Where can I check whether my pension is calculated correctly?

Related article: Farewell to youth!

What awaits Russians if the funded pension is cancelled? To check the accrual of a pension, a pensioner should contact the Pension Fund of Russia (PFR) at the place of registration with an application addressed to the manager with a request to double-check the correctness of the accrual of the pension. After reviewing the pensioner’s application, employees will recheck the correctness of the pension calculation and report the results.

A pensioner’s application for recalculation of the pension amount is considered no later than five days from the date of receipt.

Recalculation of the pension amount is carried out from the 1st day of the month following the month in which the pensioner’s application for recalculation of the pension amount was accepted.

If it turns out that the pension amount was calculated incorrectly, the amount will be automatically corrected. In accordance with current legislation, there are cases of revision and recalculation of pensions due to incorrect calculation. Such errors are associated, first of all, with the human factor (error in the work book, certificate of employment, etc.).

Recalculation based on length of service or earnings before January 1, 2002

When determining the amount of pension for a particular employee, the Pension Fund proceeds from the data at its disposal. At the same time, information about the length of service and earnings of citizens for the period before 2002 may be incomplete or absent altogether, which will lead to the accrual of payments in a reduced amount.

You can check the available information in your personal account on the Pension Fund website. If not all periods of work are converted into individual pension coefficients (IPC), then the citizen must provide documents confirming his earnings and length of service. It could be:

- employment history;

- certificate of wages;

- archival data about work in a specific organization.

Adjustment of pension as a result of recalculation based on length of service or earnings before 2002 is called valorization. This process concerns not only pensioners, but also those who have yet to retire. These individuals are entitled to a 10% increase in their pension, and citizens with service before 1991 are additionally assigned 1% for each year worked before this date.

For the valorization process, the legislation does not establish any restrictions on the length of service. The calculation takes into account all work time that can be confirmed, including those exceeding the maximum indicators (45 years for men and 40 for women). For example, for a citizen who retired in 1995 and has a total length of service of 47 years, the increase will be 10% + 43% (for length of service before 1991) = 53%.

- Reasons for refusal to grant a pension

- Cleansing face mask - recipes with blue clay, gelatin or activated carbon

- Thermos with wide mouth for food

How and where can I check the status of my retirement account?

You can find out about the status of your individual personal account (IPA) as follows:

- in credit institutions with which the Pension Fund of Russia has concluded a corresponding agreement (through an operator or through ATMs, as well as in electronic form - through terminals or Internet banking of credit institutions (Sberbank of Russia OJSC, Bank Uralsib OJSC, Gazprombank OJSC, Gazprombank OJSC "Bank of Moscow", CJSC VTB Bank));

- on the portal of state and municipal services. To do this, you need to register on the portal, enter your personal account, select the “PFR” tab, the “Notification of the status of an individual personal account” item;

- in the territorial bodies of the Pension Fund of the Russian Federation at the place of residence. You must have an identification document with you, an insurance certificate of compulsory pension insurance. The application can also be sent to the territorial body of the pension fund by mail, attaching notarized copies of the passport and certificate of compulsory pension insurance.

Where to complain?

Article on the topic

Government bonus. Why are government officials' pensions increasing? If you are not sure about the correct calculation of your pension, contact the head of the pension fund department with a written statement. In your application, ask for payment information. Fund employees are required to respond, and in writing.

An extract on the accrual of pensions from the fund is issued upon request only once a year.

If, after receiving the statement, you have any doubts about the correctness of pension calculation, you should contact the higher authority - the regional branch of the Pension Fund.

If after contacting the regional Pension Fund you still have questions, contact a lawyer (advocate), as you may have to go to court. Incorrect calculation of pensions by the courts is often recognized as illegally underestimated.

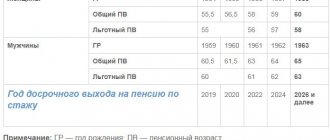

What is the minimum length of service required to receive a pension?

From 2020, the minimum total length of service for receiving an old-age pension will be gradually increased. From 6 years to 1 year per year for 10 years. Those whose total length of service by 2025 will be less than 15 years have the right to apply to the Pension Fund for a social pension (women at 60 years old, men at 65 years old).

In 2025, the minimum total length of service to receive an old-age pension will reach 15 years.

