Reduction of pensioners in 2020

If a pensioner feels that he cannot fulfill his work duties due to his advanced age, he has the right to write a letter of resignation. It is also submitted to the head of the organization. A record of dismissal under Art. must be made in the citizen’s work book. No. 77 - retirement.

- Within three days, all remaining wages are paid for the days worked before the layoff.

- Compensation for unused vacation.

- Severance pay in the amount of one month's salary.

- If, after being laid off, a citizen registers with the Employment Center, then the former employer pays him the average salary within 2 months.

What payments are made upon dismissal?

Above, we have already examined options for paying compensation to working pensioners during staff reductions, so we will analyze exactly how the dismissal procedure proceeds. The main thing you need to know is that a pensioner can officially retire only once. The corresponding entry is made in the work book, and only one such entry can be made. The departing employee must be accrued everything that is due to him: salary for days worked, vacation pay, sick leave and other payments, and also be given everything that is due under the employment contract: bonuses, bonuses, etc. for time worked, for achievements, etc.

Note that here you need to clearly understand the reason for the dismissal. If a person quits on his own, then he is usually not given bonus payments unless they are specified in the employment contract. But upon retirement, employees are often rewarded with cash and various thanks. In the personnel department, a corresponding entry is made in the work book, after which the person finally ends his work activity.

In some cases, company managers begin to cheat, saying that payments to the resigning person will be made later, because there is no money now, a difficult situation, lack of budget, etc. We strongly recommend not to believe such talk, since the law clearly states: all payments must be made on the same day official dismissal. If they don’t want to pay you, then you can contact the labor inspectorate or lawyers to sue your employer. In the vast majority of cases, the court takes the side of the employee, especially the pensioner, fining the employer and obliging him to make appropriate payments. At the same time, employers usually do not go to court and find the money immediately after the employee says that he will contact the labor inspectorate.

Kudrin's proposal to reduce pensioners

Whether Kudrin cares about pensioners or the Pension Fund budget is hard to say, because... one depends on the other. However, the stated goal of the CSR strategy is to transfer pensioners from the level of minimum security to a socially acceptable standard of living.

The latest news and calculations from the Central Social Research Center indicate a new figure of pensioners of 38.5 million people. Kudrin’s main justification is to reduce the number of pensioners without reducing the size of social benefits. In this way, the state will be able to provide a more acceptable level of income.

Is it now possible to fire a pensioner at the initiative of the employer?

What should an employer do? If a retired retired employee brings a certificate from the employment center, the benefit will have to be paid. However, having already paid the average salary for the third (fourth-sixth) month of unemployment, you can go to court to challenge the actions of the Central Employment Service employees and reimburse expenses.

A working pensioner has advantages when terminating an employment contract in comparison with younger Russians. The essence of the benefit is that an employee who has received an old-age or long-service pension has the right not to work for two weeks. Otherwise, labor standards do not contain exceptions or privileges. The dismissal of a working pensioner at the initiative of the employer or on other grounds is no different from the termination of an employment contract with any other citizen.

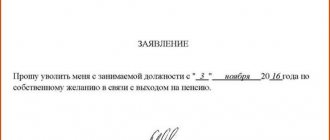

Dismissal of a pensioner at his own request

The easiest way to fire a pensioner is if he writes a statement of his own free will.

The legislation does not establish a time period between obtaining the right to receive a pension and the voluntary dismissal of a working pensioner. The employee can write an application immediately after receiving the right to pension payments or remain working as long as he considers possible.

The dismissal process in this case is no different from other employees, with one exception. We have already written about it above: if an employee receiving an old-age pension quits for this reason for the first time, he may not work the required two weeks.

First of all, a statement must be drawn up, which indicates:

- FULL NAME. employer;

- personal data and position of the resigning person;

- the text of the statement itself;

- date and signature.

After the manager has received the application, he can proceed to issue the order. It is drawn up according to the T-8 form approved by the State Statistics Committee.

The order states:

- name of the organization, OKPO code, order number, date of issue;

- the date of termination of the employment contract and the number under which it is listed in the internal archives of the organization;

- FULL NAME. the retiring pensioner and his position, personnel number;

- grounds for termination of an employment contract. To avoid an offense, this line indicates that the basis was the employee’s own desire to resign due to retirement;

- the employer’s position, his signature with a transcript and the signature with a transcript of the employee, confirming that he is familiar with the document.

After issuing the order, the manager must give the resigning employee a full payment, including mandatory payments and additional ones.

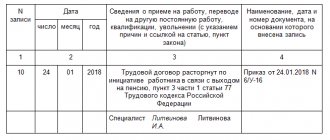

At the same time, a work book is drawn up, in which the date, reasons for dismissal, order number and date of issue are entered.

After completing all the necessary papers, they are handed over to the former employee. Who, in turn, must sign the journal for recording the movement of internal documents, confirming their receipt.

For financially responsible persons, everything is a little more complicated. The resignation letter must be submitted two weeks before the expected date of completion of work. An inventory must also be carried out and the accountable property must be transferred to the successor or employer.

