As always, we will try to answer the question “Retirement of Women Civil Servants Born in 1964.” You can also consult with lawyers for free online directly on the website without leaving your home.

The new age limit for senior executives has risen to 70 in 2020. A bonus for length of service in such a situation will rarely be established. It is rare that an official of this level has worked for less than a quarter of a century, and this gives the maximum percentage of additional charges.

- accrual statement;

- passport;

- TIN;

- employment history;

- a certificate indicating the income received by the State Civil Service over the last 12 months;

- a copy of the order on the dismissal of the State Civil Service from the position being replaced;

- those liable for military service hand over a military ID;

- a certificate listing all occupied State Civil Service positions indicating the periods of replacement;

- certificate of registration in the country and the composition of family members;

- a certificate indicating the absence of other benefits and additional payments.

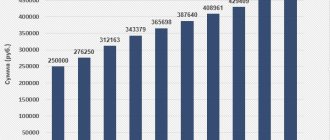

Estimated increase in the length of service of civil servants

Citizens of the country who are employed by government agencies perform their functional duties and are accepted into the workforce through a competitive process. Officially, this is called “filling a position in the state civil service” (GCS). Like all residents of the country, they have the right to retire in old age for a well-deserved rest by applying for a State Civil Service pension.

It is important to emphasize that changes in the retirement age will not affect disabled people, large families and workers in hazardous industries. But for the “northerners” they initially wanted to raise the retirement age, albeit to a smaller extent, but they changed their minds. The rules for them will not change.

Reasons for innovation

Every year in Russia the number of disabled people who require financial support increases. Therefore, the reason for the reform was the deficit of the Russian Pension Fund. Despite the fact that he receives subsidies from the budget, he is not able to provide for everyone in need.

It is expected that by shifting the age limits it will be possible to adapt the budget and increase the amount of indexation of insurance payments. Due to this, non-working pensioners will be able to receive 1000 rubles monthly. as a bonus.

For the average pensioner this is a significant amount. But how much would he receive without annual indexation if he retired under the old law? If you take the average payments within 12 thousand rubles, multiply by 12 months, and then by 5 years, the result is 780 thousand rubles. This is the amount that everyone lost due to the reform.

It became necessary for several reasons:

- increase in life expectancy;

- increasing comfort and standard of living;

- improving working conditions.

According to Rosstat, at the end of 2020 the number of workers was 83 million, and there were about 43 million pensioners. That is, the ratio between them was 1:1.9. Experts were confident that if this situation continues, by 2032, employed citizens and those retired will level off. This means that there will not be enough money to pay current pensions.

Updated retirement deadline in Russia

At what age do men and women retire in Russia now? By 2029, men will end their working career at 65, women at 60. Initially, the State Duma proposed adopting a more stringent law in relation to the latter. The issue of establishing the retirement age for women at 63 was raised.

To implement the reform on retirement by 60 and 65 years for women and men, respectively, a period of 2020-2028 has been established. Upon completion, the number of citizens who apply for state benefits based on age will significantly decrease.

The essence of the transition period is to annually add 12 months to the retirement age. In women born in 1964-1965. there are advantages for better adaptation - they begin to receive the required payments six months earlier. A well-deserved rest for this category begins at 55.5 years of age. A similar decree was approved for men born from 1959 to 1960 inclusive. When should a man in 1960 get ready to retire? In 2021

You can clearly evaluate the characteristics of women’s retirement in the table

| Year and month of birth | Release time (year) |

| 1964 January to June | 2020 |

| 1964 July to December | 2020 |

| 1965 January to June | 2021 |

| 1965 July to December | 2022 |

| 1966 | 2024 |

| 1967 | 2026 |

| 1968 | 2028 |

Gradual transition to a well-deserved retirement for male citizens

| Year and month of birth | Year of retirement (year) |

| 1959 | 2020 |

| 1960 January to June | 2021 |

| 1960 July to December | 2022 |

| 1961 | 2024 |

| 1962 | 2026 |

| 1963 | 2028 |

Calculation of old age pension for those born in 1964

When applying for a pension, you should collect all documents confirming your work experience, especially those that took place in the former Soviet republics. After all, the Pension Fund does not have a single database that includes the length of service of all citizens before the collapse of the USSR. It is very important to confirm your entire work experience, because it affects the size of your pension.

We recommend reading: Purchasing Diploma Products in 2020

Year of birth 1964, how will the pension be calculated?