Read more about pension calculation in the help>>

Increase upon completion of seniority

Current legislation does not provide for additional payments for long-term employment (for example, 40 or 45 years). Regulatory legal acts consider certain specific situations in which pension payments increase:

- Awarding the title “Veteran of Labor”. Indirectly, such an increase in pension can be considered additional payment for length of service, since a veteran’s certificate is issued precisely for long-term work. Such appointments fall under the competence of regional authorities, and not the Pension Fund, so the size of the increase varies depending on the place of residence of the recipient of the payments.

- Continuation of work activity. Pensions for working pensioners are reviewed annually on August 1 in order to index them in connection with an increase in accumulated length of service. The maximum increase is 3 points (individual pension coefficient - IPC).

- Receiving an increase due to benefits provided for working in the Far North and equivalent regions. The employee's fixed part of the pension increases.

- Providing documents on the development of preferential length of service according to Lists 1 and 2 established by law. These lists determine the circle of workers entitled to early retirement (due to increased social contributions by the employer, these payments will be larger than in normal cases).

Northern surcharge

In accordance with the Labor Code of the Russian Federation, those working in the Far North can qualify for an increased pension. The supplement is due:

- Residents of the northern regions who had a permanent place of work there.

- Workers there periodically (for shift workers) when the established time is fully worked out.

The law establishes benefits for northern workers:

- Increased basic (fixed) part of pension payments.

- Early assignment of an old-age pension (55 years for men and 50 for women, subject to working out at least a 15-year term in the Far North or 20 years in equivalent regions).

There are special conditions that give the right to recalculate the insurance pension. If there is at least one of them, a citizen can apply to the Pension Fund with an application to adjust the existing payments:

- Development of calendar length of service established by law in the northern regions (for working pensioners).

- Receiving a fixed disability pension due to work in the Far North.

- An increase in the insurance period, which entails an increase in pension (for example, when providing documents confirming previously unaccounted for work intervals). The number of IPCs is also increasing.

The amount of the increase depends on the specific situation (general and preferential length of service) and is calculated individually. A separate case of increased payments can be considered when a pensioner moves to the Far North or equivalent regions. The assigned pension is multiplied by the regional coefficient established for the given area.

- North Kuril region (Sakhalin region) – 2.0.

- Norilsk (Krasnoyarsk Territory) – 1.8.

- Vorkuta (Komi Republic) – 1.6.

- Severodvinsk (Arkhangelsk region) – 1.3.

- Komsomolsk-on-Amur (Khabarovsk Territory) – 1.2.

Preferential length of service according to List 1 and 2

The legislation provides lists of professions whose representatives are entitled to a preferential pension. These regulatory documents include:

- List 1. Contains professions with harmful and dangerous working conditions (for example, metallurgists, miners).

- List 2. It includes activities that are harmful to the health of the worker (cellulose production, oil refining, etc.).

Representatives of professions from these lists can retire earlier, which is partial compensation for difficult working conditions. For example, female employees of anti-tuberculosis institutions (occupation from List 2), with a special experience of 10 years, have the right to a preferential pension at the age of 50. With 5 years of service, the generally accepted retirement age is reduced (for example, for a female employee with 6 years of service it is 52 years).

- How to turn on bluetooth on a laptop - where it is and how to connect

- How to bet on football - choosing an online bookmaker or mobile application, secrets of making money

- Digital grocery cards may be introduced in Russia

A mandatory condition for early retirement is increased employer insurance contributions. The need to revise your pension arises if you have length of service according to two of these lists at once. The law allows the summation of years worked for retirement with the benefits of List No. 2. This is possible if the following conditions are met:

- Reaching the age for a preferential pension according to List No. 2 (55 years for men and 50 for women with full completion of special service). At the same time, the current legislation does not provide for the adjustment of payments for non-working persons upon reaching the general pension age, therefore the recalculation of the preferential pension at 60 years for such men (and 55 for women) is not carried out.

- The total length of work experience in specialties from the two lists as of 01/01/2002 is sufficient for retirement. The minimum general interval of work in these professions, which gives the right to reduce the retirement age, is 6.25 years for men and 5 for women.

- The total insurance period as of 01/01/2002 is not less than the norm established by law. It is 25 years for men and 20 for women.

Recalculation of pension payments occurs after submitting to the Pension Fund an application and a package of documents confirming the presence of special experience in Lists 1 and 2. The increase in the amount of the pension depends on the specific indicators of the applicant’s time worked and the ratio of these periods. In some cases (for example, when the output on the first list is greater), the result obtained will be less than the amount of current payments. In this case, the Pension Fund leaves everything as before.

