A survivor's pension is one of the methods of state support. Regular payments are provided to disabled citizens who have lost loved ones who could provide for them. The amount of allowance is determined individually. It depends on the regional cost of living and periodically increases due to indexation.

Concept of survivor's pension

Pension provision of this type affects a person who is no longer alive at the time of payment, and his close people:

- Breadwinner. They are considered to be able-bodied citizens whose earnings allow them to support their relatives. His loss is death or disappearance.

- Dependents. These are disabled relatives of the deceased, whom he provided for until the moment of death.

Survivor's pension - social payments received monthly to the disabled dependents of a deceased (missing) person. The money partially compensates for the assistance that served as the main source of livelihood.

Concept, law, conditions of appointment

A special type of pension that the state pays to disabled persons who were supported by a deceased person is called a survivor's pension.

Emerging legal relations in this area are regulated by federal laws on pensions, decrees and orders of relevant ministries and departments.

The main conditions for the emergence of pension rights in the event of the loss of a breadwinner:

- Death of the breadwinner - mother, father, grandmother, sister or any other relative actually supporting the child.

- Confirmed fact of disability.

Confirmation of the fact of incapacity for work is not required for young children who simply have not reached working age. There is no need to prove the fact of incapacity for work for young people who continue their studies at an institute or university full-time.

Types of pensions in case of loss of a breadwinner

With the death of the main breadwinner, family income decreases and in many cases ceases. The state provides financial assistance to citizens. There are several types of such payments.

Social

Relies on disabled relatives of deceased persons who have not accumulated official work experience. They could have been employed without registration, or were pensioners or disabled people. The allowance is paid by the state, its size is the basis for the subsequent calculation of other types of deductions.

Insurance

Issued by the Pension Fund and consists of 2 parts. The size of the first is fixed and is not affected by the breadwinner’s length of service. The second is calculated personally, taking into account the number of years worked by the person. Payments are due if the deceased person had official work experience.

State

This support option is available to the families of deceased astronauts and people whose lives were interrupted as a result of man-made disasters. The category includes military pensions assigned to dependents of employees of the Ministry of Internal Affairs and military personnel who passed away while performing their duty.

Regional surcharge

Regional executive authorities are authorized to establish additional payments to pensions. The following documents provide guidance for this: Federal Law No. 454, Federal Law No. 420, Federal Law “On the subsistence minimum in the Russian Federation” (Article 4). Regions can set the volume of the consumer basket and, based on its size, regulate this minimum.

Supplemental payments are made to the lowest level of income required to meet needs.

What is a social survivor pension?

Assistance is provided to disabled persons if the deceased relative supporting them did not work officially. Indications for the accrual of funds are:

- confirmed death of the breadwinner;

- a court decision to declare a person dead (in the event of his sudden disappearance).

The legislative framework

The presented type of social assistance is regulated by Federal Law No. 166 of December 15, 2001 (as amended on March 6, 2019). The regulatory document establishes a list of citizens who are entitled to financial support and determines the procedure for calculating finances.

Conditions for receiving pensions due to the loss of a breadwinner in 2020

If a person has lost a family member who supported him, according to the current legislation regarding such compensation to relatives, he may qualify for assistance from the state. To complete it, you first need to collect all the required documents.

The assignment of support payments can be approved if one of the following documents is required:

- Death certificates of a person who provided for the family

- A decision made by a court to recognize such a person as missing.

Additionally, a person applying for pensioner status must provide documents confirming the fact of his inability to work and being dependent on the deceased. Also, this person must be a permanent resident of Russia.

Registration for a child

The survivor's pension in 2020 for minor children is calculated by including the insurance premiums paid by the deceased parent and his insurance points. If an orphan has lost both parents, then the indicators are summed up. According to Russian law, complete orphans must be either in an orphanage or with guardians, but their benefits will be retained. At the same time, stepchildren also apply for benefits if their adoptive father has been caring for them for more than 5 years.

Registration if parents are divorced

It does not matter whether the parents were married at the time of the death of one of them, divorced or in a civil marriage. A child under 18 years of age will automatically be recognized as a dependent; the second parent only needs to submit an application to the local branch of the responsible authority and attach the necessary documents.