When terminating an employment contract at his own request, the employer must pay:

- wages for actual time worked;

- compensation for unused vacation this year;

- additional payments at the discretion of the employer.

Dismissal of pensioners in 2020 at their own request or due to staff reduction

The second is an entry in the work book. It must fully correspond to the situation and duplicate verbatim the paragraph of the text of the Labor Code of the Russian Federation regulating the circumstances of the procedure. The person who resigned signs to the right of the mark in the document.

- The resigning person draws up an application addressed to the head of the company (in the case of a voluntary decision of the worker).

- An appropriate order is issued.

- Within two days, the person is notified of the release of the document, which he must subsequently sign.

- The resigning person is transferred the payments due.

- Relevant notes are made in the work book.

The amount of payments when a pensioner is laid off according to the Labor Code of the Russian Federation in 2020 - 2020

Above, we examined in detail what payments are due when a pensioner is laid off in 2020 - 2020. Such redundancy payments to pensioners necessarily include severance pay in the amount of average monthly earnings.

This is interesting: Federal Law on Enforcement Proceedings Breaking Doors

Is benefits paid when a pensioner is laid off? Yes, all payments and compensations due to an employee upon layoff are paid to the working pensioner in exactly the same manner as to all other employees whose employment contract (hereinafter referred to as TD) is terminated due to staff reduction.

Dismissal of a pensioner by agreement of the parties

In this case, termination of the employment contract occurs at the initiative of both parties. The procedure is completed in the same way as when leaving at your own request. But with one exception. In this case, withdrawal of the application is practically impossible. Withdrawal of the application and return to work must also occur by mutual agreement.

Sometimes a manager offers a working pensioner to switch to an easier job that corresponds to the health status of the subordinate. The transfer must be carried out only with the consent of the employee.

Dismissal of a pensioner due to staff reduction in 2020

Reaching retirement age and obtaining the right to stop working does not mean that the pensioner loses the opportunity to work and receive money for it. An elderly person has the right to retire, but he is not obliged to do so. In general, in Russia all citizens have the right to employment except representatives of some special categories of disabled people and minors.

Answer: Yes, these payments are mandatory both for pensioners laid off due to staff reduction and for young employees, but only if the pensioner registers with the Employment Center. If not, then he will receive severance pay only once, upon dismissal.

Features of pensioner reduction

Employees who have reached old age are the category of employees who, in the event of a reduction in staff, have the right to terminate the employment agreement at will before the expiration of the two-month period that must pass from notification of dismissal to the provision of an order to complete the hiring. In addition, in this situation, the employee is not required to work fourteen days, as prescribed by law.

What and in what amounts are paid to dismissed working pensioners in 2020 depends on their specialty, length of service and position.

Important! The amount of payments depends on the type of production. The employer can be civil, which means its activities are regulated by Russian labor laws, or special, whose work and financial support are controlled by departmental acts.

How does the dismissal of an employee of pre-retirement age occur?

3. The right to improve qualifications or undergo retraining. Moreover, the cost of the courses is paid by the employer. His expenses are reimbursed from the local budget. This program has been successfully implemented in several regions. Thanks to which people can improve their skills for free, learn new things in order to meet the requirements of the time.

takes payment on the last day of his work . He visits the accounting department, where he is paid his actual salary (the days worked by the employee are taken into account). Unused vacation period and other payments (due to everyone).

Dismissal of pensioners due to staff reduction - compensation 2020, payments, how and whether it can be reduced

Accordingly, the cuts will affect working pensioners who are not subject to this protectionist law. In the end, it is often beneficial for the employer to renew its staff with younger specialists who have modern knowledge and have youthful energy and work initiative.

The reduction of a pensioner occurs in the same manner as the reduction of an employee who has not reached retirement age. If the employer anticipates the layoff of an employee, then he is obliged to provide him with the opportunity to exercise the preemptive right to remain at work provided for in Article 179 of the Labor Code of the Russian Federation.

How a pensioner is laid off

Employment Law). Is it necessary to pay benefits for the third month after dismissal? According to the law, those dismissed due to staff reduction can retain their average monthly earnings for the third month from the date of dismissal (in the Far North also during the fourth to sixth months). The employment service has the right to make such a decision if three conditions are met at once (part two of Art.

178, 318 of the Labor Code of the Russian Federation): – the employee applied to the employment service within two weeks after dismissal (in the regions of the Far North - within one month); – the employment service was unable to employ the employee; – the circumstances preventing the employee’s employment are recognized as exceptional. Since the legislator does not define the term “exceptional cases” of unemployment, this leads to unexpected and sometimes curious conclusions (diagram on page ...).

Month Number of days worked Salary amount, rubles Bonuses, subsidies, allowances (rubles) Remuneration for length of service (rubles) March 2014 20 20.000 780.35 — April 2014 20 20.000 552.50 — May 2014 20 20.000 700.00 — June 201 4 15 15,000 — — July 2014 10 10,000 — — August 2014 20 20,000 1000 — September 2014 20 20.