What social benefits are provided for pensions?

Article on the topic

European-style pension: how the elderly live in Spain, Germany and Poland If the total amount of cash payments to a non-working pensioner is lower than the pensioner’s subsistence level established in the region of his residence, then he is provided with a federal or regional social supplement to his pension.

The federal social supplement to pension is set in such an amount as to:

additional payment + pension = minimum living wage for a pensioner in a given region.

If the pensioner works, no additional payment is made.

A regional surcharge is established if the cost of living of a pensioner in the region is higher than the cost of living of a pensioner in the Russian Federation.

The cost of living for a specific region can be found on the website >>

The federal social supplement to the pension is paid by the territorial body of the Pension Fund of the Russian Federation (PFR), and the regional one - by the authorized executive body of the constituent entity of the Russian Federation.

See also: Minimum pension in Russia from January 1, 2020 →

What is included in work experience?

Related news

Russians do not hope for a state pension. Total length of service is understood as the total duration of labor and other socially useful activities until January 1, 2002, which includes:

- periods of work as a worker, employee (including hired work outside the territory of the Russian Federation), member of a collective farm or other cooperative organization; periods of other work in which the employee, not being a worker or employee, was subject to compulsory pension insurance; periods of work (service) in paramilitary security, special communications agencies or in a mine rescue unit, regardless of its nature; periods of individual labor activity, including in agriculture;

- periods of creative activity of members of creative unions - writers, artists, composers, filmmakers, theater workers, as well as writers and artists who are not members of the relevant creative unions;

- service in the Armed Forces of the Russian Federation and other military formations created in accordance with the legislation of the Russian Federation, the United Armed Forces of the Commonwealth of Independent States, the Armed Forces of the former USSR, internal affairs bodies of the Russian Federation, foreign intelligence agencies, federal security service agencies, federal executive authorities, which provide for military service, the former state security bodies of the Russian Federation, as well as in the state security bodies and internal affairs bodies of the former USSR (including during periods when these bodies were called differently), stay in partisan detachments during the civil war and Great Patriotic War;

- periods of temporary disability that began during the period of work, and the period of being on disability of groups I and II, received as a result of an injury associated with production or an occupational disease;

- the period of stay in places of detention beyond the period assigned during the review of the case;

- periods of receiving unemployment benefits, participating in paid public works, moving in the direction of the employment service to another area and finding employment.

Recalculation of pensions: what is the reason for the unprecedented rush

A preferential pension is a reason to come to the Pension Fund. “As for men,” continues Alfiya Yambaeva, “military service has always been taken into account when assigning a pension, and under the old legislation, even double the amount! Now there are options to take into account this service in a calendar version and according to points. There is no point in asking men to count their military service by points if they receive a simple old-age pension! Everything has already been counted and credited to them! For men who have a long duration of preferential service, that is, those who retired before turning 60 years old, it is worth contacting us. There is a whole list of such professions and working conditions. In this case, it is usually beneficial to review the pension. We make sure to make an appointment for these citizens. Let's look at a specific example here too. The man has 25 years of experience, including 20 years according to List No. 1. In this case, the assessment of pension rights will be made based on the preferential length of service as the most profitable option. And only in this case will the pensioner be awarded points for military service.

There is an unprecedented influx of clients in the city and district departments of the Pension Fund of Mordovia. People who retired at different times come here to have their pension recalculated. Women want the time spent caring for a child/children up to 1.5 years to be counted, and men ask that years of military service be included in the length of service. Everyone goes with the hope that after the recalculation they will receive a slightly larger pension. As a result, the number of requests to pension fund specialists is growing like a snowball. But people are just making appointments, and the queue has already stretched for several months. However, this circumstance only fuels the confidence of pensioners that they are right. For clarification corr. “VS” turned to the head of the department of organization, assignment and recalculation of pensions of the Branch of the Pension Fund for the Republic of Moldova Alfiya Yambaeva.

19 Oct 2020 lawurist7 321

Share this post

- Related Posts

- What changes have occurred under Article 228, how to get out on parole

- What is the Regional Coefficient in Altai Territory 2020

- How to Register a Large Family of Children: Children Must Be Registered Together

- Punishment for Nasvai