What matters here is the fact of paternity and maintenance of the child by the deceased parent, and not the relationship of the former spouses. The child’s second parent will not be able to obtain pensioner status, even if he was actually a dependent; this benefit is assigned only to official widows/widowers.

Who is assigned an insurance pension upon the death of the breadwinner?

To receive this type of assistance, it is necessary that the deceased person has accumulated insurance experience (at least 1 working day). A relative claiming financial support should not be involved in the death of a person. Payments are due to people who were previously dependent on the deceased or were not supported.

Dependents and disabled people

This category includes close people who previously lived off the income of the deceased. The main conditions for calculating payments to them:

- disability;

- lack of other financial assistance other than that received from the deceased person.

The law determines who is entitled to government support after the death of the head of the family. The list of relatives who are classified as disabled is given in the table:

| Relation degree | Disability condition |

| Children (natural, adopted) | Age up to 18 years |

| Children, brothers, sisters, grandchildren who have no loved ones left who are ready to take responsibility for their maintenance. | Over 18 years of age and full-time education. After age 23, payments stop. For disabled children, they continue for life. |

| Spouse, grandmother, grandfather, parents (provided there are no persons who can take care of their care). | Age 60 for women, 65 for men, or documented disability. |

Non-dependent relatives

According to the law, relatives of the deceased, whom he did not previously provide, can apply for funds. The parents, spouse, brother, sister, grandmother, grandfather, and children of the deceased over 18 years of age have the right to do this. When applying for benefits, 2 conditions are taken into account:

- lack of employment;

- care for relatives of the deceased who are under 14 years of age.

Federal Law No. 400 explains that if the spouse or parents of the deceased are left without a source of income, they have the right to receive such a payment. The time that has passed since the date of death is not important. If a widow (widower) enters into another marriage but remains incapacitated, the funds will not be denied.

Payments to students

The right to financial assistance is reserved for full-time students. If a citizen graduated from one educational institution and immediately began studying further, payments are maintained until the age of 23. The exception is children with disabilities. For them, the allowance remains for life.

Age characteristics

The legislation establishes age specificities when calculating the amount of monthly survivor benefits. All potential adult recipients must prove that they were supported by the deceased citizen.

Child payments

Minor children of the deceased belong to the category of persons for whom documentary or judicial proof of the fact of incapacity and dependency is not required.

If there are two young children who have not reached the age of majority, each of them has the right to receive pension compensation equally.

If the deceased was dependent on minors of the second degree of kinship, then they also have the right to receive this compensation from the state before reaching adulthood, subject to confirmation of the fact of dependency.

After 18 years and up to 23 years

After dependents reach the age of majority, the payment of a survivor's pension in some cases can be continued. This applies to persons who are not actually able to work.

This applies to children who, after graduating from school, entered higher education institutions as full-time students and who, as a result, cannot fully engage in labor activity during this period.

In this case, there is a limitation on the duration of payments - until the recipient reaches 23 years of age.

After 23 years

Separately, it is worth considering cases in which compensation payments for the loss of a breadwinner can be extended after 23 years.

This right is granted to children with irreversible loss of ability to work. This category includes disabled persons who received diseases leading to limited ability to work before or after the death of the breadwinner.

After reaching the age of 23, only social security benefits for the loss of a breadwinner can be paid.

Who can claim a state pension

Payments are due to relatives of deceased cosmonauts and persons who died as a result of man-made disasters:

- children of the deceased (minors and full-time students under 23 years old);

- retired parents;

- spouse when caring for children under 14 years of age or when reaching the retirement age threshold.

Military payments are accrued to relatives if the death of the head of the family occurs:

- on duty;

- after dismissal (within 3 months);

- when injured before dismissal.

The list of applicants for payments is the same as for the insurance pension. There are some small additions to it. Parents of military personnel who have reached the age of 50 years (women) and 55 years (men) apply for payments.

The widow of a serviceman over 55 years of age can also apply for benefits. An important condition for this is the absence of a new marriage.

Kinds

A social pension for the loss of a breadwinner can be assigned indefinitely - for cases where the child has become an adult, but remains disabled

There are three types of pension benefits for the loss of a breadwinner:

- Insurance (formerly labor) pension. Applicable when the deceased had work experience.