PC2 on the date of pension assignment = =158343.12*1.307*1.177*1.114*1.127*1.16*1.204*1.269*1.1427*1.088*1.07= 721026.71 After calculating PC2, we determine the amount of valorization (SV): The applicant had until 01/01/1991. 14 years of experience have been developed, respectively, the percentage of valorization is 24 (14% for experience before 1991 + 10% for experience before 2002) 721026.71 * 0.24 (24%) = 173046.41 The employer transferred the amount of insurance premiums for the insured person , starting from 01/01/2002, in the amount of 185,000 rubles (PC1). Let's calculate the estimated pension capital on the date of pension assignment (PC): PC=PC1+PC2+SV=185000+721026.71+173046.41=1079073.12 As a result, the size of the insurance part (IP) will be equal to the sum of the fixed base size of the insurance part of the labor old-age pension (B), established on the date of assignment of the pension, and estimated pension capital (as of the date of assignment of the pension (PC), divided by the period of payment of the pension (T) (SC = PC/T+B) B - established by the Government of the Russian Federation according to as of 02/01/2020 is equal to 3170.48. SP = PC/T+B = 1079073.12/216+3170.48 = 8166.19 Thus, on the date of assignment of the pension, its amount was 8166 rubles 19 kopecks. Subsequently calculated the size of the pension will be constantly indexed taking into account rising prices in accordance with regulations of the Government of the Russian Federation.

Thus, over the next 5 years for men and 8 years for women there will be a so-called “transition period”, during which the period of working capacity will gradually increase in increments of “1 year per year”, and starting from 2023 and 2026 for them the values stipulated by the bill will be established - 63 and 65 years.

Requirements for assigning material content

For citizens who have completed their working career due to age, maintenance is calculated based on certain indicators of the insurance period and the individual pension coefficient.

Now these indicators are set at 10 years of experience and an IPC of 16.2 points. These numbers began to increase in 2020 and continue to increase annually. By 2025, it is planned to set a minimum mark of 30 points. A similar calculation is made for men born in 1959.

| Year and month of birth | Experience (years) | Points |

| 1964 January to June | 10 | 16,2 |

| 1964 July to December | 11 | 18,6 |

| 1965 January to June | 12 | 21 |

| 1865 July to December | 13 | 23,4 |

| 1966 | 15 | 28,2 |

| 1967 | 15 | 30 |

| 1968 | 15 | 30 |

Retirement age is the time when it is time to retire and receive monthly compensation from the state for regular payment of taxes to the budget. But often retirees have to continue working because there is not enough money to live on.

The new law allows you to enjoy benefits and receive a well-deserved salary. State Duma deputies wanted to prohibit pensioners from working so that the state would not incur additional costs. But, fortunately, the project failed. An additional advantage is the monthly payment of insurance premiums. After all, the coefficient and number of points increase every year.

The insurance period includes such periods as:

- labor activity during which insurance premiums were paid;

- parental leave for a total of not exceeding 6 years;

- caring for a child with a disability, a disabled person of group 1, or a relative who has reached 80 years of age;

- period of military service;

- other periods that are prescribed in Article 12 of Law No. 400-FZ.

Important! To receive an old-age insurance pension, your work experience must be at least 15 years. If the length of service or accumulated points is not enough, then you can forget about the insurance pension. In return, the state will provide a standard social service.

Often you lack a certain number of points or are a couple of years short of your insurance pension. In this case, the authorities have provided a backup option: after filling out the application, everyone can purchase the missing length of service and points at their own expense from the pension fund.

Formula for determining the insurance part

Taking into account the above criteria and relying on the provisions of Law No. 400-FZ (December 28, 2013), the insurance pension formula for women born in 1964 can be expressed as follows:

RSP = FV + SPB × KPIK, where:

- RSP – amount of insurance pension;

- FV is a fixed (basic) component, the size of which for 2019 is set at 4,982.90 rubles;

- SPB - the cost of a pension point (in 2020 - 81.49 rubles)

Please note that in addition to the insurance pension, women born in 1964 can also receive a funded pension, but only if it is formed. The size of the payment depends on several factors:

- the amount of contributions to be deducted;

- the number of years during which contributions were made;

- in which fund the savings were placed (each company has its own interest rates).

- Recalculation of pension payments for January 2020

- Additional compensation due upon dismissal

- Additional payment to pensions for flight crews of civil aviation vessels

What factors influence the value of the IPC?

