Do I need to inform a pensioner about his dismissal at the Pension Fund?

And thus, this year the average size of pension payments was:

- social – 8.82 thousand;

- insurance – 13.7.

It is also worth pointing out that this year the government does not intend to completely stop paying pensions to working senior citizens. This optimization measure was rejected in the past, when the economic situation was very unstable.

Now, due to the fact that there are all the prerequisites for an increase in indicators, it is even more useless. There is one more nuance that you should be aware of. If a pensioner, having resigned, begins to receive recalculated payments, but then gets a new job again, then their amount will be fixed at the last level.

Attention! As part of our website, you have a unique opportunity to receive free advice from a professional lawyer. All you need to do is write your question in the form below.

Issuing PFR reports to employees

The article from the magazine “MAIN BOOK” is current as of November 18, 2016. E.O. Kalinchenko, economist-accountant Everyone who works for you under an employment or civil contract must be given copies of the SZV-M and individual information. And it was always necessary! We hasten to reassure you that failure to comply with this obligation is not criminal.

The Law on Personalized Accounting obliges employees to be given copies of information about them presented as part of reports, , , (hereinafter referred to as Law No. 27-FZ): in the form RSV-1.

In this report, personalized information is indicated in section 6, which is filled out separately for each employee.

Do I need to report to the pension fund if a pensioner quits his job?

Moreover, those who have the status of individual entrepreneurs and, for example, lawyers, were also left without indexation. According to the authors of this legislative act, persons who continue to work in retirement:

- have additional income;

- suffer less from inflation.

According to the relevant regulatory framework of Russia, annual payments are designed to protect the income of pensioners from depreciation and in size must correspond to the level of growth in consumer prices (that is, inflation itself).

Attention

At the same time, this new approach to the problem allowed the state budget to save approximately 450 billion by not paying indexation to pensioners who continue to work. According to statistics, there are currently more than 14 million of them in the country.

From April 1, pensioners do not need to inform the Pension Fund about the fact of dismissal from work

Important

If a pensioner quits his job, is it necessary to inform (submit a notification) to the Pension Fund? It depends on when exactly the pensioner stopped working. Previously, pensioners did not need to submit any notifications to the Pension Fund about their dismissal.

But now the situation has changed. This is due to the abolition of indexation of pension payments for workers from 2020. Find out in this article whether pensions for working pensioners in Russia will be indexed from January 1, 2020? Rules for indexing the insurance pension from 2020 In 2020, the rules for indexing the insurance part of the pension changed. Now only non-working pensioners can count on an annual increase in their pension. The new rules also affected pensioners who have the status of individual entrepreneurs or lawyers. According to the authors of the law, working pensioners have other sources of income and are less exposed to inflation risks than their unemployed colleagues.

Is a pensioner required to report finding a job?

In practice, a situation may arise when, for some reason, a pensioner cannot provide a document. In this situation, an employer who wants to officially record the fact of interaction with a citizen can enter into an employment contract without a work book.

The employer has the right to establish a probationary period, assign overtime work, hire a pensioner for irregular working hours and send him on a business trip. A person on well-deserved rest has the right to continue working on a general basis.

Working pensioners do not need to go to the pension fund after dismissal

Home → Good to know Contents

- Do I need to report dismissal to the Pension Fund?

- How will the pension change after official dismissal?

Very often, citizens of the Russian Federation, being pensioners, continue to officially work as long as they have the time and energy to do so. Currently, the state does not index the pensions of working citizens as long as they have an official place of work.

In this regard, the question often arises if a pensioner quits his job: does he need to report his decision to the Pension Fund. Indexation of pensions after dismissal Do I need to report dismissal to the Pension Fund of the Russian Federation? A couple of years ago, pensioners were required to personally contact the Pension Fund after leaving their workplace to confirm their “unemployed” status.

Since April 2020, the obligation to notify Pension Fund employees has been removed from retired pensioners.