- Social. It is approved when the deceased has no work experience at all.

- State. It is the prerogative of dependents of deceased citizens affected by man-made disasters, military personnel, employees of the Ministry of Internal Affairs, astronauts and other persons with a special status before the state.

The insurance (labor) pension is assigned to any relatives of the deceased; as for the social pension, it is provided only to the children of the deceased. The state pension is assigned to the same persons as the insurance pension, but due to the characteristics of the status of the deceased, it has a different amount of payments.

Conditions and procedure for appointment

The loss of a breadwinner is considered as a situation in which the main family breadwinner dies or disappears, and it is impossible to find him. Registration of death takes several stages:

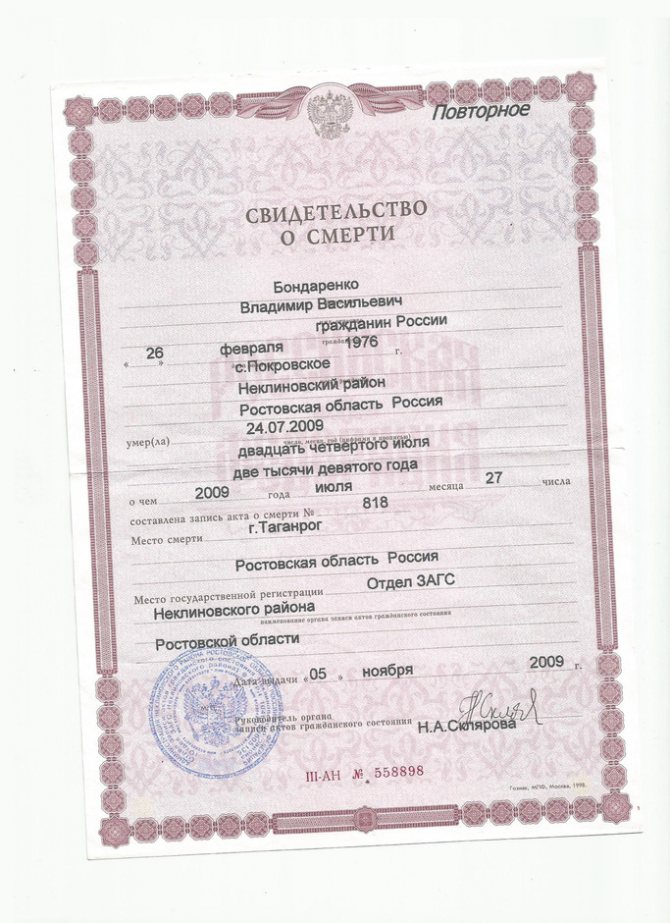

- Obtaining a medical certificate for relatives. It is issued within 24 hours by the institution where the fact of death was registered.

- Contact the regional registry office to obtain a certificate of the last registration of the deceased.

- Registration of a death certificate in the registry office. It must be provided when submitting documents for pension accrual.

When a person is missing for more than 3 days and cannot be located, the police should be notified. If a professional search does not produce results, it is necessary to go to court to declare the person missing. The decision of this authority is an important document for proving the right to social assistance.

Is it possible to receive 2 types of pensions?

The conditions under which simultaneous receipt of 2 types of support are allowed are discussed in the table:

| Recipient | Type of second payment |

| Military parents, widows who have not remarried. | Social, long service, old age, disability insurance. |

| Disabled relatives of citizens who died as a result of man-made emergencies and the Chernobyl accident. | Social, old age insurance. |

| Relatives of astronauts. | Any. |

FAQ

The loss of loved ones is always difficult to experience, but if at the same time the question of one’s own financial support arises, the situation becomes critical. Therefore, it is very important to receive clear and understandable questions to all questions of interest to the future pensioner regarding the conditions and procedure for assigning payments. And there are usually enough of them, since in this case legal regulation does not always give unambiguous answers.

Payments in the event of the death of a military personnel or police officer

A separate case is state support for family members of a military man or an employee of the Ministry of Internal Affairs. Conditions for its purpose and dimensions:

- If a man dies from injuries incompatible with life while serving in the army, his relatives will be paid a double standard social benefit. The amount of the survivor's pension in 2020 in this case will be 10,800 rubles.

