Features of the pension system

To understand how pensions are calculated, it is important to learn about the current pension system. It includes 3 levels at which payments are formed differently. The first two are state-owned. They take care of providing for every person who has 15 years of experience and has reached the age of 62 years.

Payments are made on the basis of deductions made by employees during their working career. The last level is formed thanks to the contribution of the citizens themselves.

Social tax in 2020 is 34%. In this case, the main part is contributed by the employer, and only 10.5% is withheld from the citizen’s income. The following types of payments are distinguished:

- Pension provision from general funds that come from the population from wages.

- A pension that was accumulated from insurance payments of every citizen born after July 1, 1971.

- Voluntary savings of citizens. These are the amounts that are deducted to the pension fund in the process of working independently.

Pension system[ | ]

Three-tier pension system[ | ]

First level - state pensions

, which accumulate in the Social Insurance Fund, which is separate from the general state budget. These funds provide basic pensions and are not inherited in the event of the death of the insured person. The social insurance fund is formed from contributions from workers, from which pensions are paid to current pensioners, which ensures the principle of solidarity between generations. However, due to a shrinking and aging population, there is a risk of fund shortages, making it necessary to increase the retirement age.

Second level - state funded pensions

, introduced on July 1, 2001. Part of social savings is allocated to this system, which has grown since implementation from 1% to 6% (2016) and is managed by private pension funds. The second pillar pension capital is inherited, the insured person has the right to choose the manager of his savings and investment plan[10].

Third level - private pensions

, which can be accumulated through contributions from the employer or the insured person to private pension funds. If the employer makes the savings, these expenses are counted as business-related expenses and are not subject to payroll taxes, provided that the contribution does not exceed 10% of the gross salary.

Indexation of pensions[ | ]

The procedure for indexing pensions was stipulated by law in paragraph 15 of the transitional rules and was subsequently regularly revised[1]. Indexation was stopped after the global economic crisis of 2008, which affected Latvia more than other EU countries (loss of more than 20% of GDP) and forced the introduction of austerity[11]. In particular, for persons retiring from January 1, 2010 to December 31, 2020, the pension was calculated with a coefficient of less than one in relation to their accumulated pension capital[12].

In 2014, the indexation of pensions was resumed - the adopted amendments to the law “On State Pensions” provided for the indexation of pensions less than 285 euros and part of pensions in the amount of 285 euros for persons whose accrued old-age benefits exceed this amount.[5] Pension indexation in the fall of 2014 was carried out with a coefficient of 1.0158[13]. At this time, there were about 470 thousand pensioners in Latvia, 60.9% of them received an old-age pension in the amount of 200 to 300 euros per month[12]. As a result of indexation, each of them received an additional 7 euros on average[5].

On June 18, 2020, the Seimas of Latvia adopted amendments to the law that abolished the crisis negative capital indexation when calculating pensions in the future, as well as containing promises to begin recalculating pensions accrued during the crisis in 2020 and to exclude the use of a negative capital index when calculating pensions in the future. When recalculating, negative contribution indices from salaries of 2009, 2010 and 2011 are replaced by one. The procedure for recalculating disability pensions for groups I and II was also clarified.[12] To recalculate pensions in 2020, an additional amount of about 4.1 million euros was required, in 2020 - 21.6 million, in 2020 - 49.3 million euros.[12]

Taxation of pensions[ | ]

Pensions in Latvia are subject to personal income tax, and the non-taxable minimum did not change from 2006 to 2020 and amounted to 235 euros. From 2020 it was increased by 15 euros, with an increase in the next two years to 280 euros. On the portal of people's initiatives Manabalss.lv in 2020, 10 thousand signatures were collected for the abolition of income tax on small pensions and increasing the non-taxable minimum to 500 euros. This would affect 289 thousand people receiving pensions of up to 500 euros[14].