Recalculation of pension after dismissal

Info

For example, a pensioner quit his job in June. This means that the indexed pension will begin to be paid to him in September. How to notify the Pension Fund of dismissal? Citizens of retirement age who retired between October 1 and March 31, 2016 were required to report this fact to the local Pension Fund office.

This had to be done before the end of May. Otherwise, the pensioner would continue to receive a pension without indexation. Is a working pensioner required to work 2 weeks upon dismissal? We answered here.

Since April 2020, pensioners have been relieved of the responsibility for submitting notices of dismissal to the Pension Fund. This responsibility has been transferred to employers, who must submit monthly information about all persons working for them.

Thus, the Pension Fund will automatically determine the fact of employment of each citizen.

Dismissal of a pensioner

Pensioners are older workers who do not always cope with their responsibilities due to outdated knowledge. Not all employers are happy with the fact that their staff consists of people of retirement age. But you can’t just fire a pensioner!

Harassment of workers based on age directly falls under the concept of “discrimination,” and this phenomenon is not acceptable in the modern legal zone.

Is it possible to fire pensioners?

Yes, it is possible to fire such a worker, but in compliance with labor laws. Grounds for termination of relations:

If an employee who has already reached the appropriate age decides to quit on his own, then his superiors cannot prevent him or detain him in the workplace. If the employer himself decided to terminate the relationship, then one of the following conditions must be present:

- the enterprise ceases its activities;

- a pensioner is laid off. It has some perks;

- he repeatedly violated discipline and internal regulations;

- the employee is not suitable for the position he currently occupies. This is evidenced by the results of the certification;

- other reasons specified in Art. 81 Labor Code of the Russian Federation.

That's why:

- age is not a reason to end a relationship;

- pensioners have a number of advantages and benefits;

- they can independently protect their rights.

At your own request

If an employee who has already retired due to age no longer wants to work, he can resign by expressing his desire. You need to do this:

- he writes a statement addressed to the head of the organization;

- in it he indicates the reason for leaving - “of his own free will to retire.”

If there is no such mark, then work is required. - an order is issued, a record of dismissal is made in the labor record;

- receives a work book and full payment;

- the employment relationship is over.

Russian labor laws do not stipulate how many times a pensioner can be fired upon “retirement”. There are two different points of view on this matter.

Some people believe that you can only quit once. A person’s status changes to “retired.” Therefore, he can resign on this basis only once.

On the other hand, the departure of an employee who has already reached a certain age is his retirement. Therefore, he can resign on this basis as many times as he likes.

There are also judicial precedents regarding these points of view.

If a pensioner indicates in the application the reason for terminating the contract “in connection with retirement,” then he may not work the required 2 weeks. He can resign on any day convenient for him, and receive a full payment immediately.

By agreement of the parties

The bosses and the working pensioner can reach an agreement on the conditions for the latter’s departure from his job. They need to be reflected in the agreement.

The initiator can be both the worker and the administration of the enterprise. It is important to reach an agreement in good faith and without pressure. A draft agreement can also be drawn up by one of the parties and offered for discussion. The document can reflect:

- date of dismissal;

- the amount of compensation payments;

- working conditions or lack thereof;

- other important points.

The advantages of such a dismissal are as follows:

- terms discussed;

- the possibility of receiving additional monetary compensation;

- “convenient” date of dismissal.

It is imperative to prepare 2 identical documents - one for each side. Both copies are signed by both parties. On the agreement that remains at the enterprise, the employee must write “I received my copy,” date it and sign it.

It is almost impossible to challenge such a dismissal, since it is assumed that the agreement is signed in good faith.

Reduction of a pensioner

When the administration of an enterprise decides to begin measures to reduce workers, the procedure for the administration of the company should be as follows:

- it is mandatory to notify workers who are being laid off. This must be done at least 2 months in advance;

- offer vacancies;

- prepare personnel documents;

- pay severance pay.

When laying off pensioners, you need to know that they have a priority right to remain at work, since they often have great skills and qualifications, which is a priority for remaining in their position.