- If a military contractor is sick due to illness, the payment will be less, its amount is 7900 rubles.

Is it possible to receive 2 types of pensions?

Currently it is allowed to receive only one type of security. If several options are suitable at the same time, the recipient can choose the most profitable option. But some categories: relatives of fallen military personnel, astronauts, victims of man-made disasters - are entitled to several pensions at the same time.

What date does it arrive?

State and social maintenance are assigned to the applicant if a positive decision is made from the 1st day of the month in which he applied.

If the future pensioner applies within a year from the date of death of the caregiver, insurance money will be paid from the date of his death. If the applicant applied a year later, they will appoint a year earlier than the day of application. For example, a citizen died on 04/07/2019. If you apply for help within a year, it will be assigned from April 7, 2020. If the pensioner submits an application on April 10, 2020, it will be paid from April 10, 2020, and will arrive on time.

Is it possible to work officially?

State, insurance and social survivor's pensions are a measure of support for people who cannot work and whose support depended on the income of a deceased family member. This is not a one-time payment, but a monthly one, designed to maintain a minimum standard of living for the dependent. If the recipient was able to find official work, the basis for payment of benefits disappears. At the same time, it is the responsibility of the recipient to inform the Pension Fund that there are no longer grounds for payment. The department will still find out that the dependent is officially working, which means it will have the right to hold him accountable and recover the illegally paid amount.

Required documents and where to submit them

Payments are accrued after collecting and submitting papers confirming the right to financial assistance to the regional office of the MFC or Pension Fund. The applicant will be required to:

- death certificate of the breadwinner;

- SNILS;

- confirmation of relationship and permanent registration;

- passport;

- confirmation of the deceased’s work experience;

- a certificate from an educational institution (when applying for a pension for a child);

- other papers on request.

Registration of regional surcharge

An applicant for payments should contact the regional office of the Pension Fund of the Russian Federation with documents, the list of which should be clarified in advance. This is the death certificate and work book of the deceased, the applicant’s passport and other papers to which the application is attached. The money is accrued until the main pension is paid.

How to re-register and restore

Re-registration is necessary for the heirs of the deceased who have reached the age of majority but are continuing their education. If you contact the Pension Fund with this question in September, payments will resume in October. A recalculation for the previous period will also be made.

Reinstatement is possible at any time if no more than 10 years have passed since the termination of payments. To renew them you should:

- understand what circumstances influenced the lack of financial assistance;

- provide the Pension Fund with documentary evidence of the legal right to deductions;

- choose a method of receiving money.

Set age for payments

Children, as well as close relatives who were financially supported by the deceased, if it is possible to accrue and receive pension payments for the loss of a breadwinner. This is provided for by Federal Laws No. 166-FZ and No. 400-FZ.

It is worth noting that if a person has work experience, then only the insurance part or the insurance + labor part (if any) will be taken into account for the payment. Let's take a closer look at who and up to what certain age will be able to receive the pension payment assigned for the loss of a breadwinner.

The legislation of the Russian Federation indicates the category of people who have full right to receive payments. In Art. 10 “On Insurance Payments” clearly states the rules by which you can count on benefits.

So if you:

- you are a minor child who was financially dependent on the deceased (no documents are required to confirm the fact of dependence on the deceased or missing person);

- relatives of the first and second degrees (spouse, parents who reached retirement age at the time of the death of the breadwinner;

- relatives of the third degree (grandparents), but only under one condition, if by law there are no other people who are obliged to support them.

Children of a deceased or missing person who have not yet turned 18 years of age do not have to prove that they were dependent, unlike other relatives of the deceased.

Remember! The main and only source of income should be payment for the loss of a breadwinner.

For children under 18 years of age, pensions are paid only until they reach adulthood. As for the spouse, parents, grandparents, this payment is assigned to them for life.

Until what age is a survivor's pension paid?

The payment in question will be accrued to children until they reach the age of majority, or until the age of 23 if the child is a full-time student. Immediate second and third degree relatives can receive benefits if they have reached retirement age. Now more about the termination of payments.

If at least one condition written below is met, the pension will not be accrued:

- the person to whom the pension was paid died;

- upon reaching the established age, the payment stops automatically;

- if a person has another main source of income, such as official employment;

- if the child has regained his ability to work, or the validity period of his disability recognition has expired.