During their working career, women receive a salary, based on the amount of which the employer pays insurance contributions to the Pension Fund. Subsequently, they are converted into pension points, the number of which directly affects the size of the pension payment. For different periods of employment, the IPC is determined taking into account a number of features:

| Calculation time periods | Criteria taken into account when calculating | Peculiarities |

| Until 2002 |

| Due to the fact that the Pension Fund does not have enough information about the length of service and accruals made, the IPC may be reflected erroneously in each individual case. To avoid this, it is recommended to provide all possible evidence of employment at this time and confirm the amount of salary received. |

| 2002–2014 | Funds accumulated in accounts are converted into IPC using a special formula | You can calculate the number of IPCs yourself by using the calculator on the Pension Fund website |

| Since 2015 | Determined by the amount of insurance premiums | Calculation is carried out for each year worked |

| Other periods | The IPC is stipulated by law depending on the reason for lack of employment | The periods during which the woman did not work are taken into account. This includes:

|

The number of pension points can be calculated on the Pension Fund website, using a special calculator, or using the following formula:

IPC = Amount of insurance contributions of a citizen for a specific year / Standard amount of contributions for an insurance pension × 10

What is pre-retirement status?

For the pre-retirement category of citizens, the state provided a number of benefits and guarantees. These benefits can only be used 5 years before retirement. The calculations use the currently valid requirements. For example: in 2020, women born in 1968 received benefits and will retire in 2028. Since the rule for possible retirement at 56 years of age is currently in effect, the pre-retirement age is considered 51 years.

Benefits provided by the state:

- free travel on public transport;

- benefits for medicines and medical care;

- exemption from land and housing taxes;

- discounts on utility bills and current repairs;

- annual free medical examination;

- increased unemployment benefits.

Also, additional guarantees have recently been introduced in the form of protection against unreasonable refusal of employment and dismissal of citizens of pre-retirement age.

Question:

How can a citizen find out if he falls under the preferential category of pre-retirement people?

Answer:

In connection with retirement in a new way, the Pension Fund has created a server that stores data on Russian citizens who fall under the preferential category of pre-retirees. Information in electronic form is sent to the Unified Social Security System and transmitted online to employers. A certificate of benefits provided can be obtained from local branches of the fund or printed from your personal account.

Calculate pension Online

Pension consultant > Calculate pension Online

Important!

- The calculations presented are for informational purposes only and reflect the approximate value of your future pension. To obtain a more accurate calculation of the pension amount, you must contact the territorial office of the Pension Fund.

- The values used in pension calculations are presented in amounts taking into account 2020 indexation. The current values of the IPC, fixed payment and other coefficients are valid during 2020.

- The calculator will be equally useful for both those retiring this year and citizens who have just started working.

- When calculating the pension amount, the conditional data entered by you will be used.

- If you need to calculate the GIPC, use the separate calculator presented below.

Retirement calculator for those retiring in 2020

Amount of insurance pension (SP)*

: Your work experience is less than 9 years The number of accumulated PCs is less than 13.8 Your work experience is less than 9 years and the number of pension savings PC is less than 13.8: You are entitled to a minimum pension: 8703 rubles

Number of individual pension coefficients (PC)

:

Clear and recalculate

* Your pension calculations are approximate. To obtain more accurate results, we recommend contacting the Pension Fund of the Russian Federation. When calculating the conditional amount of the insurance pension, the following indicators for 2020 are used: Fixed payment - 5,334 rubles; The cost of 1 pension coefficient is 87.24 rubles;

The maximum salary before personal income tax, subject to insurance contributions, is 85,083 rubles per month.

Calculation of insurance pension in 2020

The insurance pension includes payments, the formation of which is based on insurance contributions for the employee. This area is regulated by Federal Law-400 “On Insurance Pensions” .

There are three types of this payment:

- By old age . Issued upon reaching the age of retirement;

- Due to disability . Requires a disability as determined by the ITU;

- Due to the loss of a breadwinner . Addressees are children under 18 or 23 years of age (when studying full-time), spouses and parents of retirement age or disability, that is, disabled citizens left without care.

An important condition for calculating such a pension is the length of service during which contributions were made to the Pension Fund. In 2020, the threshold for obtaining insurance coverage remains at 10 years. The figure will increase until 2025, when it will be 15 years.

Calculating a pension using a pension fund calculator: how is the calculation done online?

The pension calculator uses the following formula for calculation:

Attention! If you have any questions, you can consult with a lawyer on social issues for free by phone: +7 in Moscow, St. Petersburg, +7 throughout Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

IPC * SPK + FV,

wherein:

calculate your pension using a pension calculator in 2019 by substituting the number of points into the equation:

Insurance pension = IPK * 87.24 + 5334.19

The number of accumulated beams can be found out by contacting the Pension Fund.