000 1000 — October 2014 20 20.000 1000 — November 2014 20 20.000 — — December 2014 1 1000 — — January 2020 14 14.000 — — February 2020 20 20.000 1000 — Total 20 0 days 200,000 rubles 6032.85 rubles 0 Based on the table data, you can determine the average daily earnings in the past year: Severance pay is due to employee K.

We explained above: a working pensioner can be laid off from work in the same manner as other employees. This means that such a person will receive all payments due by law in the prescribed amount.

Compensation for working pensioners in the event of a reduction in staff also provides for a payment in the amount of the average monthly earnings for the second month after termination of the employment contract, but provided that the dismissed employee did not get a job within the second month after the reduction (i.e., the average monthly earnings for the period of employment are maintained).

A benefit for the period of employment is paid if an employee who was laid off due to redundancy registered with the employment service within 2 weeks (and for residents of the Far North and equivalent regions - 1 month), but was unable to find employment within two months from the date of termination TD.

To receive payment, the employee contacts the former employer after two months from the date of dismissal, presenting an identification document and work book without another entry about the new place of work.

He is not entitled to payment for the first month after the employee is laid off, since it was already included in the severance pay and paid on the day of dismissal.

Example

As a basis for calculations, we will take the example discussed above, when the average monthly salary of an employee was 3641.3 rubles.

Let’s assume that in the second month after the layoff, such an employee was unable to find a job and there were 22 working days in that month.

Then the amount of benefits for the period of employment will be: 3641.3 × 22 = 80,108.6 rubles.

Situations are possible when an employee finds a job within the second month after being laid off. In this case, he is also entitled to benefits for the period of employment, but not for the entire month, but only for the working days when he was still unemployed.

IMPORTANT! Neither severance pay when an employee is laid off, nor benefits for the period of employment are subject to income tax for individuals in a part not exceeding three times (and for residents of the Far North and equivalent areas - six times) the average monthly salary (Part 3 of Article 217 of the Tax Code). Code of the Russian Federation).

We suggest you read: Tax for barn, bathhouse and toilet – who will have to pay and who will be exempt

So, when a pensioner is dismissed due to staff reduction, compensation payments are still the same as when employees who are not pensioners are laid off.

What payments are provided by law when a pensioner is laid off? This:

- wages for the pay period;

- compensation for missed vacation;

- severance pay;

- benefits for the period of employment (in cases established by law).

Every citizen has the legal right to work, regardless of gender and age. This means that a retired worker can also work, perform duties, and receive wages, just like ordinary workers. Officials did not provide any special restrictions or exceptions for this category of citizens.

However, controversial situations arise. For example, the opinions of experts are divided on the question of what payments are due when a pensioner is laid off. Some believe that a pensioner should not receive severance pay for the third month. And the latter, on the contrary, interpret the current legislation in favor of the elderly. Let's figure out when and what payments the employer must pay when dismissing a pensioner due to redundancy.

Dismissal of a pensioner due to staff reduction in 2020

Increasing the age of working-age citizens for their retirement in old age is still not a reason for citizens to lose the right to work. All Russian citizens have this right, with the exception of some minors and disabled people.

This is interesting: Changes About the Retirement Age in 2020

In such a situation, an employee of retirement age has the right, in accordance with Article 261 of the Labor Code of the Russian Federation, to have a kind of immunity to terminate the employment relationship, because in accordance with the stipulated article, if there are small dependent children and there are no family members with independent earnings, the dismissal of an employee is prohibited.

Severance pay for layoffs for pensioners for 3 months

What payments are due to a laid-off pensioner? When reducing the number or staff of employees, the employer does not say goodbye to the employee on the last day of work, since labor legislation provides for certain payments even after several months after dismissal. And if everything is clear and understandable with ordinary workers, then what about retired workers, since they are already socially protected by the state by assigning them a pension?

These conclusions follow from a number of decisions of regional courts (the ruling of the Samara Regional Court dated 07.12.11 in case No. 33-6963, the Kirov Regional Court dated 01.31.12 in case No. 33-306, the Kostroma Regional Court dated 05.16.12 in case No. 33-702A and etc.). Dismissal of a pensioner due to staff reduction: payments, benefits So, what points will the court pay attention to and what must be avoided at all costs so as not to lose what is required by law?

Article 178 of the Labor Code of the Russian Federation establishes the conditions for maintaining average earnings for the third month: timely, within two weeks, contacting the employment service plus unemployment over the next three months. Failure to comply with these formal requirements, of course, deprives the former employee of the right to payment of average earnings for the third month.

The employer will be obliged at any time, based on the application and the employee, to provide him with amounts of legal assistance. If he refuses to do this, the pensioner can protect his rights by contacting the following organizations:

- trade union;

- labor inspection;

- the prosecutor's office;

- court.

Employees of the labor inspectorate and the prosecutor's office will check the legality of the pensioner's dismissal and oblige the employer to pay the debt.