Other reasons for dismissal of a pensioner

Reaching retirement age is not a reason to fire a worker. However, such an employee can be dismissed under Article 83 of the Labor Code of the Russian Federation, which describes the reasons for termination of an employment contract due to circumstances beyond the control of the parties.

You can also terminate your employment relationship with an employee of retirement age for all the reasons described in Article 81 of the Labor Code of the Russian Federation. Age is not a barrier to dismissal if the following conditions are met:

- the company ceases its business activities;

- the employee himself does not correspond to the position he occupies.

- he violated the internal routine;

- committed an illegal act at his workplace;

- other grounds prescribed in Art. 81 Labor Code of the Russian Federation.

If the worker is at fault, then the termination of the relationship must be properly formalized. If there is even the slightest mistake, the fired person will be able to be reinstated in the workplace through the court.

The procedure for terminating the contract is as follows:

- an internal investigation must be carried out;

- if a crime is committed at the workplace, the employee’s guilt must be proven;

- written explanations must be taken from the perpetrator;

- if necessary, remove him from performing labor functions;

- issue a dismissal order. In it, indicate the basis, according to the article of the Labor Code of the Russian Federation;

- The dismissed pensioner must be familiarized with the order. If he does not agree, he must still sign for acquaintance, but also indicate “disagree”;

- on the day of dismissal, pay the dismissed person in full;

- give him his work book and issue all the necessary documents. The work certificate is given against signature on receipt in the accounting journal.

You can challenge dismissal “under the article” in court.

Is it possible to fire an employee a year before retirement?

It is possible if the enterprise ceases its activities, as well as on other grounds specified in Articles 77, 78, 80, 81 and 83 of the Labor Code of the Russian Federation. But the employer must follow the entire procedure.

An employee of pre-retirement age can be dismissed for these reasons at any time. A year remaining until retirement is not protection from dismissal.

Is it possible to retire several times?

There is no clear answer regarding multiple dismissals “due to retirement”. Judicial practice shows conflicting opinions.

The first opinion is that a working person’s status changes to “pensioner”. This happens once in a lifetime, when you reach a certain age. Consequently, you can resign “due to retirement” only once.

Another opinion is that an employee who celebrated an anniversary and retired due to age is already a pensioner. Every time he quits, he “turns” into a pensioner and retires. Then he can get a job again and quit again. That is, “retire.” Therefore, you can terminate the employment relationship on this basis as many times as you like.

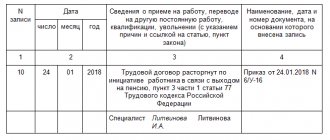

Entry in the work book

When the employment contract is terminated, the pensioner must be given his work book, which must contain a record of the termination of the employment relationship. It is done by a HR employee. Depending on the grounds for dismissal, he will indicate:

- own desire - 80 Labor Code of the Russian Federation;

- agreement of the parties - 78 Labor Code of the Russian Federation;

- employer's initiative – Art. 81 of the Labor Code of the Russian Federation indicating the point;

The entry made must be certified by the “live” seal of the employer. The employee must also sign. This means that he saw the recording and is familiar with it.

Payments and compensations

When a pensioner leaves work, the employer must pay him:

- salary for the period of time that he actually worked since the last payment;

- compensation for vacation if the person leaving did not have time to take it off;

- additional payments . For example, an employer has decided that it will pay extra for each retiree who resigns. This amount is not regulated by any law, but must be specified in local regulations.

A resigning person may be paid severance pay :

- upon liquidation of an enterprise or layoff - in the amount of one average monthly salary;

- if he refuses to transfer him to another position in connection with a medical opinion - in the amount of average earnings for 2 weeks;

- upon reinstatement of another employee who previously held this position - average earnings for 2 weeks;

- if you refuse to move to another area with the employer - in the amount of average earnings for 2 weeks;

When dismissal under Article 78 of the Labor Code of the Russian Federation, a different amount of severance pay may be specified in the agreement (it is negotiated and approved by the employee and the employer).

Does a working pensioner need to inform the Pension Fund that he has quit?