At the same time, there are several situations when the pension amount can increase significantly and is calculated using the formula:

IPC * SPK * K + FV * K

where K is the increasing coefficient. It works when:

- Residence of a pensioner in the Far North;

- If you have northern work experience in the amount necessary to apply increasing factors to the payment.

The increased amount of the fixed payment is addressed to:

- Persons with group 1 disabilities;

- Persons who are 80 years of age or older;

- For pensioners who support disabled relatives;

- In case of loss of both parents when paying for the loss of a breadwinner.

An increase in pension is also possible in a situation where access to it is delayed. Points continue to accumulate, and bonus rates for deferred payment also come into force.

Pension indexation in 2020 - latest news and changes in calculation.

Calculation of experience

The Federal Law “On Insurance Pensions” refers to the insurance period as all periods when insurance premiums were paid . That is, periods of official work with contributions to the Pension Fund. At the same time, the insurance period also implies other employment:

- Service in the armed forces;

- Time spent on sick leave;

- Parental leave until the child turns one and a half years old. In total, it is allowed to include in the length of service no more than 6 years spent on these vacations;

- Time without work, when a citizen was registered and received benefits as unemployed;

- Participation in the work of the society, which was paid for;

- Time spent moving on the initiative of the Employment Center for employment;

- Time of imprisonment in a situation where the innocence of the prisoner will later be proven;

- The period when care was provided for persons over 80 years of age, persons with group 1 disabilities;

- For military wives up to 5 years when living in areas where there is no opportunity to work;

- For spouses of consular officers and diplomats – time spent abroad.

In addition, there is the concept of special experience - time spent working in special climatic zones, in conditions of difficult, dangerous or harmful work. This length of service entitles you to privileges in the payment of a pension.

Calculation example for a pensioner retiring in 2019

Let's look at how future pensions are calculated based on specific examples.

Konstantin Semenovich reached retirement age in 2020, but due to continued work, he decided to postpone applying for a pension until 2020.

By 2020, the amount of points accumulated was 61; the pensioner does not have any bonus conditions. The exception is deferment of pension for 4 years. This gives the right to increase the fixed part by a factor of 1.27. Let's calculate using the formula:

IPC * SPK + FV * K = 61 * 87.24 rub. + 5334.19 * 1.27 = 5321.64 + 6774.42 = 12,096 rubles. 6 kop .

Note that with a deferment of 4 years, the size of the fixed part increased significantly, which generally affected the entire amount.

His friend, Yegor Pavlovich, will retire only in January 2019, when he turns 60. The man’s total IPC was 86 points. Place of residence is the city of Kem, where the regional coefficient is 1.4; no other pension supplements will be assigned. The calculation of the pension for Yegor Pavlovich is made using the same formula and will look like this:

86*87,24 +5334,19 * 1,4 = 7502,64 + 7467,86 = RUB 14,970 50 kopecks .

Konstantin Semenovich’s pension was also recalculated from January 1, taking into account annual indexation by 7.05%, and Yegor Pavlovich’s pension was accrued taking into account the past changes.

Calculation of GIPC in 2020

In 2020, the calculation of pensions switched to a new system, which was based on GIPC - individual pension coefficients . They have become a value that simultaneously reflects the length of service and the amount of contributions to the Pension Fund.

The cost of coefficients or points changes annually due to indexation by the state.

How to calculate pension points?

GIPC calculation calculator

GIPC size

:

Clear and recalculate

* Your pension calculations are approximate. To obtain more accurate results, we recommend contacting the Pension Fund of the Russian Federation. When calculating the conditional amount of the insurance pension, the following indicators for 2020 are used: Fixed payment - 5,334 rubles; The cost of 1 pension coefficient is 87.24 rubles;

The maximum salary before personal income tax, subject to insurance contributions, is 85,083 rubles per month.

How is GIPC calculated?

The number of IPCs increases every year. This is based on the employer transferring 10-16% of wages before income tax. The maximum taxable annual salary in 2018 is 1,021,000 rubles, in 2020 - 1,150,000 rubles. And the number of points eligible for admission this year is 9.13. By 2021, this figure will increase to 10.

There are restrictions on the formation of insurance payments that relate to the number of accumulated pension points. In 2020, the requirement is 16.2. By 2025, this value will gradually increase to 30.

The number of IPCs depends on:

- The size of the official salary from which pension contributions are made;

- From work experience.