Attention

In addition, if it is established that the procedure for dismissal and calculation of layoffs was violated, the enterprise or organization that made such an oversight will face significant fines and personnel changes. It is obvious that payments to a pensioner who is subject to layoffs are guaranteed at the legislative level.

In this article, I want to tell you about the mandatory payments received upon dismissal due to staff reduction, the timing of receiving compensation payments and the features of redundancy payments for pensioners. Contents of the article ○ Part 1. What benefits will an employee receive if there is a reduction in staff? ○ Part 2.

Deadlines for receiving mandatory payments. Calculation example.○ Part 3. Payments when laying off pensioners. Dismissal of an employee is a rather complicated procedure, especially when such dismissal occurs at the initiative of the employer.

First of all, the employer himself is interested in ensuring that the process of dismissing an employee is as painless as possible, and that the payments due to the employee comply with the requirements of the current legislation of the Russian Federation. What benefits will the employee receive if his staff is reduced? The Labor Code of the Russian Federation provides for mandatory payments that the employer must make in the event of a reduction in the organization's staff. Such payments include:

- First of all, this is the employee’s salary for the time actually worked (Article 140 of the Labor Code of the Russian Federation).

- If the vacation was not used by the employee being laid off, then in accordance with Art. 127 of the Labor Code of the Russian Federation, it is necessary to accrue compensation for unused vacation.

- Art. 178 of the Labor Code of the Russian Federation provides for the payment of severance pay, calculated in the amount of average earnings.

To carry out this simple event, all necessary conditions provided for by the current legislation of our state must also be met. This means that the initiator of the early termination of the employment agreement and all labor relations accompanying this agreement must be the employer, and not the employee who has been laid off.

The employee, in turn, is obliged to express in writing his agreement with this fact in the current situation. In a situation where the end of the notice period has not yet arrived, but the employee has already found a new job, he is obliged to inform his current superiors in writing about his intention to terminate the employment agreement.

If all of the above conditions are met, the employer has every right to early terminate all employment relationships with this employee.

Uniform application of these standards is an important task in providing employees with the same degree of legal protection in the event of adverse consequences upon dismissal. However, in relation to pensioners with whom the employment contract is terminated under clause 2, part 1, art. 81 of the Labor Code of the Russian Federation, there is no unity in judicial practice regarding the provision of severance pay.

In the Resolution of the Federal Antimonopoly Service of the Volga Region dated May 24, 2007 N A12-18844/06, satisfying the application of Volgograd Tool Plant CJSC, the cassation instance proceeded from the fact that the courts of the first (12/12/2006) and appellate (02/08/2007) instances came to a legitimate the conclusion that the existence of exceptional circumstances that could be taken into account when making a decision to pay at the expense of the Company’s funds the average monthly salary to a former employee of the Company for the third month from the date of dismissal was not proven, since citizen A.G. They are accrued during the last two months of work.

A pensioner dismissed due to layoff can apply for payment of his average monthly earnings for the third month after layoff if the following set of conditions is met (Part 2 of Article 178 of the Labor Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated March 15, 2006 No. 03-03-04/1/234) :

- such employee is registered with the employment service within 14 days from the date of dismissal;

- such an employee was unable to find a job within 3 months from the date of dismissal;

- there is a decision from the employment service to maintain the average monthly earnings for the third month.

We invite you to read: Which pensioners are exempt from paying land tax

Payment of old-age pensions to citizens does not cancel the validity of labor legislation in relation to such persons in terms of the possibility of maintaining their average monthly earnings, including for the third month after layoff in the presence of the above circumstances (ruling of the Krasnodar Regional Court dated September 27, 2012 in case No. 33 -19551/2012).

The opinion that paying an old-age pension to a citizen is a reason not to provide the pensioner with compensation for the third month after a layoff is not supported by the courts, because if the citizen is not recognized as unemployed (and a person receiving an old-age pension cannot be recognized as such, since he has a means of subsistence), this does not prevent the employment center from providing, at his request, a public service to find a suitable job (see the decision of the Central District Court of Sochi dated January 25, 2016 in case No. 2a-856/16).

To formulate a decision on maintaining a pensioner’s average monthly earnings for the third month, the employment service must assess the existence of exceptional circumstances that did not allow him to be employed. The fact that, if there were suitable vacancies, the pensioner refused them without objective reasons, will serve as a basis in court for annulment of the decision of the employment service to maintain benefits (see the previous example of a decision).

What payments are made when retirees are laid off from work in the Far North or equivalent areas? As a general rule, the same as for workers in other territories:

- wages for the period worked;

- compensation for missed vacation;

- severance pay.

However, the period for which the average monthly salary can be saved (for the period of employment) after termination of a trade union is somewhat different.

For citizens working in the Far North or equivalent areas, the average monthly salary is retained for a period of up to 3 months from the date of termination of the labor contract, including severance pay (Article 318 of the Labor Code of the Russian Federation).

In exceptional cases, the average monthly earnings are retained for such employees for the fourth, fifth or sixth months by decision of the employment service, subject to the following conditions:

- the employee contacted the employment service within a month from the date of dismissal;

- such an employee was not employed by the employment service.