The undoubted disadvantage of this procedure is that for the months that have passed since the dismissal, during which the information was received by the Pension Fund and processed there, compensation will not be paid. Despite his actual status as an unemployed pensioner, a person is forced to receive reduced payments for 3-4 months. Working citizens who have already had a recalculation made after leaving work can be officially employed again, and their pension will not be reduced again (but will not be indexed in the future, during the entire period of work). Important! If information about the dismissal was not sent to the Pension Fund in due time, then the appropriate punishment will be applied to the employer.

Recalculation of pension after dismissal in 2020: procedure and timing

In most cases, SNILS + passport is a standard package for the Pension Fund in the event of a revision of the payment amount. A statement is also drawn up. If necessary, an authorized employee will independently make requests to the necessary authorities in order to collect the necessary information.

Readers are interested in whether there will be a downward recalculation if they get a job again. It all depends on the period that has passed since the previous dismissal. If less than 3 months have passed, the additional payment will simply be canceled due to new circumstances. If the bonus has already been assigned, then there is no need to worry about it being removed. Such a requirement is not provided for by law. Consequently, having increased their pension, a citizen can safely return to their previous or new place of work. There will be no reduction.

This is interesting: Mat Help From Mat Capital

Military pensioners for Russia and its armed forces

You will need:

- copy of the passport;

- an extract from the work record book confirming leaving work;

- SNILS;

- a statement containing the relevant notification.

Package allowed:

- bring in person;

- send by mail;

- transfer through a representative (you will need to issue a notarized power of attorney for this action).

What's new If the year before last the indexation amount was 11 percent, then this year it is only 4. However, the authorities are reassuring pensioners, pointing out that another indexation will probably be carried out in mid-autumn. Such actions of the government are largely due to the fact that in recent years, revenues to the state budget have decreased noticeably and a rather serious deficit of funds has developed there.

Is it necessary to write an application to the pension fund if a pensioner quits his job?

How does the Pension Fund receive information about dismissal? Those elderly citizens who stopped working between the beginning of October 2020 and the end of March 2016 are required to independently report that they no longer belong to the category of workers. Such a notification is sent to the Pension Fund office at the place of residence.

Otherwise, the citizen will continue to receive a pension in the future without taking into account all past indexations. If you are resigning now, you should know that, starting last April, pensioners are no longer required to personally inform the Pension Fund of the fact that they are leaving work.

Now the employer has been assigned to do this directly. The latter reports every month to the Pension Fund about all persons working for him.

Consequently, the employees of this organization now already know what the status of each individual pensioner is. Today, this is done by employers who submit monthly reports containing up-to-date information about each employee. Based on them, the Foundation monitors the fact of official employment of citizens of the Russian Federation. After dismissal, it is necessary to apply for a pension as a non-working citizen. How will the pension change after official dismissal? If a pensioner stops working, then the size of his pension will become larger, since for non-working citizens, annual indexation of cash payments is mandatory. For example, in 2020, due to indexation, pensions will increase by 4.1% from April 1. Typically, pension indexation is carried out in the fourth month after official dismissal. In practice, unpleasant situations occur when a pensioner became unemployed more than four months ago, but still receives the same pension as before.

If a pensioner quits his job, do I need to notify the pension fund?

Pensions » Questions and answers » If a pensioner quits his job, do I need to report it to the Pension Fund? If a pensioner quits his job, is it necessary to inform (submit a notification) to the Pension Fund? It depends on when exactly the pensioner stopped working. Previously, pensioners did not need to submit any notifications to the Pension Fund about their dismissal. But now the situation has changed. This is due to the abolition of indexation of pension payments for workers from 2020. Find out in this article whether pensions for working pensioners will be indexed from January 1. Rules for indexing the insurance pension from 2020 In 2016, the rules for indexing the insurance part of the pension changed. Now only non-working pensioners can count on an annual increase in their pension. The new rules also affected pensioners who have the status of individual entrepreneurs or lawyers. Details Author: Nikita Krutikov The Pension Fund reminds all working pensioners that, in accordance with changes in pension legislation, since 2016, the insurance pension and a fixed payment to it are paid without taking into account the February indexations of the pension coefficient by 4% in 2020 and 5.4% in 2020. In case of dismissal from work, a pensioner does not need to come to the Pension Fund Office to report this. From the 2nd quarter of 2020, monthly simplified reporting has been introduced for employers (here), and the fact of work will be determined by the Pension Fund automatically, based on this personalized reporting. After the Pension Fund Office receives and processes reports from which it follows that the pensioner has stopped working, he will begin to receive the amount of the insurance pension, taking into account the indexations that took place during his work.