The transfer of the pension system to a points system in 2020 caused the transfer to the IPC of earlier periods:

- Before 2002. The number of points awarded during the period will depend on:

- Duration of experience;

Average earnings for 5 years before 2002;

- Duration of experience until 1991.

- – 2014 The number of points is determined based on contributions for this period through employer transfers. This period is reflected in detail in personalized cards of citizens in the pension system;

- From 2020, the calculation is based on the formula:

It is important to note that the Pension Fund often does not have adequate information about the length of service and earnings of citizens during this period. You must provide them yourself.

IPC = (0.16 * minimum wage / 140 160) * 10,

where the minimum wage is the maximum annual salary that is taken into account for the calculation.

Points are accrued for periods included in the length of service, but not related to work activity. Data for accruing points for one year:

Activity Number of points per year

| Baby care |

|

| Military service | 1.8 |

| Caring for the elderly and disabled | 1.8 |

Example for calculating GIPC from January 1, 2020

The degree of dependence of the number of accumulated points on the amount of wages is clearly demonstrated by the example of calculating the GIPC based on data on various salaries.

- Ivan Kiselev from Yekaterinburg receives an average of 23 thousand rubles per month before tax. His annual earnings are 276 thousand rubles. Over the course of a year, Ivan will receive (0.16 * 276,000 / 140,160) * 10 = 3.15 points.

- Ivan’s university friend Fedor went to the capital and found a job with a salary of 59,000 rubles. A man’s annual earnings are 708 thousand rubles, and the sum of points for 2020 will be 8.08.

- And their friend Stanislav found a job that brings him 90,000 rubles a month. But most of it goes unofficially. Deductions come only from 16 thousand. That is, for the Pension Fund of Russia, a man’s earnings for the year will be 192 thousand rubles, and the number of points for the year will be only 2.19.

This example gives an understanding of the dependence of the number of IPCs on the amount of earnings and its formality.

Source: https://pensia-advisor.ru/rasschitat-pensiyu/

For whom the changes in the law are not provided?

The pension reform does not apply to representatives of certain professions and socially disadvantaged groups. These are citizens who have the right to retire earlier than the generally established period.

This rule applies to women employed in the following industries:

- textile industry with difficult working conditions;

- mechanical engineering, road repair services, as well as tractor drivers in the agricultural industry.

The new law has not changed the rules for the retirement of citizens involved in industries hazardous to health:

- miners;

- geologists;

- employees of air aviation, sailing personnel, mechanical engineering, railway transport;

- workers of chemical, mining, oil refineries;

- representatives of law enforcement agencies: the Ministry of Emergency Situations, the Ministry of Internal Affairs and the Federal Penitentiary Service system.

The full list of specialties is contained in the text of Federal Law-400, adopted on December 28. 2013 The main feature of preferential professions is the payment by the employer for each full-time unit of separate insurance, which is determined according to special tariffs. Working in one of the above professions gives a man the right to retire at age 60.

The increase in the retirement age will not affect mothers with 5 or more children, as well as women with 2 or more children if the latter have insurance coverage and work experience in the Far North.

Also, the following persons of both sexes do not fall under the new law:

- guardians and educators of disabled children;

- visually impaired people of group 1, as well as those injured during hostilities;

- residents of the Far North involved in reindeer husbandry, fishing, and hunting.

Circumstances of reducing the retirement age

Under the old law, pensions can be received by those categories of citizens who meet the following requirements:

- A long period of work - if a woman has 37 years of experience, then she goes on vacation at 55 years old. But the length of service includes only periods of working activity and paid sick leave. Leave for children over 6 years is not included in the length of service. If a man has 42 years of continuous work, then he is allowed to retire at the age of 60;

- Women with many children with 3 children can retire 3 years earlier, with 4 children - 4 years, but there are certain features: the insurance period must be at least 15 years, IPC - 30 points or more, children under 8 years of age;

- Lack of employment - persons for whom the employment center was unable to find a job retire 2 years earlier.

How to calculate future pension for those born in 1965

If you need to calculate a pension for those born before 1967, each condition must be considered separately. Old-age labor compensation is assigned to people who have reached the age of 60 years for men and 55 years for women. There are certain categories of citizens who can count on early retirement and a well-deserved rest. These include:

The second step is submitting documents to the Pension Fund of the Russian Federation.

After collecting at any time after reaching old age (for women the age should be 55, for men - 60 years or more), you must contact the Pension Fund of your region to assign and calculate the amount of payments. Then the calculation of payments for those born before 1967 begins from the date of submission of the application with a complete set of documents.