These provisions of the Labor Code of the Russian Federation also apply to working pensioners (see letter of Rostrud dated February 11, 2010 No. 594-TZ).

IMPORTANT! The exercise of the right to maintain average monthly earnings for the fourth, fifth and sixth months from the date of dismissal is subject to the presence of an exceptional case to be established by the employment service. The absence of a list of exceptional cases in the law cannot serve as a basis for the employment service to make a decision to maintain the average monthly earnings for the specified periods, provided only that such an employee and the employment service itself comply with the established procedure for providing public services to assist in finding a suitable job (see decision Kuril District Court of the Sakhalin Region dated February 27, 2018 in case No. 2-19/2018).

If a laid-off employee has not found a new job within the third month after the layoff, then he is entitled to additional compensation (Article 178 of the Labor Code of the Russian Federation). However, the issue of pensioners has not been resolved to this day. What should an employer do if even legislators have not reached a consensus on the dispute over whether benefits are paid when a pensioner is laid off for the third month of unemployment?

Most officials are of the opinion that if a pensioner is laid off, additional compensation for the third month is not due. After all, a pensioner is a socially protected category of the population, and he is guaranteed payment of a pension (for old age, length of service and on other grounds). However, the opinion of officials will not prevent the pensioner from going to court and, possibly, obtaining payments in his favor.

There is a solution: the basis for assigning compensation for the third month of unemployment is the corresponding decision of the Employment Service. And if representatives of the Employment Service recognized the dismissed pensioner as unemployed and issued an official decision of the established form, then the money will have to be paid.

What will a pensioner get from being fired in 2020?

A rumor spread that quitting would be much more profitable than losing indexation. This is also incorrect. Economists say that today the benefit from receiving a stable salary is almost always higher than from purchasing indexation. It makes sense to leave a job only when the salary itself is very low, for example, when working part-time or in a low-skilled specialty.

Periodic changes in the rules for calculating and paying pensions give rise to a lot of rumors, speculation, and informational reasons for discussion in the media and social networks. One of the latest high-profile news was the supposedly upcoming reform, according to which all working people of the appropriate age will be deprived of any old-age payments.

Will there be a reduction in working pensioners in 2020 in Russia?

Therefore, we can expect that many pensioners will be laid off. If a pensioner has small but regular benefit payments, and in the event of a job loss, they will have a means of subsistence. Young workers, who are also at risk of being laid off, do not have this either.

Today, very serious changes are taking place in the field of education, which in the future will lead to staff reductions. The state is trying to reduce budget expenditures in a difficult economic situation. Today, many mid-level educational institutions and universities are undergoing complex reorganization. It is accompanied by salary delays or rate cuts.

Payments when a pensioner is laid off in 2020

The second is an entry in the work book. It must fully correspond to the situation and duplicate verbatim the paragraph of the text of the Labor Code of the Russian Federation regulating the occurrence of the procedure. The person who resigned signs to the right of the mark in the document.

Often, with the advent of old age, an employee experiences various health difficulties - he begins to get sick more often, his memory and general performance deteriorate. It is clear that it is more profitable for the employer to hire a younger and more hard-working person for this position.

On what grounds can a pensioner be dismissed?

All features of termination of a contract with employees are prescribed in the provisions of the labor legislation of the Russian Federation. The Labor Code does not provide for any exceptions to these rules for hired workers, regardless of their age. The only preference currently in force for working older people is that he does not have to work a 2-week period when leaving at his own request.

Among the legitimate grounds on which an employer can dismiss a retired employee, the Labor Code provides for the following:

- Complete liquidation of the employing company.

- Reduction of staff of the organization.

- Inconsistency with the position held.

- Change of owner of the company (applicable only for certain management positions).

- Repeated violations of labor discipline, failure to fulfill work obligations.

Often, with the advent of old age, an employee experiences various health difficulties - he begins to get sick more often, his memory and general performance deteriorate. It is clear that it is more profitable for the employer to hire a younger and more hard-working person for this position.

Based on the results of the certification, when the old employee does not meet the labor requirements, he can be offered a different position or the employment contract with him can be terminated. In a situation where a working pensioner is not suitable to fulfill work obligations according to medical certificates, the employer must transfer him to an easier job.

If there are no such vacancies, the pensioner may be fired. When he is not satisfied with the new proposed job, he has the right to write a letter of resignation of his own free will.

Reduction of pensioners in 2020

Due to the increase in the retirement age, many are wondering whether there will be a massive reduction in pensioners after 2020. The reason for such assumptions is the fact that with the increase in retirement age to 65 and 60 years, the number of older workers will sharply increase. At the same time, the adopted legislation will not allow the employer to fire employees of pre-retirement age.

1. Within three days, all remaining wages are paid for the days worked before the layoff. 2. Compensation for unused vacation. 3. Severance pay in the amount of one month’s salary. 4. If, after being laid off, a citizen is registered with the Employment Center, then the former employer pays him the average salary within 2 months.

