen every year and summed up over his entire working career. A payment from the state (fixed payment) is added to it - an analogue of the basic part of the pension. Today its size is about five thousand rubles. The pension, like the fixed payment, is indexed annually for inflation. There is also another type of pension - funded. It is received by those who have pension savings.

Most people in Russia today receive an old-age insurance pension. There are three specific conditions for its appointment. The first is reaching the generally established retirement age (currently it is 55 years for women and 60 for men). The second condition is the presence of a minimum duration of insurance experience - at least 15 years (this indicator is being introduced gradually: this year 9 years are required, next year it will be 10, etc.). And the third condition is the presence of a minimum number of individual pension coefficients (there should be at least 30 by 2024, and in 2018 – 13.8).

What determines the size of your pension today? The pension is calculated depending on the number of individual pension coefficients earned. The sum of the coefficients that a person has earned throughout his entire career is multiplied by the cost of one coefficient. From this the amount of the insurance pension is obtained. The higher the salary, the higher the coefficient.

06/28/2018 Video

How pensioners find work in Novosibirsk

“First of all, the size of the future pension is influenced by the size of the official (“white”) salary - in case of official employment,” recalls Lyudmila Yakushenko, deputy manager of the PFR branch for the Novosibirsk region. — From the official salary, the employer makes contributions to the pension fund, where all this information is taken into account in the form of pension rights. Now every person officially employed and insured in the compulsory pension insurance system can log into his personal account on the Pension Fund website and see how much individual coefficients he has already earned at the moment.”

Deputy Manager of the PFR branch for the Novosibirsk region Lyudmila Yakushenko

What do people of pre-retirement age need to do now to increase their pension? The answer is simple - the size of the pension is directly affected by the official salary and is taken into account throughout the entire working life of a person. Also, the size of the pension is directly affected by the length of service. The higher the length of service, the more a person earns, the more insurance premiums are paid for him, the greater the amount of individual pension coefficients will be. So the influence of length of service and official wages on the size of the pension is obvious.

By the way, the length of service includes not only work activity. The law provides for periods for which certain coefficients are also established - they are taken into account when assigning a pension. For example, this is military service on conscription or the period of caring for a child up to one and a half years.

“The size of the pension may also be affected by a later retirement,” explains Lyudmila Yakushenko. - If a person decides to assign him a pension later than the established retirement age, then for each full year of application later (retirement age) - additional coefficients are established for him. For example, if a woman decided to retire not at 55, but at 56, then her insurance pension increases by 1.07 times, 5 years later - by 1.45.”

“In fact, it is not so important what exactly the formula for calculating pensions is in force now - it is important that a person has an official salary, a certain length of legal work experience,” says Lyudmila Yakushenko.

The next point is also important - you cannot earn a high pension only in the last year or two of your career. When calculating a pension, the entire contribution to formation during the entire working life is taken into account: not only the size of the salary, possibly high, at the end of a career, but his entire working activity throughout his life.

When calculating pensions, only official information will be taken into account. Let us remind you again. Today you can see in your personal Pension Fund account what the individual coefficient will be. This information comes to the Pension Fund from the employer, so the size of the future pension depends on his conscientiousness.

Unlike people of pre-retirement age, young people do not yet think about the size of their future pension. But now it is worth clarifying the prospects for the expected size of payments. Because for young specialists, first of all, the indicator of “purity” of wages is important. If in the future a person plans to receive a decent pension, the salary should not be “black” or “gray”. Only official, “white” wages give a chance to accrue a decent pension.

“The formation of a person’s pension right begins from the first day of his working life. And if, in addition to the main job, there is additional income, then it is also important to have an official employment contract, which provides for contributions to the pension fund,” recalls Lyudmila Yakushenko.

Ahead of us lies the implementation of a new pension bill. If the retirement age is increased, how will this affect the increase in pension amounts? Pension Fund specialists are confident that the accrual principle will remain the same if the bill on raising the retirement age is implemented. If a person works more, he will have more funds, from which pensions will then be calculated.