Rules for calculating pensions for citizens born before 1967

- passport (not for Russian citizens - residence permit);

- Insurance number of an individual personal account;

- confirmation of the main work experience, including that which occurred during the Soviet period, especially in the republics of the Soviet Union;

- documents confirming non-insurance periods (diploma, certificates and certificates indicating incapacity for work, life in a military camp, etc.).

For older citizens born before January 1, 1967, the pension is calculated in a different way: it consists of a mandatory fixed state payment and an insurance part, the calculation rules and the amount of which will depend on compliance with certain conditions.

Pension calculator

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment, taking into account all the generated pension rights and benefits provided for by pension legislation on the date of assignment of the pension.

For example, for disabled people of group I, citizens who have reached the age of 80, citizens who worked or lived in the Far North and equivalent areas, the insurance pension will be assigned in an increased amount from the calculated amount due to the increased size of the fixed payment or the use of “northern” coefficients

These results of calculating the insurance pension are purely conditional and should not be perceived by you as the real amount of your future pension. To make the results easier to understand, all calculations are performed under constant conditions of 2020.

For calculation purposes, it is assumed that the entire period of formation of your future pension rights took place in 2020 and you were “assigned” an insurance pension in 2020, taking into account the life plans you personally indicated, and also on the condition that you will “receive” all the years of your working life the salary you specified.

Calculation of pensions for those born before 1967

The pension assigned to persons born before December 31, 1966 will be calculated in such a way that it will consist primarily of a basic part guaranteed by the state and an insurance part, entirely dependent on the length of service and salary of the individual. And only people who have joined the pension co-financing program since 2009 and voluntarily contribute money to a funded pension will be able to add it to the basic amount.

- Must be 55 or 60 years old (for women and men, respectively). Until this age, only early pensions can be granted - preferential service on the hot grid, medical, teaching workers, the Federal Penitentiary Service, parents of disabled children, persons who worked in the north, etc. The list is very large and to find out whether you have such experience, you need to consult your local Pension Fund office.

- A certain size of the individual coefficient. It denotes the ratio of a person’s entire pension capital (earnings + insurance contributions + periods of activity) to the current value of the point in the country. The value of the IPC for 2020 is 11.4, and for each subsequent year it increases by 2.4, and so on until its value reaches the maximum possible - 30. Further increase is not provided for by law. The value of the pension point is determined at the beginning of each year by the Government of the Russian Federation. This year it is 78.28 kopecks.

- Work experience. From 2014, the length of service required for calculating a pension increases by 1 year, starting from a value of 5 in 2014. In 2020, 6 years were already required, and so on in ascending order until 2024. Then this figure will reach 15 years, and further growth is not yet envisaged.

Calculate pension Online

The Federal Law “On Insurance Pensions” refers to the insurance period as all periods when insurance premiums were paid . That is, periods of official work with contributions to the Pension Fund. At the same time, the insurance period also implies other employment:

Amount of insurance pension (SP)*

: Your work experience is less than 9 years The number of accumulated PCs is less than 13.8 Your work experience is less than 9 years and the number of pension savings PC is less than 13.8 : You are entitled to a minimum pension: 8703 rubles

Number of individual pension coefficients (PC)

:

Pension calculator Online

- SP is the amount of pension for a specific year.

- PV is a fixed part of the pension.

- The bonus K coefficient depends mainly on the retirement age. For example, if a citizen retired 3 years later than the established period, then the coefficient takes the value 1.19.

Amount of insurance pension (SP)*

: Your work experience is less than 9 years The number of accumulated PCs is less than 13.8 Your work experience is less than 9 years and the number of pension savings PC is less than 13.

8: You are entitled to a minimum pension: 8703 rubles

Number of individual pension coefficients (PC)

:

How to calculate your pension yourself

The most important change is that the insurance part of the pension will be calculated not in absolute numbers (that is, in accumulated rubles), but in points. Upon retirement, the number of points accumulated will be multiplied by their value. The latter is approved by the government and will be indexed to the level of inflation every year.

Minimum work experience requirements will increase. Now, to be eligible for a retirement pension, it is enough to work only 9 years. Officials considered that this was very little, and raised the qualification to 15 years. However, this qualification will be increased gradually until 2024. For example, in 2020, 9 years of experience is enough to qualify for an insurance pension.

12 Jul 2020 stopurist 1936

Source: https://uristtop.ru/vzyskanie-alimentov/kak-poschitat-budushhuyu-pensiyu-1965-goda-rozhdeniya