This is interesting: Travel benefits for pensioners in Tula

Redundancy payments in 2020 - benefits and compensation

The relationship between employee and employer is regulated by the Labor Code of the Russian Federation. Following the letter of the law, the employer is obliged to warn the citizen who is subject to layoff in writing about the early termination of the contract.

The notice is sent at least two months before the day of dismissal. The employee signs the order and the date of review.

The conditions for paying contributions from compensation are reflected in the second part of the Tax Code and Law No. 125-FZ (07/24/1998) on compulsory social insurance. The employer is allowed to provide additional financial support to employees during layoffs.

The criteria, methods and amount are fixed in internal corporate regulations, for example, in an employment contract.

What is required when an employee is laid off?

Redundancy payments should support the person until he finds a job. The employer transfers payment for time worked, compensation for unused vacation and severance pay.

During the period of searching for a vacancy, the dismissed person is paid an average monthly salary.

Wage

The employer is obliged to transfer the funds no later than the last day on which the employee is on the payroll. The amount is calculated in proportion to the time worked. If local regulations provide for bonuses, they are also paid.

Compensation for unused vacation

The employee receives compensation for legal rest, the days of which were not spent. During this period, up to the moment of dismissal, the employee subject to dismissal receives vacation pay. The final salary payment is made on the last day of rest.

Severance pay

According to labor law, the employer is obliged to pay severance pay in the event of a layoff. The amount of accrual cannot be less than the minimum wage (minimum wage). In 2020, this amount is 11,280 rubles.

Compensation is transferred even if the dismissed person has already found a new place of duty.

How is it calculated

The amount is determined by the formula VP = GZ / KD x NBR:

- VP - severance pay.

- ГЗ – salary for the last year. All accrued amounts are taken into account, with the exception of financial assistance and social payments.

- KD - the number of days actually worked over the last year. Sick leave and vacation are not taken into account.

- NWD – the number of working days in a conditional month after dismissal. For example: if the last shift falls on May 13, then the calculation will be made from May 14 to June 15.

Let's say an employee of an enterprise is fired due to staff reduction. The last working day is February 4, 2020. Salary for the period from February 2020 to January 2020 amounted to 350 thousand rubles.

200 days worked. Average daily income 1,750 rub. (350,000 / 200 = 1,750). From February 5 to March 4, the calendar provides 20 working days. The severance pay in connection with the reduction will be 35 thousand rubles.

(1,750 x 20 = 35,000).

While looking for a job

If a citizen does not have time to find a new job within two months, the former employer pays him the average salary. To calculate compensation, you must provide a work record. The document confirms the fact of unemployment. If a dismissed employee does not find a job within a month, the ex-employer pays him assistance only for the period of forced idleness.

An unemployed person can also claim a third payment from his old employer if he registers with the labor exchange within two weeks after his dismissal.

You can count on money if the state employment service was unable to find a job that meets your qualifications. The calculation is based on average daily earnings. The amount is multiplied by the number of working days of the month for which redundancy compensation is due.

In case of early dismissal

The parties have the right to agree on an earlier date of dismissal. Additional compensation is paid for this. Its amount is calculated by multiplying the average daily earnings by the number of days between the actual date of termination of the employment contract and the time of dismissal specified in the notice.

Salaries for this time are no longer assigned.

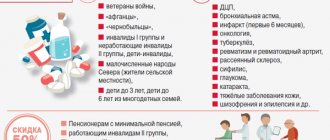

Features for certain categories of citizens

Cannot be shortened:

- Single parents who are raising a child under 14 years of age or a disabled minor.

- Parents with many children.

- Women in position.

- The sole breadwinner of a disabled child or a child under 3 years old, if the second parent does not work.

Pensioners

Citizens of retirement age are dismissed according to the standard procedure. There are no benefits for them. When calculating the amount of benefits, the average salary is taken into account. Pensioners included in the list do not receive the third payment.

Persons of pre-retirement age

There are no legislatively established preferences for pre-retirees. When staffing is reduced, they receive standard payments. At the initiative of the employer, benefits may be established for such employees. The possibility of providing support is fixed in local regulations.

Part-timers

Severance pay is awarded to everyone without exception. Part-time workers are not paid the average salary in the second and third months. You can get it by resigning from your main job before being laid off. The employee confirms this fact with an entry in the work book.

Northerners and residents of territories equated to the RKS

Employees who live and work in difficult climatic conditions receive severance pay in addition to the average earnings for the second and third months automatically.

If a dismissed person joins the labor exchange within 30 calendar days from the date of dismissal, he will receive an additional compensation payment for the fourth, fifth and sixth months.

Registration procedure

Official redundancy procedure:

An order is issued for the enterprise.

Two months before dismissal, the employer sends a notice of contract termination to the employees included in the list.

An employee is offered a transfer to a vacant position in the organization, but he has the right to refuse.

The employer informs the Employment Center about the event.

The accounting department makes the final calculation.