The Ministry of Finance of the Republic of Latvia rejected this initiative under the pretext that the reduction in income from pension taxes would reduce the budget of local governments, from which social assistance is financed. However, in local government revenues in 2020 (1,312 million euros from personal income tax), the 104 million euros of tax paid by pensioners was less than 8%. If the non-taxable minimum is increased to 500 euros, local governments, due to the mechanism of redistribution of tax revenues between them and the state treasury, will not receive 77 million, as the Ministry of Finance claims, but only 80%, that is, 61.6 million. According to the mayor of Rezekne, Aleksandar Bartashevich, this deficit can be resolved by returning the proportion of distribution of personal income tax funds between the main budget and local government budgets, which was reduced from 90% to 80% during the crisis years. Even if the state were to start paying 85% of the tax collected locally, the amount of tranches would increase from 1,312 to 1,394 million euros, significantly exceeding the income tax shortfall. At the same time, the burden on the social functions of local governments would be reduced, since with the growth of real incomes of pensioners, the need for social benefits, for example, to pay for utilities, decreases[14].

Even survivors' pensions are subject to personal income tax in Latvia, which contributes 80 thousand euros to the budget every quarter[14].

Long service pensions[ | ]

Regulated by the regulation of March 26, 1992, adopted by decision of the Council of Ministers of the Republic of Latvia No. 104.[15] It applies to transport workers (pilots, aircraft crews, air traffic controllers, engineers and technicians, machinists and railway dispatchers), creative workers (ballet and musical theater artists, circus) and allows them to retire if they have 20-25 years of experience and upon reaching the age of 45-50 years.

The Law “On Long Service Pensions for Military Personnel” was adopted by the Seimas on March 19, 1998 and allows persons with at least 20 years of service, of which 15 were served in the National Armed Forces of the Republic of Latvia, to apply for a pension.[16]

The Law “On length of service pensions for employees of the Ministry of Internal Affairs” was adopted by the Seimas on April 2, 1998 and allows persons with at least 25 years of work experience, of which at least half worked in the Ministry of Internal Affairs, to apply for a pension[17]. A similar procedure was then adopted in relation to employees of the Bureau for the Prevention and Combating of Corruption and state security services.[18]

The Law “On Service Pensions for Judges” was adopted by the Seimas on June 22, 2006[19] and allows persons with at least 20 years of work experience and at least 10 years as a judge to receive such a pension.

The Law “On long-service pensions for emergency medical workers” was adopted by the Seimas on July 8, 2020 and came into force on January 1, 2016. It allows these workers to retire at age 55, provided they have at least 20 years of work experience, at least the last five of which were spent working in the emergency department.[20]

On April 15, 2020, the Parliamentary Commission on Education, Science and Culture supported the proposal to introduce long-service pensions for physical education teachers and teachers of special and preschool institutions. The long-service pension was supposed to be paid to teachers over 60 years of age with at least 30 years of teaching experience, and the pension amount was to be 80% of the average monthly salary, but not less than the state social security benefit. These long-service pensions were supposed to be paid before retirement age. The law was supposed to come into force on January 1, 2020. In 2020, 435 thousand euros would have been required in the state budget for these purposes, and 90 teachers could have been covered by long-service pensions.[21]

At what age do they retire?