The accrual of pensions may be terminated or suspended if, at the time the child turns 18, he does not provide documents to extend the receipt of a survivor's pension, such as a certificate of full-time education or a certificate of disability.a

Payment is suspended for a period of 6 months. During this time, the child must document his education or incapacity, otherwise payments will stop.

Appointment dates

The pension is calculated from the date of application to the Pension Fund. A standard check of papers takes 10 days, after which the applicant is informed of the decision made. If there are problems with documents, the procedure may take 3 months. The day of payment determines the time for submitting documents and applications. Funds are transferred starting from the month following the month when the decision to accrue them was made.

If less than a year has passed since the death of the breadwinner, payments will be accrued for the previous period.

When the death occurred a year ago or more, money will be transferred only for the last 12 months.

Payment terms

The timing of payment of the insurance pension for the loss of a breadwinner is regulated by Article 22 of the Federal Law “On Insurance Pensions of the Russian Federation” dated December 28, 2013 No. 400-FZ. According to the article, insurance payments are assigned for the time during which a person is considered disabled or for an indefinite period.

The accrual of an insurance pension in connection with the loss of a breadwinner begins from the moment of his death, if the application for this payment was sent within 1 year from the date of death. If the application was sent later, the pension will be accrued 1 year earlier than the day on which the application was sent to assign the agreed payment.

Termination of payment

Funds are no longer transferred in the following situations:

- the disabled relative of the deceased is 18 years old or 23 years old (if he continues to study full-time);

- a military widow entered into another marriage;

- the recipient returned to official work;

- the youngest relative of the breadwinner, whom the recipient cares for, is 14 years old.

Amount of pension in case of loss of a breadwinner

According to the standards of existing legislation, the amount of deductions must be equal to or exceed the subsistence level. If Pension Fund employees accrue less, the pensioner is entitled to an additional payment from the regional budget.

Social

The payment structure includes a fixed amount and additional payments.

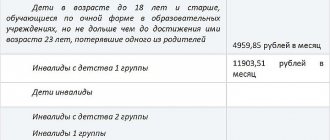

Since April 2020, its dimensions are:

- 5606.17 rubles, if we are talking about the death of one of the breadwinners;

- 11212.6 rubles when the applicant was orphaned or lost a single mother.

State

Disabled relatives of military personnel are entitled to a provision of 150% of the social pension if the breadwinner passes away from an illness that overtook him in service. In the event of a tragic death from injury during combat operations, the percentage of accruals increases to 200.

Families of deceased Russian cosmonauts and victims of man-made accidents can receive benefits in the amount of 125% of social benefits. For orphans and mothers raising children alone, the amount increases to 200%.

Cost of one pension coefficient

The insurance payment is determined by the formula: IPC points multiplied by the cash equivalent (in 2020 - 93 rubles). The volume of a fixed share is added to this value.

Fixed payment towards pension

The amount adopted by the Government Decree is the same for all categories of applicants. In 2020, its value is 2843.13 rubles. For persons who have lost both breadwinners, the amount is doubled. The increase occurs due to allowances for residents of the northern regions and areas that are equivalent to them.

Promotion and indexing

For recipients of insurance coverage, the change in payments occurred from January 1, 2020. The planned indexation of the insurance pension was 6.6%. At the same time, the social supplement was adjusted due to changes in the cost of living.

The amount of monetary allowance was increased by 6.1% from 04/01/2020.

Simultaneously with the indexation, payments to the families of deceased military personnel increased by 6.1%.

Exceptions

So, it has been found out that, in accordance with current Russian legislation, a survivor's pension is paid until the age of 18, but if you study full-time, the money will be received until the age of 23. But there are some exceptions to this rule.

- Conscription.

If a young person is called up to serve in the Armed Forces immediately after he reaches the age of 18, then there are no grounds for accruing a pension to him during the period of his completion. This is largely due to the fact that in the army a serviceman is fully supported by the state, that is, he is provided with clothing, food and material allowances.

- Disability.

If the recipient of the pension in question has been disabled since childhood, then he has the right to count on payments until the disability is lifted. In this case, his age will not be of fundamental importance.