No later than the last day of work, severance pay, salary and vacation compensation are transferred. If payments are not received, the dismissed person has the right to file a claim in court. In this case, the tenant will be charged all due money and penalties for each day of delay.

A person subject to personnel changes is given a copy of the order, a completed work book and a salary certificate.

Source: sovets24.ru/2468-vyiplatyi-pri-sokraschenii-v-2019-godu.html

Source: https://kampensioner.ru/vyplaty-pri-sokrashhenii-v-2019-godu-posobiya-i-kompensacii/

Is it possible to lay off a retired employee?

Like all other employees, pensioners have the right to severance pay upon dismissal due to reduction in number or staff in the amount of average monthly earnings (Article 178 of the Labor Code). They also retain their average monthly earnings for the period of employment, but not more than two months from the date of dismissal (including severance pay).

Whether a pensioner has the right to average earnings for the third month is a controversial issue. Article 178 of the Labor Code does not establish any exceptions for pensioners. But this payment is targeted - to protect unemployed citizens. But according to the law, pensioners with an old-age pension are not classified as unemployed.

Why should payments to pensioners in case of staff reduction be made in full?

You can pay older employees who have been laid off more than twice their average salary.

But only if the increased amounts of compensation are fixed in an employment or collective agreement (part four of article 178

Labor Code of the Russian Federation) Can a pensioner register with an employment center? The state guarantees every citizen free assistance in selecting a suitable job and finding employment (Article 9, Article 12 of the Employment Law). This means that not only the unemployed, but also people who are in an employment relationship and want to change jobs, students, students, and pensioners can contact the Employment Centers and register as job seekers (clause

2 Rules for registering citizens for the purpose of finding a suitable job, approved by Decree of the Government of the Russian Federation of September 7, 2012 No. 891).

Human Resources Department of a Budgetary Institution”, 2009, No. 4 What payments are due to a laid-off pensioner? When reducing the number or staff of employees, the employer does not say goodbye to the employee on the last day of work, since labor legislation provides for certain payments even after several months after dismissal.

And if everything is clear and understandable with ordinary workers, then what about retired workers, since they are already socially protected by the state by assigning them a pension? In this regard, questions arise: is the average salary of pensioners retained during the third month after dismissal, what cases are considered exceptional for maintaining earnings? By virtue of Art.

And the employer will make payments to a laid-off pensioner for no more than two months. This position is also supported by the courts. For example, the FAS Central Election Commission in its Resolution dated 04/02/2007 in case No. A54-2967/2006 noted that the provisions of Part.

2 tbsp. 178 of the Labor Code of the Russian Federation do not apply to citizens who are paid a pension, since the payment specified in it is a measure of social protection for the unemployed, to which pensioners do not belong. The FAS PO came to the same conclusion in its Resolution dated 04/04/2006 in case No. A12-14930/05-C15, Arbitration Court of the city.

Moscow in the Decision of November 2, 2006 in case No. A40-53171/06-145-310. Others believe that guarantees for dismissal due to a reduction in the number or staff of an organization also apply to persons who are paid an old-age pension. Link to clause 3 of Art. 3 of Law N 1032-1 cannot be taken into account, since Art.

There is a lot of discussion among lawyers (both practitioners and theorists) on the topic of paying severance pay to retirees. Some believe that labor legislation applies to all workers, regardless of whether they are pensioners, while others believe that this rule does not apply to retired workers, since they do not need employment and receive a pension from the state, that is, they have income.

Upon termination of the employment contract under clause 2, part 1, art. 81 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), in connection with a reduction in staff, a dismissed employee is paid severance pay in the amount of average monthly earnings, and he also retains the average monthly earnings for the period of employment, but not more than two months from the date of dismissal (including severance benefits) (Part 1 of Article 178 of the Labor Code of the Russian Federation).

The same position was previously expressed by specialists from Rostrud in letters dated September 13, 2005 No. 1539-6-2 and dated December 28, 2005 No. 2191-6-2). The Krasnodar Regional Court came to the conclusion that only two facts have legal significance (appeal ruling dated October 11, 2012 No.

Info

Severance pay in case of layoff. calculation of payments after reduction. This increases the chances that the court will satisfy the requirement to pay average earnings for the third month, because:

- the employee’s right to receive payment is based on the decision of the authorized body;

- this decision has entered into legal force;

- the decision was not challenged in the prescribed manner;

in the absence of a judicial act recognizing the decision of the employment center as unlawful, it is subject to execution.

But suddenly, for example, an economic crisis struck, unemployment came, enterprises went bankrupt and there was a massive layoff of workers. You have a retired employee who is on the redundancy list.

Severance pay when a pensioner is laid off Absolutely all citizens, resigning from work by agreement of the parties, as well as simply on their own initiative, have the legal right to mandatory receipt of severance pay. But the size of this payment depends solely on the reason why the person leaves his job.

But in any case, the organization will incur some expenses. That is why it is not at all surprising that enterprise management is trying to save money in any way, looking for any opportunity not to count on the resigning employee according to all the rules.