Now there are many pensioners who continue to work while receiving a pension. According to the regional branch of the Pension Fund of Russia, today in the Novosibirsk region 25% of the total number of pensioners are working. They were assigned a pension, which is paid without taking into account current indexations, but annually, from August 1, it is recalculated taking into account their labor contribution for the previous calendar year. For non-working pensioners, payments are indexed annually. The coefficient is determined by the Government of the Russian Federation. For example, since January 2018, insurance pensions have been indexed by 3.7%.

In 2021-24, pensions of Russians will increase significantly

The Ministry of Labor reported yesterday that in the period 2021-24. the increase in pension accruals will be the maximum in the entire history of the Pension Fund. Indexation will exceed the annual inflation threshold.

The Pension Fund also reported that the percentage of Russians applying to the agency for an old-age pension much later than the established age limits is growing every year. Thanks to this, it is possible to increase the rate.

The legislative framework

The following documents will be the basis for applying for a pension before 2010:

- Resolution of the Council of Ministers of the USSR No. 1397 of 1959;

- Federal Law No. 340-1 of 1990.

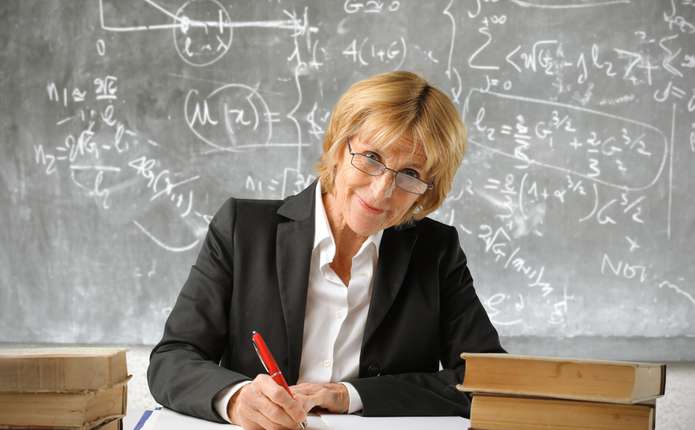

For the first time, a document adopted in 2001 was devoted to pension provision and teaching work. Under such circumstances, long service payments were abolished. The right to go on vacation early is preserved. Only teaching experience over 25 years is taken into account; age has nothing to do with this phenomenon.

The current laws were subject to further changes in 2020. When calculating the entire pension benefit, the salary accrued for all work previously is not taken into account.

The latest edits were made for February 2020. Experience includes only periods of time during which teaching staff directly performed duties. A new pension reform is planned in the near future.

List of positions included in teaching experience

People who have a pedagogical education and work with children can apply for an early pension. Law No. 173 describes such positions in detail. Benefits apply to employees of the following categories:

- kindergarten teachers;

- school psychologists;

- physical education teachers;

- music teachers;

- speech therapists;

- labor teachers;

- speech pathologists;

- teachers;

- class teachers;

- heads of academic department;

- director.

Lists of educational institutions are regulated at the legislative level:

- organizing additional education for children;

- music and ballet schools;

- kindergartens, nurseries;

- sanatorium schools;

- boarding schools for children up to adulthood;

- orphanages;

- naval schools;

- cadet corps;

- gymnasiums;

- schools, lyceums.

Before registering for early retirement, they also take a closer look at the place of work.

How to calculate teaching experience for retirement

The following periods form the bulk of the length of service:

- time to study at a pedagogical university;

- maternity leave and child care until the child is three years old;

- loss of ability to work for a time associated with the payment of benefits;

- vacation time taken by teachers each year;

- work under a contract, according to which the manager paid the appropriate contributions.

But work activity is taken into account only if there was a corresponding load. For example, for a village – at least 18 hours.