Procedure and methods for paying a survivor's pension

Funds are transferred monthly. Pensioners can choose a convenient method for receiving cash (either on their own or through a proxy).

Post office

The money is delivered to your home by the postman according to a predetermined schedule. They can also be obtained by presenting your passport at the post office.

Bank account

You can receive benefits using your personal account or card. In the first case, to withdraw money and conduct transactions with it, you can use Internet banking or visit financial institutions.

It is convenient to withdraw funds from the card at ATMs immediately after the cash assistance is credited.

An organization specializing in the delivery of pensions

You can find out the list of companies that provide such services when applying for a pension at the Pension Fund.

Other survivor benefits

The state’s additional concern for people who have lost loved ones is expressed in the following:

- Children of the deceased do not pay for travel on public transport, hot meals in the school canteen, medicines (up to 3 years), and visits to museums.

- Relatives of a serviceman have benefits for utility bills and sanatorium and resort treatment.

- Orphans receive free trips to health camps, funds to purchase office supplies, and personal belongings. They enjoy benefits for necessary treatment and good nutrition.

Answers to popular questions

There are many nuances associated with payments of this kind. For clarification, please refer to legislative documents.

Is the survivor's pension included in the taxable base?

Payments are considered income but are not taxed. Information about this is in the letter of the Ministry of Finance of the Russian Federation No. 03-05-04-01/57921 dated 08/05/2018.

Payments in case of divorce

The circumstance is not an obstacle to payment to the common child of one of the deceased former spouses. This is stated in Federal Law No. 400 (Article 10) and Federal Law No. 166 (Article 11).

Is it possible to receive a pension if a child works?

Working officially means accumulating experience and pension points. However, in this case, financial support is canceled.

Suspension or refusal of pension

For this purpose, you should submit an application to the Pension Fund to stop accruals, otherwise payments will be received illegally. Subsequently, they will be recovered in court.

Is there a social scholarship?

Payments are provided to students who study at the expense of the budget. To accrue them, you must obtain a certificate from the social security authorities.

Who can apply for a second pension?

The following are eligible to receive 2 different types of financial assistance:

- disabled children receiving a labor pension for the loss of a breadwinner;

- family members of deceased cosmonauts and victims of man-made disasters;

- parents and the unmarried widow of a deceased Interior Ministry employee.

Is a survivor's pension available upon remarriage?

A woman receiving such payments can marry again. Payments to her are retained even if the last name is changed. The main condition for receiving money is the absence of official employment. The exception is payments to widows of military personnel.

How is the pension divided?

Payments are made in equal shares to each applicant. For example, the deceased left a child from his first marriage, and an heir was born in the second legal union. If children are assigned an insurance pension, it will be divided equally. The size of each part is not less than the established minimum wage. To apply for regional additional payments, please contact the Pension Fund office.

Where can I get a certificate of loss of a breadwinner?

To apply for a pension, you must provide a death certificate to a Pension Fund employee. The document is issued by the registry office on the basis of a certificate from a medical institution documenting the fact of death. You can apply for a pension with a court decision declaring the breadwinner missing.

Social cards for residents of some cities

In large cities, pension recipients are issued social cards that entitle them to additional privileges:

- free travel on city public transport (except minibuses);

- the ability to pay for goods and services by card, withdraw cash without commission;

- affiliate program discounts.

Often a pension is the only source of income for a family in the event of the loss of the main breadwinner. Persons established by law have the right to receive it. For some citizens, social assistance is provided for life, for others it serves as temporary financial support.

Useful tips

Summarizing the aspects discussed in the article, we can draw the following conclusions:

- In the event of the death of one of the parents or another person who was supporting children or other dependents, the state guarantees social protection.

- There are 3 types of survivors' pensions, each of which has its own specific features. It is possible to correctly determine what type of compensation is due through a comprehensive analysis of the current legislation.

- The social pension has a minimum fixed amount and is assigned if it is impossible to apply other types of payments.

- The amount of any type of pension provision cannot be lower than the subsistence minimum for the corresponding region.

- In addition to pensions, the state guarantees the provision of other benefits to children who have lost one or both parents.

Answers to all questions regarding survivor pensions can be obtained from the branch of the Russian Pension Fund nearest to you.