Important

On the last working day, he will receive copies of the documents he needs, a completed employment form, as well as the amount of salary, severance pay and compensation in connection with dismissal. Deadlines The last working day is the date of full settlement with the working pensioner.

But the employer can also pay the amounts of compensation and benefits before the actual settlement date specified in the layoff order. To do this, it is enough to reach mutual agreement with the working pensioner. In this case, the amount of compensation will not be reduced by the number of days that remained before the actual termination of the employment relationship.

They are accrued during the last two months of work.

- Payments depending on the decision of the employment service (paid, if accrued, within the third month).

- A pensioner cannot be unemployed. Therefore, based on all the information above, we can state the fact that people who have reached retirement age in our country are fired in exactly the same manner and subject to the same rules as when dismissing workers of other age categories. In turn, the employment service considered it necessary to explain to citizens that it does not have any reasons for refusing help to pensioners in finding a job, but the payment of benefits to this category of applicants will not be made.

To be specific, compensation for a pensioner laid off due to redundancy must be equal to the amount of his average salary. It is calculated in proportion to the amount of time remaining until the end of the warning period. It is a mistake to believe that when staffing is reduced, dismissed pensioners are paid only severance pay.

- Severance pay. It is paid on the last working day.

- Payments during the period of searching for a new job.

- Severance pay in the amount of average earnings (Part 1 of Article 178 of the Labor Code of the Russian Federation).

- The pensioner retains his average earnings for the period of employment.

We suggest you read: Overpayment of land tax, how to offset it

Let's dwell on this in a little more detail. In accordance with Part 1 of Art. 178 of the Labor Code of the Russian Federation, a dismissed employee retains the average monthly salary for the period of employment, but not more than two months from the date of dismissal.

Part 2 Art. 178 of the Labor Code of the Russian Federation gives the right to employment service bodies to maintain the average earnings of a dismissed employee for the third month from the date of dismissal. A decision on this is made in exceptional cases and provided that the dismissed employee contacted the employment service within two weeks after the dismissal and was not employed.

Part 1 art. 318 of the Labor Code of the Russian Federation establishes an extended period for maintaining average earnings for a dismissed employee in the regions of the Far North and equivalent areas. The specified period is three months from the date of dismissal.

Part 2 Art. 318 of the Labor Code of the Russian Federation establishes that in exceptional cases, the average monthly salary is maintained during the fourth, fifth and sixth months from the date of dismissal. The decision is made by the employment service body, provided that within a month after dismissal the employee applied to this body and was not employed by it.

It is the payments of average monthly earnings during the period of employment, which are made at the expense of the employer, that often become a stumbling block. Conflicts arise both between a former employee and an employer, and between an employer and an employment service agency.

- Maintaining average earnings for a period of two (three) months.

If we return to the norms of labor legislation, it is obvious that all payments are due to an employee dismissed due to staff reduction. It is the dismissed employee who retains his average earnings; the legislation does not establish any additional conditions.

- Maintaining average earnings during the third month (for the northern regions - the fourth, fifth and sixth months).

If a pensioner applies to the employment service, he will not be recognized as unemployed; this is determined by the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population in the Russian Federation.” But they will register you as a citizen looking for work and provide assistance in finding employment.

Thus, the payment of average earnings is carried out by decision of the employment service body, subject to the following conditions:

- The dismissed employee contacted the employment service within the established time frame (see above - two weeks and a month for northerners).

- The dismissed employee is not employed.

Summarizing. A dismissed pensioner has the right to receive payments related to staff reduction in full.

Reduction of an employee of pre-retirement age

All items will be introduced only from January 1, 2020. It is worth considering that an additional system of benefits for persons of pre-retirement age will be developed, based on the fact that they will become a category with state guarantees.

- The experience must be at least 20 and 25 years for women and men. It does not matter whether there was an interruption of service or not;

- It is possible to retire only with two years remaining. If there is a period of two years and several days, then the procedure is impossible;

- You must obtain permission from the employment center. This is only possible if you have unemployed status. You are also required to take an active role in your job search. An important point is timely registration, which is carried out within two weeks after the date of layoff, including early layoff;

- You will need to provide all documents to the pension department at the place of registration.

Early retirement: what will change from January 1, 2020 under the new law

The size of the pension is directly affected by the individual pension coefficient (IPC). When transferring contributions to the Pension Fund, the amount of money is converted into points according to a special formula, which, upon retirement, are summed up and then multiplied by the cost of the IPC (the value is indexed annually).

Women with at least 37 years of experience and men with at least 42 years of experience will be able to retire two years earlier than the generally established retirement age. At the same time, women will be able to retire no earlier than 55 years of age, and men – no earlier than 60 years of age. Thus, in order to achieve early retirement, you need to start working at the age of 18 and have continuous official employment.

10 Jun 2020 lawurist7 210

Share this post

- Related Posts

- Benefits for Veterans 90 Years Old

- Benefit on Intercity Bus for Pensioners After 60 Years

- What is the length of service for a labor veteran in Astrakhan

- Shock Absorption Group Furniture Stapler 2019