Part-time workers who have accumulated the required number of hours can also go on vacation on preferential terms. A few months before applying for a pension, it is recommended to make statements from your personal account. Then it will be easier to check the time periods for the entire work experience and make sure that the necessary requirements are met.

Does the place of work affect the right to receive benefits?

The size of a teacher’s pension is influenced by the type of institution where the work was carried out. The employee must collect all the information from his work record in advance in order to verify everything and receive the benefit.

How does a pension depend on length of service and official salary?

The rights of citizens are formed in individual pension coefficients, or pension points, the branch of the Pension Fund of the Russian Federation in the city told AiF.ru.

Moscow and Moscow region. It is these points, their number, that your salary affects.

“Taking into account that the insurance pension formula: insurance pension = sum of pension points x value of pension point on the date of pension + fixed payment, where the value of the pension point and the size of the fixed payment are established by the state, the amount of pension points comes to the fore, which directly depends on the person"

, said the fund. If your salary will be indexed

How does the size of your pension depend on your length of service?

- By this we mean the total time a person works in the territory of the Russian Federation.

We calculate the number of points: 42,240 / 113,760 * 10 = 3.713 That is, at this salary level you will receive approximately 3.7 points.In this case, not only the time a person works at the enterprise is taken into account, but also the so-called non-working periods during which deductions to the Pension Fund of the Russian Federation occurred.

In the future, the time received is taken into account when calculating the citizen’s insurance pension. The longer and more regularly a person pays contributions to the Pension Fund of the Russian Federation, the longer his experience.

We recommend reading: Law on Compulsory Audit

The insurance period also includes the time when the person worked outside of Russia, but only if the corresponding contributions were made during this period. So, now, when calculating the amount of the pension, the insurance period is taken into account.

The general one is taken into account only for persons who worked before the 2002 reform. The calculation of length of service, which will then be used when calculating the pension amount, is carried out according to the following scheme:

- On

Does the size of the pension depend on the size of the salary or just the length of service?

So, now, when calculating the amount of pension, the insurance period is taken into account.

The general one is taken into account only for persons who worked before the 2002 reform.

The calculation of length of service, which will then be used to calculate the amount of the pension, is carried out according to the following scheme:

- At the second stage, the duration of work after 2020 is calculated based on Federal Law No. 400.

- At the first stage, data on a person’s employment until 2020 is taken, and based on previously existing rules, the length of service for a given period is calculated, taking into account the preferential procedure.

There are also special types of internships that provide advantages to workers in a particular field. General conditions To receive social benefits, you must:

- be a citizen of the Russian Federation, have lived in Russia for at least 15 years, and have reached retirement age;

We calculate the IPC for each stage

For each period of time, the IPC is calculated differently. The first period lasts until 2002, the second covers 2002-2014, and the third begins after 01/01/2015.

Period until 2002

It is heterogeneous, the following parameters matter here.

- Duration of Soviet work experience (until 1991);

- Number of years worked before 2002;

- Amount of earnings.

It is at this stage that active citizens achieve significant success in increasing their pension security. It also matters how successfully, or rather, how competently the options for calculating earnings are chosen.

Everything that was taken into account is collected, the pension is calculated in rubles, and the final figure is converted into pension points (IPC), acting according to a specially prescribed algorithm.

Period 2002-2014

Starting from 01/01/2002, the Pension Fund of the Russian Federation has all the information about the labor activities of citizens. The pension capital is formed from the amount of contributions, and the length of service itself (the amount of time worked) does not play a role at this stage. Unless it is a permit - it should be enough to receive an insurance pension.

Is study included in work experience?

For example, this applies to those who work in difficult or dangerous conditions. Early retirement is possible for them only if they have a certain number of years spent in such conditions. Therefore, even if the employer pays for educational leave, they will not be taken into account when assigning a preferential pension.

As a rule, a person chooses this form of obtaining a specialty precisely because he works full time. Accordingly, the employer pays insurance contributions to the pension fund throughout this period.