Pensioners who retired in April and later no longer need to submit an application to the Pension Fund.

In accordance with Federal Law No. 385-FZ dated December 29, 2015, payment of insurance pensions to working pensioners from February 1, 2016 was made without taking into account indexation. Upon subsequent dismissal, pensioners could apply to the Pension Fund of Russia with an application and documents confirming the fact of dismissal, and from the month following the application, the payment of their pension was carried out taking into account indexation (4%). This was the case until April 1, 2020, while the transition period provided for by the said Law was in effect. Starting from April 1, 2020, the procedure for paying insurance pensions, taking into account indexation, has changed.

Now, if a pensioner is dismissed on April 1 or later, the indexation of the insurance pension will be carried out on the basis of data submitted by the employer to the Pension Fund of Russia. Information about work will be provided by the employer every month no later than the 10th day of the month following the reporting month.

Thus, a pensioner who resigned after March 31, 2016 is no longer required to inform the Pension Fund of Russia about his employment or dismissal. The decision to pay a pension, taking into account indexation, in this case is made by the Pension Fund of Russia in the month following the month the employer submits reports, and payment of the pension, taking into account indexation, will be made from the month following the month in which the decision was made, i.e. 2 months after the employer provides information.

For example: A citizen resigned on April 20, 2020. The employer will submit information for April in which this citizen is listed as employed by May 10.

But when submitting information in June for the reporting month of May, this citizen will no longer be listed as an employee.

Accordingly, the PFR authorities will make a decision on the payment of an insurance pension, taking into account indexation, in July 2020, and payment in the new amount will be made from August 1, 2020 (without additional payment for the past). If the dismissal occurs in May, the pension amount will be revised from September 1, 2016. If the recipient of the insurance pension is dismissed, for example, in September 2020, the new pension amount will be set accordingly from January 1.

From 2020, insurance pensions of working pensioners will not be indexed depending on inflation. This is due to changes in the pension legislation of the Russian Federation, which were recently approved by the State Duma.

“The upcoming indexation of insurance pensions in February 2020 will apply only to pensioners who did not work as of September 30, 2020,” explained Pension Fund No. 3 for Moscow and the Moscow region. — These dates are related to the periods for which the Pension Fund received employer reports.

If a pensioner stopped or will stop working between October 1, 2020 and March 31, 2020, he can notify the Pension Fund about this, and starting from the next month his pension will be indexed. The application and documents confirming dismissal are submitted from January 1 to May 31, 2020. You can submit documents in person to the Pension Fund client services at your place of residence, through an authorized representative, or you can send notarized documents by mail.

You can also submit applications to State Service Centers, which accept applications for the appointment and delivery of pensions. The application form and the rules for filling it out can be found on the PFR website in the “Life Situations” section: If a pensioner quits after March 31, he will not be required to confirm the termination of his work activity, this will be determined automatically.

Moreover, if a pensioner, after dismissal and indexation of the insurance pension, gets a job again, the amount of his insurance pension will not be reduced.

Insurance pensions for non-working pensioners will be increased by 4% in February 2020. And in April, state pension pensions will be indexed by 4% (these are social pensions for those who do not have a minimum length of service, as well as disability pensions), and the April indexation for these categories of pensioners will be carried out regardless of whether they work or not.