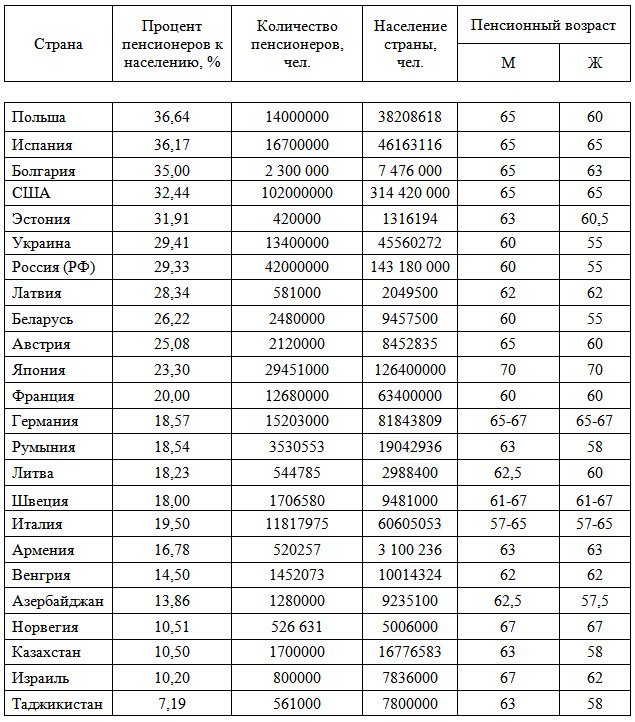

In accordance with the country's legislation, the retirement age in Latvia for men starts at 62 years, as for women. But since 2014, this limit has gradually increased. It is planned that by 2025 the retirement age will be 65 years.

There are some exceptions when early retirement is granted:

- parents with many children with at least 5 children retire 8 years earlier;

- if a citizen participated in the liquidation of the Chernobyl accident, he can retire at the age of 57;

- if you have at least 30 years of work experience, you can retire at age 60;

- a parent or guardian of a child with a disability can retire 8 years earlier.

Also, disabled women, dwarfs, and citizens with visual impairments retire earlier.

More to read:

What is the minimum pension in Finland?

What is the minimum pension in Lithuania?

Minimum pension amount

There is no official minimum set as it depends on contributions and lifetime work experience. In addition, a gradation of pensioners is established depending on social status and membership in certain professions.

The minimum pension in Latvia in 2020 is at 70.43 euros. At the same time, those who have an income below 128.06 euros per month receive beggar status. Local authorities establish the following benefits for such income:

- payment of utilities;

- Food;

- providing free lunches;

- funds for the purchase of firewood in the private sector.

Expert: retirement age in Latvia could reach 70 years

According to Rosenfelds, the demographic situation in Western countries is close to Latvian.

“Perhaps in several states this softens the flow of immigration, but in fact the trends are the same everywhere - fewer children are being born, and questions arise about whether the current social system can provide for old age through pensions.”

, he emphasized. At the same time, the expert noted that in the West, people cannot rely only on state-guaranteed pensions.

Average payments to pensioners in the Republic of Latvia

What is the average pension in Latvia in 2020? It is equal to 304.30 euros in the country. This level exceeded last year's figures by 8.15 euros. But more than half of pensioners receive 200-300 euros monthly. 12.2% of pensioners receive less than 200 euros. And only 7.3% have payments over 27.4%.

Most pensioners have support from the state at the level of 300-500 euros monthly. This income is acceptable for most large cities, allowing you to live comfortably and pay for current expenses.

Pension indexation is carried out annually. After it, the average size increases by 18.27 euros. A maximum of 27.5 euros is added to monthly income. Only income up to 382 euros is indexed. If the amount is larger, the increase is carried out only from the amount of 382 euros.

Statistics by year

Statistics of pensions received for 2012:

- Up to 200 euros – 13.1% of the population.

- From 200 to 300 euros – 67.5% of residents of the Republic of Latvia.

- From 300 to 500 euros – 19.4% of residents of this country.

- More than 500 euros – 4%.

More on the topic Maternity capital in 2020: to whom, how and for what purposes

Statistics of pensions received for 2013:

- Up to 200 euros – 12%.

- From 200 to 300 euros – 64.8%.

- From 300 to 500 euros – 23.2%.

- More than 500 euros – 4.4%.

Statistics of pensions received for 2014:

- Up to 200 euros – 9.9%.

- From 200 to 300 euros – 62.7%.

- From 300 to 500 euros – 27.4%.

- More than 500 euros – 5.2%.

Statistics of pensions received for 2020:

- Up to 200 euros – 12%.

- From 200 to 300 euros – 58.5%.

- From 300 to 500 euros – 29.5%.

- More than 500 euros – 5.8%.

Statistics of pensions received for 2020:

- Up to 200 euros – 12.1%.

- From 200 to 300 euros – 54.8%.

- From 300 to 500 euros – 33.1%.

- More than 500 euros – 6.7%.

Statistics of pensions received for 2020:

- Up to 200 euros – 11.7%.

- From 200 to 300 euros – 48.2%.

- From 300 to 500 euros – 40.1%.

- More than 500 euros – 8.3%.

From the statistics we can conclude that the number of pensioners receiving a pension of up to 100 euros is rapidly decreasing, while the number of people receiving more than 500 euros is increasing.

Those with incomes below the subsistence level can count on benefits

Standard of living of pensioners in Latvia

How do pensioners live in Latvia? They have the opportunity to support themselves with dignity if they have good experience. At the same time, more than 16% of older people continue to work over the age of 65. The bulk of working pensioners are in the Riga region, where the overall unemployment rate in the country is minimal and amounts to 4.6%.

In most cases, an old-age pension allows you to avoid working as it provides basic expenses. This is true for those who have their own housing and use free medical care. Married couples and persons receiving child support have greater comfort.

Due to the fact that the retirement age for women in Latvia begins at the same time as men at 62, it is possible to retire almost simultaneously. Spouses, even with average income, can live with dignity.

Pension for military personnel in Latvia in 2020

Military personnel with Russian citizenship, thanks to their service in Latvia, received a pension in a foreign country. This situation has developed for a very long time. Many people know that during the existence of the USSR, military personnel were sent to serve in various regions of the Soviet Union. After the collapse of the USSR, Latvia decided to reward the military (not Latvian citizens, but Russian residents) for their past service and awarded them a pension.

Military pensioners in Latvia have long received pensions from two states: Latvia and the Russian Federation. But in 2011 the situation changed. The State Control of the Republic of Latvia established this fact, therefore Latvia stopped payments for the following periods that were previously paid by Russia:

- Duration of compulsory military service.

- Carrying out overtime service in the armed forces of the Union of Soviet Socialist Republics.

- Serving in the Ministry of Internal Affairs and its structural divisions.

The fight for the rights of Russians in Latvia. More details in the next video.

Retired Russian military personnel receive pension payments from Latvia only for length of service. On average, a military pensioner with Russian citizenship receives benefits in the amount of 550 euros per month.

The country has also adopted certain types of pensions, which are created exclusively for certain categories of citizens, for example, military personnel. Certain benefits may be applied to them, and special types of payments are provided for them. For citizens with a Russian passport, the payment amount is on average 550 euros monthly.

The situation of military pensioners

Military pensions in Latvia are calculated in a new way from 2020. You must serve a minimum of 25 years in the army. In this case, pension provision is provided, amounting to 55% of the average salary during work. On average, 380 euros are paid.

Since 2011, the authorities have paid special attention to Russian citizens who served in the Russian Federation in military service. When they move to Latvia, as a rule, employment is carried out in civilian professions. At the same time, it is revealed that the pension was received both from Russia and from the Latvian authorities. To correct the situation, payments are stopped for the following periods:

- long-term service in the USSR Armed Forces;

- compulsory military service;

- studying at a higher educational institution;

- services in internal affairs institutions.

Now Russian military pensioners are only entitled to payment for length of service that meets legal requirements. On average, the payment is 550-560 euros, which in rubles would be 41030-41776.

Legislation[ | ]

Law “On State Pensions”[ | ]

Adopted by the Seimas on November 23, 1995 and proclaimed by President G. Ulmanis on November 23 of the same year. Since then, it has been changed 47 times as of May 2020.[1]

The law established the principle of calculating pensions depending on social insurance contributions paid, which initially amounted to 37% of gross wages, and three types of pensions: old age, disability and loss of a breadwinner. The latter was paid only if the deceased breadwinner was a socially insured person, and ranged from 50% (for one child) to 90% (for three or more children) of the expected pension of the breadwinner[1].

The law provided that compulsory social insurance contributions should be accrued to employees from the age of 15 years. According to the law, the majority of the social contribution was made by the employer, the smaller part by the employee himself, but in fact, responsibility for paying contributions rested solely with the employer.