In August, as usual, the pensions of working pensioners will be automatically recalculated upward, based on the pension contributions transferred in 2020. If you find an error: select the text and press Ctrl+Enter Address of the page containing the error:* Incorrectly filled field Text containing an error* Incorrectly filled field Your browser* Internet Explorer 6.x Internet Explorer 7.x Internet Explorer 8.x Mozilla FireFox 1.x Mozilla FireFox 2.x Mozilla FireFox 3.x Opera Google Chrome Apple Safari 2.x Apple Safari 3.x Another browser Incorrect field filled in Correct text or suggestions for improvement* Incorrectly filled in Username field* Incorrectly filled in E-mail field user* Incorrectly filled field Message text* Incorrectly filled field IP address* Incorrectly filled field Security code * Enable Javascript for audio controls

If a working pensioner quits the organization, does he need to go with his work book to the pension fund or should the organization itself report the dismissal of the working pensioner to the pension fund?

Answer to the question: There is no need to specifically notify the Pension Fund that a retired employee has resigned.

The Pension Fund learns about the dismissal of a retired employee from the monthly reports of SZV-M. The pensioner himself also does not have to notify the Pension Fund of his dismissal. In accordance with Article 26.1 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions,” payment of insurance pension amounts, including taking into account the fixed payment to the insurance pension, to pensioners who carried out work and (or) other activities, is made without taking into account indexing.

The size of the insurance pension for working pensioners is indexed, but not paid.

Form SZV-M, which is submitted monthly by the employer, is the basis for payment of an insurance pension, taking into account indexation. Namely, if a pensioner works, then the amount of the insurance pension is indexed, but not paid. And if the pensioner does not work, then the insurance pension is paid taking into account indexation.

In the SZV-M form for the month when the employee has already been dismissed, you will not indicate the pensioner as working, therefore, from the next month, his pension will be paid taking into account indexation.

We recommend reading: Neighbors are flooding their apartments, how to deal with it

There is no need to submit additional documents for a dismissed pensioner. Details in the materials of the Personnel System: 1.

Situation: Is a working pensioner entitled to a pension? Yes, he is.

However, starting from 2020, the insurance pension and the fixed payment to it are paid without taking into account planned indexations.

This rule applies to pensioners working not only under labor contracts, but also under, including copyright agreements.

The same rule applies if the pensioner belongs to the category of the self-employed population, that is, is registered with the Pension Fund of the Russian Federation as an individual entrepreneur, notary, lawyer, etc.

p. This procedure is established in Article 26.1 of the Law of December 28, 2013 No. 400-FZ and Article 7 of the Law of December 29, 2020.

No. 385-FZ. If a pensioner stopped working under an employment or civil contract during the period from October 1, 2020 to March 31, 2020, then he can notify the Pension Fund of the Russian Federation about this. To do this, the pensioner must submit an application to the Pension Fund of the Russian Federation and submit the relevant documents.

This can be done until May 31, 2020. If the Pension Fund of the Russian Federation makes a positive decision after considering the application, the pensioner will be paid an insurance pension starting next month, taking into account indexation.

If the pensioner subsequently gets a job again under an employment or civil contract, the amount of his insurance pension will not be reduced. If a pensioner stopped working after March 31, 2020, then there is no need to submit an application to the Pension Fund of the Russian Federation.

Since April 2020, a special one has been introduced for employers, and the fact that pensioners are working is determined by the Pension Fund of the Russian Federation based on the data of these reports.

Similar explanations are given by specialists from the Pension Fund of the Russian Federation in information dated January 13, 2020. This point must be taken into account by a retired employee when making a decision to continue working in the organization.

Attention: issues of pension provision for employees fall within the competence of the Pension Fund of the Russian Federation, and not the employer. Therefore, for all questions and nuances related to the assignment and payment of pensions to employees, including the procedure for calculating insurance pensions, you should contact the territorial office of the Pension Fund of the Russian Federation, where specialists will be able to give comprehensive advice taking into account individual accruals and the characteristics of the employee’s length of service for the entire period his work activity.

From the answer “” Ivan Shklovets, Deputy Head of the Federal Service for Labor and Employment 09.19.2017 With respect and wishes for comfortable work, Anastasia Sinitsyna, HR System expert