A funeral benefit was provided in the amount of two months' pension of the deceased, which was paid to his relatives.

When traveling abroad, Latvian citizens retained the right to receive a pension for life; non-citizens received a pension earned in Latvia in advance for 6 months from the date of departure and then its payment ceased (Article 38)[1].

The transitional rules to the law established that work experience and equivalent activities (studying at a university or secondary specialized educational institution, service in the Soviet Army and internal affairs bodies, with the exception of the KGB, caring for a child under 8 years of age, caring for a disabled child up to 16 years old) until January 1, 1991, citizens of the Republic of Latvia are fully credited, regardless of their place of work before that time and the fact of paid insurance premiums, while for foreigners and stateless persons who at that time lived in Latvia, this rule applied only to period worked in Latvia. Experience accumulated outside Latvia or at enterprises of union subordination located in Latvia was not taken into account when calculating the pension of non-citizens[1]. For politically repressed persons, the time they spent in exile was counted towards their length of service in triple the amount; in exile in the regions of the Far North and equivalent areas - in the amount of five times.

Retirement age[ | ]

The retirement age was initially set at 60 for both men and women, in contrast to the Soviet system in which women retired at 55. The Law of the Republic of Lithuania granted women the right to retire early at the age of 55, with the payment of a reduced old-age benefit[1].

Since 2014, the new version of the law “On State Pensions” has set the retirement age at 65 years for men and women, with a gradual increase of three months every six months until it reaches 65 years in 2025[2]. In 2020, the Bank of Latvia proposed increasing the retirement age to 67 years, taking into account the trend towards aging of the population: if in 2020 there will be 37 pensioners per 100 workers, then in 2060 there will be 67[3]. At the same time, the size of pensions in Latvia is one of the lowest in the EU: 44.2% of pensioners in the country are at risk of poverty, receiving less than 60% of the average income per resident of the country.[4] Since 2014, the Central Statistical Office of Latvia has stopped calculating the cost of living, which in December 2013 was last calculated in accordance with the methodology approved back in 1991 and amounted to 177 lats, or 252 euros[5].

Minimum wage[ | ]

Main article: Minimum wage in Latvia

The first minimum wage rules concerned state and municipal employees and were adopted on November 13, 1991 by decision of the Council of Ministers of the Republic of Latvia Nr. 318 “On a unified system of remuneration for employees of institutions financed from the budget.”[6]

The Republic of Latvia began changes in the general rules of remuneration in 1992, when amendments to the Labor Code of the Latvian SSR abolished the ceiling on remuneration, but did not establish a minimum.[7] At this point, the minimum wage was 670 Latvian rubles, and by the end of this year it had risen to 1,400 Latvian rubles[8].

On August 17, 1993, the Cabinet of Ministers of the Republic of Latvia adopted Resolution No. 4 “On changes in wages for employees of institutions financed from the budget,” in which the minimum wage for the lowest category was set at 22.50 lats.[9]

Pension payments to Russians

Russian citizens can receive a pension in Latvia. To do this, you must reach the age of 62 and have worked in the country for at least 15 years. The application is submitted both according to the standard procedure and electronically. The following information and documents must be provided:

- statement;

- passport;

- bank account number opened in a Latvian bank;

- information about place of residence.

The size of the pension in Latvia for Russians does not differ from payments to indigenous residents if they have fulfilled the basic requirements.

We recommend these articles:

What is the minimum pension in Estonia?

What is the retirement age in Norway for women and men?

Additional benefits for Latvian pensioners

For the elderly, various benefits are established here, which depend on various factors. Thus, residents of Riga over the age of 100 receive a one-time payment of 150 euros. All pensioners have the right to use public transport free of charge. If the pension is less than 128 euros, additional subsidies are provided.

In Latvia, tax-free income is set at 235 euros. The income tax here is set at 23%. This measure becomes a help to pensioners with low payments. If a pensioner is single, he receives serious assistance from the municipality.